PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708124

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708124

Automotive Fuel Transfer Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

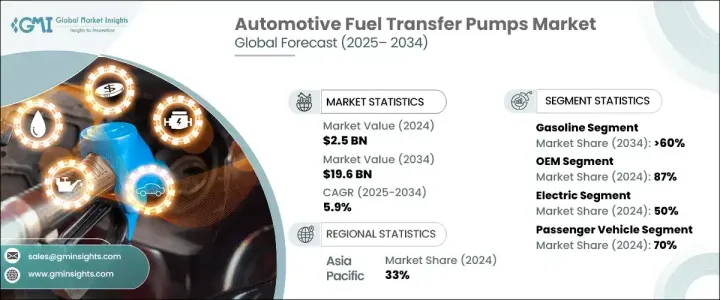

The Global Automotive Fuel Transfer Pumps Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. The expanding global automotive industry, driven by rising vehicle production and increasing demand for fuel-efficient solutions, is propelling the market forward. With the growing preference for high-performance vehicles, manufacturers are focusing on advanced fuel transfer pump technologies that enhance engine efficiency and durability. Emerging economies, particularly in Asia and Latin America, are witnessing a surge in automobile sales due to rapid urbanization, rising disposable incomes, and government policies favoring local vehicle manufacturing. This has directly contributed to the increasing adoption of fuel transfer pumps as automakers emphasize vehicle efficiency and regulatory compliance. Additionally, the shift toward stringent fuel efficiency standards worldwide has created a demand for innovative fuel transfer solutions that optimize fuel usage and reduce emissions.

The automotive fuel transfer pumps market is segmented into gasoline and diesel fuel categories. The gasoline segment accounted for a 60% market share in 2024, reflecting its strong presence in the passenger vehicle sector. The widespread use of gasoline-powered cars, coupled with advancements in fuel efficiency technology, has strengthened the segment's dominance. Consumers continue to favor gasoline engines due to their lower emissions and affordable fuel prices in many regions, particularly in markets where environmental regulations influence vehicle preferences. The adoption of next-generation gasoline engines, designed for improved mileage and reduced carbon footprints, is further driving demand for efficient fuel transfer pumps.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 billion |

| Forecast Value | $19.6 billion |

| CAGR | 5.9% |

Original Equipment Manufacturers (OEMs) hold a leading position in the automotive fuel transfer pumps market. Automakers rely on OEM components due to their compatibility, reliability, and superior performance. Established relationships between OEMs and major automotive brands ensure a consistent supply chain, fostering long-term contracts and reinforcing the dominance of OEM suppliers. The trust in OEM-manufactured fuel transfer pumps stems from their ability to meet stringent industry standards, guaranteeing optimal performance in modern vehicles.

The Asia Pacific automotive fuel transfer pumps market commanded a 33% share in 2024, with demand surging in top vehicle manufacturing nations. Countries with robust automotive industries continue to be major consumers of fuel transfer pumps as increased production volumes drive market expansion. Government-backed incentives to promote domestic vehicle manufacturing further accelerate regional growth. Infrastructure developments across the Asia Pacific are enhancing automotive supply chain efficiency, supporting the demand for advanced fuel transfer pumps across various vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Material providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Cost breakdown

- 3.5 Price trend

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for lightweight and ergonomic seating

- 3.7.1.2 Stringent safety and emission regulations

- 3.7.1.3 Growth in e-commerce and logistics

- 3.7.1.4 Advancements in sustainable materials

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High cost of advanced seating technologies

- 3.7.2.2 Supply chain disruptions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mechanical

- 5.3 Electrical

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airtex Pumps

- 10.2 Aisin Seiki

- 10.3 Carter Fuel Systems

- 10.4 Continental Automotive

- 10.5 Cummins Fuel

- 10.6 Delphi Technologies

- 10.7 Denso Corporation

- 10.8 Edelbrock Group

- 10.9 GMB

- 10.10 Hitachi Astemo

- 10.11 Holley Performance Products

- 10.12 Mitsubishi Electric

- 10.13 Pierburg

- 10.14 Robert Bosch

- 10.15 Spectra Premium

- 10.16 Stanadyne

- 10.17 TI Fluid Systems

- 10.18 UFI Filters

- 10.19 VDO Automotive

- 10.20 Walbro