PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708122

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1708122

Artificial Intelligence in Military Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

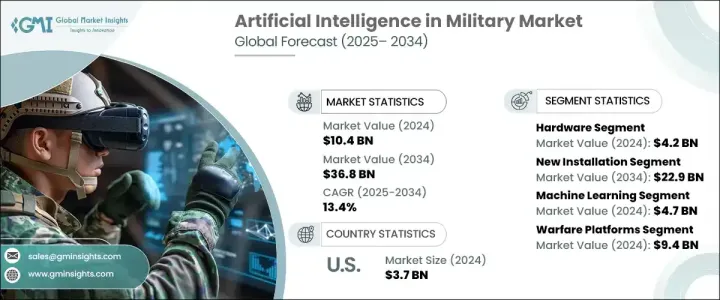

The global artificial intelligence in military market was valued at USD 10.4 billion in 2024 and is projected to grow at a CAGR of 13.4% between 2025 and 2034. This rapid growth is fueled by increased military spending and a rising emphasis on utilizing AI to analyze vast amounts of data swiftly, enabling forces to make informed decisions during operations. Militaries worldwide are integrating AI into defense systems to enhance operational efficiency, reduce response times, and improve decision-making accuracy. AI applications span various domains, from combat and surveillance to logistics and cybersecurity, where real-time insights can determine mission success. As threats become more complex and unpredictable, the need for adaptive and intelligent systems is driving investments in AI technologies that can streamline defense operations and anticipate potential threats.

AI-powered solutions are increasingly in demand as defense organizations aim to modernize their command centers, optimize asset utilization, and strengthen security protocols. AI's ability to automate routine processes, detect anomalies, and predict patterns in battlefield data empowers military personnel to operate with greater precision and agility. Moreover, the rise of autonomous systems, including drones, robotic vehicles, and unmanned ground systems, is accelerating the adoption of AI-based technologies that enhance surveillance, reconnaissance, and threat mitigation capabilities. These advancements reduce human intervention and lower the risk to personnel while improving operational outcomes. Military organizations are actively exploring AI-enhanced applications in cyber defense to safeguard critical infrastructure and detect potential breaches before they escalate. This expansion of AI applications is propelling the global market forward, attracting interest from defense technology firms, governments, and research institutions focused on strengthening national security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $36.8 Billion |

| CAGR | 13.4% |

The market is segmented into hardware, software, and services, with hardware accounting for a significant share. In 2024, the hardware segment was valued at USD 4.2 billion, driven by the growing reliance on AI-equipped systems such as autonomous drones, combat robots, and smart weaponry. These technologies require advanced AI algorithms to refine navigation systems, enhance target identification, and improve real-time threat response. As autonomous military platforms continue to evolve, the need for specialized AI-enabled hardware is rising, contributing to more accurate and efficient defense operations.

The market is also categorized by installation type into new installations and upgrades, with new installations expected to generate USD 22.9 billion by 2034. Military organizations are prioritizing the deployment of AI-driven systems to modernize their defense infrastructure. The demand for new installations stems from the need to integrate cutting-edge AI capabilities into existing command centers and defense assets, enhancing overall performance and situational awareness. Defense contractors are responding by incorporating AI features into various military platforms, including fighter jets and armored vehicles, to meet the evolving needs of modern warfare.

The U.S. artificial intelligence in military market was valued at USD 3.7 billion in 2024, reflecting the country's leadership in AI innovation for defense applications. The U.S. military remains at the forefront of AI integration, with extensive collaboration between defense technology firms and AI platforms driving the development of groundbreaking solutions. The increasing adoption of AI across U.S. military operations is enhancing the effectiveness of defense systems and transforming the way military strategies are planned and executed globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising military spending

- 3.2.1.2 Advancement in tactical unmanned aircraft systems (UAS)

- 3.2.1.3 Growing demand for autonomous military systems

- 3.2.1.4 Advancements in AI-powered cybersecurity solutions

- 3.2.1.5 Increasing deployment of AI in surveillance and reconnaissance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of ai development and implementation

- 3.2.2.2 Integration challenges with legacy military systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Offering, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.3.1 Cloud

- 5.3.2 On-premises

- 5.4 Services

- 5.4.1 Deployment & integration

- 5.4.2 Upgrades & maintenance

- 5.4.3 Software support

- 5.4.4 Others

Chapter 6 Market Estimates and Forecast, By Installation Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 New installation

- 6.3 Upgradation

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Machine learning

- 7.3 Natural language processing

- 7.4 Context-aware computing

- 7.5 Computer vision

- 7.6 Intelligent virtual agent (Iva) /virtual agents

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Warfare platforms

- 8.3 Cybersecurity

- 8.4 Logistics & transportation

- 8.5 Surveillance & situational awareness

- 8.6 Command & control

- 8.7 Battlefield healthcare

- 8.8 Simulation & training

- 8.9 Threat detection

- 8.10 Information processing

- 8.11 Others

Chapter 9 Market Estimates and Forecast, By Platform, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Airborne

- 9.2.1 Fighter aircraft

- 9.2.2 Special mission aircraft

- 9.2.3 Helicopters

- 9.2.4 Unmanned aerial vehicles (UAV)

- 9.3 Land

- 9.3.1 Military fighting vehicles (MFV)

- 9.3.2 Unmanned ground vehicles (UGV)

- 9.3.3 Weapons systems

- 9.3.4 Headquarter & command centers

- 9.3.5 Dismounted soldier systems

- 9.4 Naval

- 9.4.1 Ships

- 9.4.2 Submarines

- 9.4.3 Unmanned marine vehicles (UMVs)

- 9.5 Space

- 9.5.1 CubeSats

- 9.5.2 Satellites

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BAE Systems

- 11.2 Boeing

- 11.3 CACI International

- 11.4 General Dynamics

- 11.5 IBM

- 11.6 L3Harris Technologies

- 11.7 Leonardo

- 11.8 Lockheed Martin

- 11.9 Northrop Grumman

- 11.10 Nvidia

- 11.11 Palantir Technologies

- 11.12 Rafael Advanced Defense Systems

- 11.13 Raytheon Technologies

- 11.14 Saab

- 11.15 Safran

- 11.16 Thales