PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699437

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699437

Feminine Hygiene Wash Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

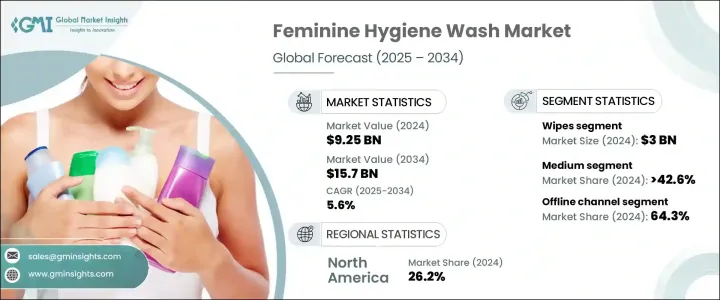

The Global Feminine Hygiene Wash Market was valued at USD 9.25 billion in 2024 and is set to expand at a CAGR of 5.6% from 2025 to 2034. Increasing awareness about intimate hygiene through government initiatives, NGOs, and healthcare organizations has significantly contributed to market expansion. Awareness campaigns highlighting menstrual hygiene, intimate care, and infection prevention have played a key role in educating women about feminine hygiene products. Social media, digital health platforms, and influencers further amplify this message, making information on hygiene care more accessible.

The demand for feminine hygiene washes, wipes, and sustainable products continues to rise as brands collaborate with health experts to educate consumers and break stigmas surrounding intimate care. Women increasingly choose dermatologically tested, pH-balanced, and organic hygiene solutions, driven by heightened awareness. More consumers now prioritize safe, high-quality products that align with health and hygiene standards, reinforcing market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.25 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 5.6% |

Segmented by product type, the market includes creams, wipes, sprays, bars, gels, and others like foams, powders, and cleansers. In 2024, feminine hygiene wipes generated USD 3 billion in revenue and are projected to grow at a CAGR of 5.8%. Their convenience and ease of use make them a preferred choice over liquid washes, especially for travel and daily routines. As urbanization progresses and more women join the workforce, demand for portable, pH-balanced, and eco-friendly hygiene products continues to surge. New product developments incorporating antibacterial properties, herbal ingredients, and biodegradable materials further drive interest.

Growing concerns about hygiene in public restrooms and shared spaces also contribute to the popularity of portable hygiene solutions. Increased disposable income and higher spending on personal care products support market expansion, while online retail and digital marketing campaigns boost product visibility and accessibility. The female labor force participation rate in urban areas rose to 25.4% in 2023, reflecting a rising need for practical hygiene solutions.

The feminine hygiene wash market is categorized by pricing tiers, with the mid-range segment dominating due to its balance between affordability and quality. Women from various income groups seek hygienic products that are dermatologist-approved, safe, and effective without the premium price of luxury brands. Mid-range hygiene washes, often gynecologist-tested and made with natural ingredients, remain widely accessible to a broad consumer base. This segment is especially relevant in urban and semi-urban areas of developing regions, where affordability plays a crucial role in purchasing decisions.

The market is further divided by distribution channels, with offline sales accounting for 64.3% of the share in 2024. Physical stores continue to be the preferred purchasing method, especially in developing regions, where consumers trust in-store purchases and pharmacist recommendations. Pharmacies, supermarkets, and specialty stores serve as primary distribution points, offering direct engagement opportunities for brands to educate consumers. Strong retail partnerships help major brands extend their reach and influence buying decisions.

In 2024, North America led the market with a 26.2% share, generating USD 2.4 billion in revenue. High consumer awareness and brand loyalty drive market dominance, as buyers prioritize natural and pH-balanced products. Digital marketing, social media promotions, and influencer endorsements have propelled intimate hygiene products into the mainstream, ensuring steady demand across both retail and online platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising awareness of feminine health

- 3.10.1.2 Health and hygiene education initiatives

- 3.10.1.3 Changing lifestyles and habits

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Safety concerns

- 3.10.2.2 Product efficacy and claims

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Creams

- 5.3 Wipes

- 5.4 Spray

- 5.5 Bar

- 5.6 Gel

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Female teenager

- 7.3 Female adult

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Offline

- 8.3 Online

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Boots

- 10.2 CB Fleet

- 10.3 Combe

- 10.4 Corman

- 10.5 CTS Group

- 10.6 Emerita

- 10.7 Happy Root

- 10.8 Healthy Hoohoo

- 10.9 Lactacyd

- 10.10 Lifeon

- 10.11 Nature Certified

- 10.12 Oriflame

- 10.13 Sliquid Splash

- 10.14 SweetSpot

- 10.15 VWash