PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699435

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699435

Electric Power Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

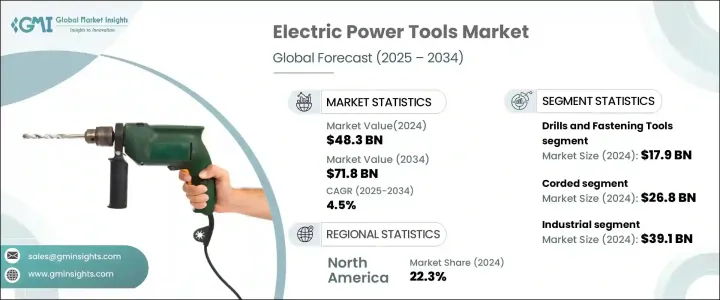

The Global Electric Power Tools Market was valued at USD 48.3 billion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. This growth is driven by the increasing adoption of electric power tools across various sectors, including construction, manufacturing, and infrastructure development. As industries strive to improve operational efficiency, reduce manual labor, and streamline processes, the demand for high-performance tools is rising. The ongoing shift toward automation and the growing emphasis on precision in operations are contributing to the increased reliance on power tools.

Residential, commercial, and industrial sectors are increasingly investing in advanced equipment to enhance productivity and ensure accuracy in their operations. The rising number of renovation projects, infrastructure upgrades, and industrial expansions is further fueling the growth of the electric power tools market. Additionally, advancements in technology, including the integration of smart features, ergonomic designs, and energy-efficient models, are making electric power tools more appealing to end users. As safety standards become more stringent and efficiency remains a top priority, industries are increasingly turning to electric power tools that offer reliability and durability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48.3 Billion |

| Forecast Value | $71.8 Billion |

| CAGR | 4.5% |

The drills and fastening tools segment generated USD 17.9 billion in 2024 and is expected to grow at a CAGR of 4.8% between 2025 and 2034. This segment is experiencing high demand due to its widespread use in construction, industrial applications, and ongoing infrastructure projects. These tools play a critical role in tasks such as screwing, drilling, and fastening, making them indispensable across residential, commercial, and industrial environments. The growing need for precision fastening and drilling capabilities, coupled with large-scale renovation projects, is driving demand in this segment. As industries continue to modernize and adopt automated solutions, power drills and fastening tools remain essential for ensuring efficiency and versatility.

The corded electric tools segment generated USD 26.8 billion in 2024. Corded electric tools provide superior power and torque, making them the preferred choice for industries that require continuous and high-performance equipment. These tools are essential for intensive applications where a consistent power supply is necessary, particularly in manufacturing and large-scale construction projects. Heavy-duty tools such as saws, grinders, and drills operate at peak efficiency when powered through direct electrical connections. While cordless tools offer flexibility for work in remote or confined spaces, corded versions remain the go-to option for applications demanding sustained power and durability.

North America electric power tools market held a 22.3% share and generated USD 10.8 billion in 2024. Growth in this region is primarily driven by increasing demand in the manufacturing sector, where tools such as drills, saws, and fastening equipment are critical for production activities, infrastructure expansion, and residential construction projects. As industries focus on optimizing efficiency and improving operational workflows, the need for reliable, high-performance tools continues to grow. The region's emphasis on adopting advanced technologies and enhancing productivity further supports the expanding use of electric power tools across multiple sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Manufacturers

- 3.7 Distributors

- 3.8 Retailers

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing construction and infrastructure development

- 3.10.1.2 Expanding DIY (Do-It-Yourself) market

- 3.10.1.3 Advancements in battery technology

- 3.10.1.4 Demand for high-performance and specialty tools

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Technological disruption

- 3.10.2.2 Supply chain disruptions

- 3.10.1 Growth drivers

- 3.11 Consumer buying behavior analysis

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Drills and fastening tools

- 5.3 Hammers

- 5.4 Saws

- 5.5 Lawn mowers

- 5.6 Vacuum cleaners

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Corded

- 6.3 Cordless

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Industrial

- 7.2.1 Construction

- 7.2.2 Automotive

- 7.2.3 Aerospace

- 7.2.4 Others

- 7.3 DIY

- 7.4 Other

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Atlas Copco AB

- 9.2 DeWalt

- 9.3 Emerson Electric Co.

- 9.4 Fein Power Tools Inc.

- 9.5 Festool Group

- 9.6 Hilti Corporation

- 9.7 Hitachi Koki Co., Ltd.

- 9.8 Makita Corporation

- 9.9 Milwaukee Electric Tool Corporation

- 9.10 Panasonic Corporation

- 9.11 Robert Bosch GmbH

- 9.12 Ryobi Limited

- 9.13 Snap-on Incorporated

- 9.14 Stanley Black & Decker, Inc.

- 9.15 Techtronic Industries Co. Ltd.