PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699428

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699428

Ethernet Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

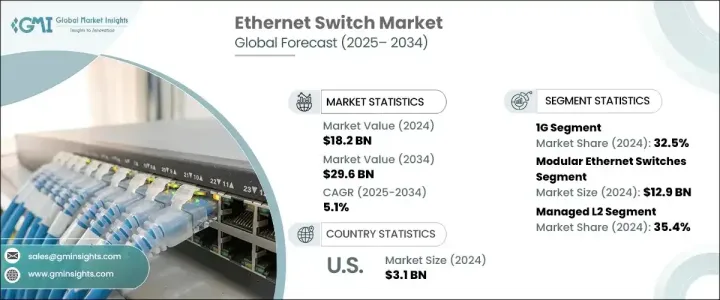

The Global Ethernet Switch Market was valued at USD 18.2 billion in 2024 and is projected to grow at a CAGR of 5.1% from 2025 to 2034, fueled by the rapid expansion of data centers worldwide. As cloud computing, big data, and the Internet of Things (IoT) continue to evolve, the need for high-speed, reliable network infrastructure is becoming more critical than ever. Organizations are increasingly investing in advanced Ethernet switches to optimize data traffic management, enhance network efficiency, and support the growing volume of data generated by digital transformation. The proliferation of remote work, smart manufacturing, and Industry 4.0 initiatives is further amplifying the demand for robust networking solutions. Enterprises are modernizing their IT infrastructure to accommodate next-generation connectivity requirements, while the ongoing deployment of 5G networks is accelerating the adoption of Ethernet switches for backhauling traffic from base stations to core networks. Additionally, software-defined networking (SDN) and network virtualization are driving innovation in Ethernet switches, allowing businesses to achieve greater agility, scalability, and cost-efficiency.

As the demand for seamless data transmission grows, Ethernet switches play a pivotal role in ensuring uninterrupted connectivity across data centers, storage networks, and enterprise systems. Businesses are prioritizing high-speed Ethernet solutions to facilitate cloud computing applications and real-time data processing, contributing to the sustained growth of the market. With rising internet traffic and the emergence of AI-driven applications, network performance and efficiency have become essential considerations for enterprises. Key players in the market are focusing on technological advancements, including AI-powered network management and automation, to enhance operational efficiency and minimize latency issues. The shift toward edge computing is also increasing the need for Ethernet switches, as enterprises require faster data exchange between cloud and on-premises environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.2 billion |

| Forecast Value | $29.6 billion |

| CAGR | 5.1% |

The market is segmented by speed, with the 1G segment accounting for a 32.5% share in 2024. Gigabit Ethernet switches have become the standard for modern networks, offering improved data transfer rates and reduced latency to enhance productivity. These switches are critical for cloud-based applications, where reliable and high-speed connectivity is essential for optimal performance. As businesses increasingly rely on cloud services, the demand for advanced Ethernet switches continues to rise, driving the growth of the 1G segment.

By type, modular switches dominated the market, reaching USD 12.9 billion in 2024. Modular Ethernet switches offer unmatched flexibility and scalability, allowing businesses to customize their networks by integrating additional modules such as security enhancements and stacking capabilities. Their ability to ensure uninterrupted network operations by replacing faulty components without downtime makes them an ideal choice for critical networks and large-scale data centers. Industries that require high availability and minimal disruption, such as finance, healthcare, and telecom, are increasingly adopting modular switches to maintain seamless connectivity.

The U.S. Ethernet Switch Market reached USD 3.1 billion in 2024, driven by rapid advancements in IoT, data center expansion, and cloud computing. With a well-established IT infrastructure and a strong presence of leading technology companies, the U.S. continues to play a vital role in shaping the global Ethernet switch landscape. Major players are investing in next-generation network solutions to support digital transformation initiatives, further propelling market growth across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surge in demand for Internet of Things (IoT) devices, as well as rapid expansion of data centers

- 3.6.1.2 Increasing rollout of 5G technology

- 3.6.1.3 Rapid expansion of data centers

- 3.6.1.4 Rise in the adoption of cloud-based services

- 3.6.1.5 Growing adoption of software-defined networking (SDN)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Technological complexity associated with ethernet switches

- 3.6.2.2 Increasing concern regarding cyber security

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Speed, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 1G

- 5.3 10 G

- 5.4 25 G

- 5.5 40 G

- 5.6 100 G

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Modular ethernet switches

- 6.3 Fixed configuration ethernet switches

Chapter 7 Market Estimates & Forecast, By Configuration, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Unmanaged

- 7.3 Smart

- 7.4 Managed L2

- 7.5 Managed L3

- 7.6 Divided

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB Ltd.

- 9.2 Advantech Co., Ltd.

- 9.3 ALE International

- 9.4 Allied Telesis Inc

- 9.5 Analog Devices

- 9.6 Arista

- 9.7 BECKHOFF Automation

- 9.8 Belden Inc.

- 9.9 Brocade Communications Systems

- 9.10 Cisco Systems Inc.

- 9.11 D-link Corporation

- 9.12 Eaton

- 9.13 H3C

- 9.14 Hewlett Packard

- 9.15 Honeywell International Inc.

- 9.16 Huawei Technologies Co., Ltd.

- 9.17 Juniper Networks, Inc.

- 9.18 Microchip Technology Inc.

- 9.19 Moxa Inc.

- 9.20 Omron Corporation

- 9.21 Robert Bosch Gmbh

- 9.22 Rockwell Automation

- 9.23 Schneider Electric

- 9.24 Siemens AG

- 9.25 Yaskawa Electric Corporation