PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699410

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699410

Biomarker Discovery Outsourcing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

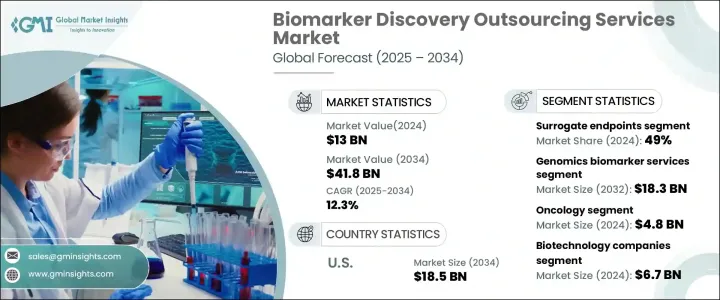

The Global Biomarker Discovery Outsourcing Services Market was valued at USD 13 billion in 2024 and is projected to expand at a CAGR of 12.3% between 2025 and 2034. The market is witnessing significant growth, driven by the increasing incidence of chronic diseases, rapid advancements in omics technologies, and rising investments in research and development within the pharmaceutical and biotechnology sectors. The growing emphasis on personalized medicine is further fueling demand for novel biomarkers that enable early detection, diagnosis, and monitoring of chronic conditions such as cancer, cardiovascular diseases, and diabetes. With chronic disease prevalence on the rise worldwide, the demand for biomarkers to facilitate targeted treatment strategies continues to increase.

Rising government initiatives, collaborations between pharmaceutical companies and research organizations, and regulatory support for biomarker validation are accelerating market expansion. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in biomarker discovery is also transforming the industry, allowing for faster identification and validation of potential biomarkers. Emerging economies are becoming key players in biomarker research due to rising healthcare expenditures and the establishment of advanced clinical research centers. Additionally, the adoption of digital health solutions and bioinformatics tools is enhancing data-driven biomarker discovery, leading to improved patient outcomes and more efficient drug development processes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $41.8 Billion |

| CAGR | 12.3% |

The market is categorized into different biomarker types, including predictive, prognostic, safety biomarkers, surrogate endpoints, and others. Surrogate endpoints dominated the market in 2024, accounting for 49% of the total revenue share, and are expected to grow at a CAGR of 12.1% from 2025 to 2034. Surrogate biomarkers play a crucial role in clinical trials by enabling researchers to assess treatment efficacy early, significantly expediting the clinical study process. Their widespread adoption, particularly in emerging markets, and strong regulatory support from authorities such as the U.S. FDA for drug approvals in oncology and rare diseases continue to drive their market share.

The biomarker discovery outsourcing services market is further segmented by service type, which includes genomics, proteomics, bioinformatics, and others. The genomics biomarker services segment alone generated USD 5.7 billion in 2024. Increasing cases of genetic disorders and the rising mortality rates associated with chronic diseases like cancer and neurodegenerative conditions are fueling the demand for genomic biomarker services. Growing public and private sector investments in genomics research are expediting the discovery and validation of genomic biomarkers, further strengthening the market. The integration of next-generation sequencing (NGS) and other high-throughput genomic technologies is enhancing biomarker identification, ensuring more precise diagnostics and personalized treatment plans.

The U.S. Biomarker Discovery Outsourcing Services Market is expected to reach USD 18.5 billion by 2034. The country's leadership in the biotechnology sector, advanced healthcare infrastructure, and well-established regulatory framework are contributing to its dominance in this space. The U.S. FDA has implemented stringent yet supportive regulatory mechanisms for biomarker validation, ensuring the successful integration of biomarkers into diagnostics and drug development processes. Ongoing partnerships between biopharmaceutical companies, academic research institutions, and government agencies are further propelling innovation and market expansion. As a result, the U.S. remains at the forefront of biomarker discovery outsourcing services, leading the global market throughout the forecast period.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising investments in research and development

- 3.2.1.2 Increasing focus on personalized medicine and targeted therapies

- 3.2.1.3 Advancements in high-throughput technologies

- 3.2.1.4 Booming biologics industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Intellectual property concerns

- 3.2.2.2 Data security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Predictive biomarkers

- 5.3 Prognostic biomarkers

- 5.4 Safety biomarkers

- 5.5 Surrogate endpoints

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Service, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Genomics biomarker services

- 6.3 Proteomics biomarker services

- 6.4 Bioinformatics biomarker services

- 6.5 Other biomarker services

Chapter 7 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Cardiology

- 7.4 Neurology

- 7.5 Autoimmune diseases

- 7.6 Other therapeutic areas

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Biotechnology companies

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Almac Group Limited

- 10.2 Biomcare ApS

- 10.3 Bio-Rad Laboratories

- 10.4 Crown Bioscience

- 10.5 Evotec

- 10.6 Excelra

- 10.7 Frontage Labs

- 10.8 ICON

- 10.9 Integrated DNA Technologies

- 10.10 Parexel International (MA) Corporation

- 10.11 RayBiotech

- 10.12 REPROCELL

- 10.13 Sino Biological

- 10.14 Svar Life Science