PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699401

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699401

Implantable Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

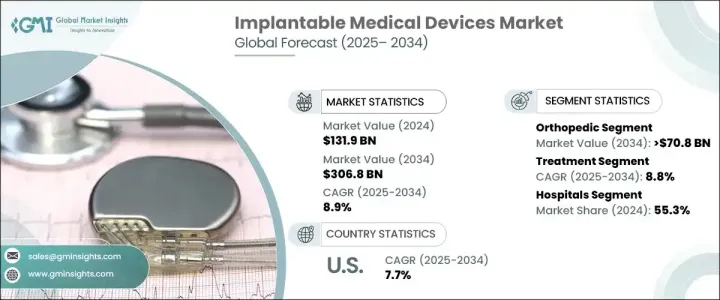

The Global Implantable Medical Devices Market was valued at USD 131.9 billion in 2024 and is projected to grow at a CAGR of 8.9% between 2025 and 2034. This growth is fueled by the increasing prevalence of chronic conditions such as cardiovascular diseases, neurological disorders, and orthopedic issues, all of which require advanced implantable solutions. As the global population ages, the demand for pacemakers, neurostimulators, orthopedic implants, and other life-enhancing devices continues to surge. The elderly demographic remains a significant driver of market expansion, given their higher susceptibility to age-related ailments and chronic conditions.

Technological advancements are further reshaping the implantable medical devices industry, with innovations in biocompatible materials, wireless technology, and smart implants enhancing the functionality and durability of these devices. The rise of minimally invasive procedures and patient preference for long-lasting solutions are also propelling adoption. The integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) is creating new growth avenues, with devices now capable of real-time health monitoring and data transmission for better patient management. The market is also seeing a surge in 3D-printed implants, allowing for greater customization and improved surgical outcomes. With healthcare spending increasing globally and regulatory approvals easing for next-generation implants, manufacturers are focusing on research and development to introduce more efficient and patient-centric devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $131.9 Billion |

| Forecast Value | $ 306.8 Billion |

| CAGR | 8.9% |

The market is segmented into various categories, with orthopedic devices expected to witness substantial growth. The orthopedic segment is projected to grow at a CAGR of 5.7%, reaching USD 70.8 billion by 2034. Rising cases of osteoporosis, osteoarthritis, and fractures are contributing to the higher demand for orthopedic implants. The increasing number of joint replacement surgeries, particularly hip, knee, and spinal implants, is further accelerating market expansion. Additionally, the growing incidence of traumatic injuries due to road accidents and sports-related mishaps is driving the adoption of advanced orthopedic solutions worldwide.

The implantable medical devices industry is also divided into treatment and diagnostic devices. The treatment segment, which encompasses devices used for therapeutic purposes, is anticipated to grow at a CAGR of 8.8%, reaching USD 303.2 billion by 2034. The increasing prevalence of lifestyle-related diseases, such as diabetes and cardiovascular disorders, is driving demand for innovative and durable implantable solutions. These devices significantly enhance patient outcomes and quality of life, leading to widespread adoption.

U.S. Implantable Medical Devices Market, valued at USD 54.8 billion in 2024, is expected to expand at a CAGR of 7.7% from 2025 to 2034. The country remains a global leader in technological advancements, with innovations in wireless charging, miniaturization, and AI-driven implants revolutionizing the industry. Smart implants that provide real-time data and personalized treatment options are gaining traction among healthcare providers. Furthermore, 3D printing technology is transforming the production of personalized implants, improving precision in surgical procedures. With continuous R&D investments and a robust healthcare infrastructure, the U.S. is poised to remain at the forefront of implantable medical device innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases across the globe

- 3.2.1.2 Scarcity of organ donors

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Rising government funding for implantable medical devices in developed countries

- 3.2.1.5 Increasing focus on the development of microelectronics and implantable sensors

- 3.2.1.6 Growing adoption of biomaterials for better biocompatibility and outcomes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulations for active implantable medical devices

- 3.2.2.3 Considerable rate of post-procedural complications

- 3.2.2.4 High number of recalls of implantable medical devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on implantable medical device security

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Orthopedic

- 5.2.1 Joint reconstruction

- 5.2.2 Spinal devices

- 5.2.3 Trauma fixation devices

- 5.2.4 Other orthopedic products

- 5.3 Cardiovascular

- 5.3.1 Stents

- 5.3.2 Implantable cardiac defibrillators (ICDs)

- 5.3.3 Pacemaker

- 5.3.4 Cardiac resynchronization therapy (CRT)

- 5.3.5 Ventricular assist devices

- 5.3.6 Implantable cardiac monitors (ICM)

- 5.3.7 Other cardiovascular products

- 5.4 Dental

- 5.4.1 Dental crowns and abutment

- 5.4.2 Dental implants

- 5.4.3 Other dental products

- 5.5 Neurology

- 5.5.1 Deep brain stimulators

- 5.5.2 Other neurology products

- 5.6 Ophthalmology

- 5.6.1 Intraocular lenses and glaucoma implants

- 5.6.2 Other ophthalmology products

- 5.7 Plastic surgery

- 5.7.1 Breast implants

- 5.7.2 Gluteal implants

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Treatment

- 6.3 Diagnostic

Chapter 7 Market Estimates and Forecast, By Nature of Device, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Static/Non-active/Passive

- 7.3 Active

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Multi-specialty centers

- 8.5 Clinics

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Advanced Bionics

- 10.3 Alcon

- 10.4 Allergan

- 10.5 BAUSCH + LOMB

- 10.6 BIOTRONIK

- 10.7 Boston Scientific

- 10.8 Cochlear

- 10.9 Demant

- 10.10 GORE

- 10.11 HENRY SCHEIN

- 10.12 Johnson & Johnson

- 10.13 MED-EL

- 10.14 Medtronic

- 10.15 MicroPort

- 10.16 mindray

- 10.17 POLYTECH

- 10.18 smith & nephew

- 10.19 stryker

- 10.20 ZIMMER BIOMET