PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699396

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699396

High Voltage Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

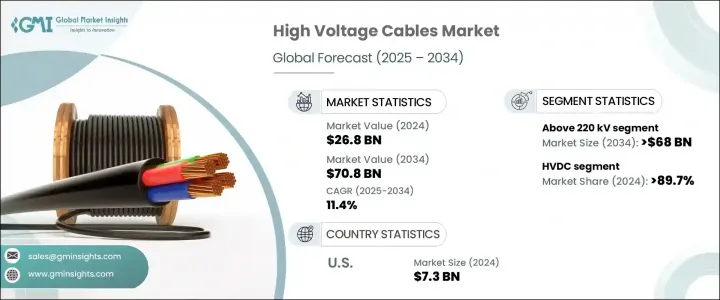

The Global High Voltage Cable Market reached USD 26.8 billion in 2024 and is projected to expand at a CAGR of 11.4% from 2025 to 2034. The increasing focus on upgrading and refurbishing aging electrical infrastructure, along with significant investments in grid network expansion worldwide, is driving industry growth. Emerging economies, in particular, are prioritizing the development of reliable and efficient grid systems to address gaps in their existing power infrastructure. The rising energy demand has intensified efforts to modernize electrical networks, with both public and private sectors investing heavily to support this transition. Additionally, the push toward integrating renewable energy sources has contributed to the need for advanced transmission technologies. The growing deployment of underground and subsea cable systems is further enhancing sustainability, offering long-term benefits in terms of reliability and environmental protection.

The industry categorizes cables based on voltage into three segments: below 110 kV, 110 kV to 220 kV, and above 220 kV. Cables under 110 kV primarily support urban distribution networks and renewable energy connections. This segment is forecasted to expand at a CAGR exceeding 25% by 2034 due to rapid urbanization and the demand for stable power distribution networks. Expanding populations in urban areas, along with ongoing infrastructure projects, are expected to drive widespread adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.8 Billion |

| Forecast Value | $70.8 Billion |

| CAGR | 11.4% |

High voltage cables are also classified into HVAC and HVDC categories. The HVDC segment accounted for over 89.7% of the market share in 2024, demonstrating its dominance in the industry. The adoption of high-capacity conductors designed to reduce power losses over long distances is reinforcing HVDC market expansion. Its cost-effective nature and efficiency in large-scale energy transmission are accelerating deployment, particularly for extensive grid networks. The increasing focus on minimizing energy loss during transmission and supporting long-distance power transfers is further boosting the demand for HVDC technology.

The U.S. high voltage cable market has experienced notable fluctuations in value, reaching USD 0.1 billion in 2022, USD 0.05 billion in 2023, and USD 7.3 billion in 2024. The market is set to witness further expansion due to rising investments in renewable energy projects, ongoing modernization of electric grids, and the growing necessity for a reliable power transmission network. The emphasis on strengthening energy infrastructure to meet sustainability goals and improve electricity distribution is contributing to sustained industry growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (km, USD Billion)

- 5.1 Key trends

- 5.2 < 110 kV

- 5.3 110 kV - 220 kV

- 5.4 > 220 kV

Chapter 6 Market Size and Forecast, By Current, 2021 – 2034 (km, USD Billion)

- 6.1 Key trends

- 6.2 HVAC

- 6.3 HVDC

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (km, USD Billion)

- 7.1 Key trends

- 7.2 Overhead

- 7.3 Submarine

- 7.4 Underground

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (km, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 Spain

- 8.3.4 Netherlands

- 8.3.5 UK

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Thailand

- 8.4.5 Indonesia

- 8.5 Rest of World

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 South Africa

Chapter 9 Company Profiles

- 9.1 alfanar Group

- 9.2 Brugg Kabel

- 9.3 Ducab

- 9.4 Elsewedy Electric

- 9.5 Furukawa Electric

- 9.6 Gupta Power

- 9.7 Iljin Electric

- 9.8 Jeddah Cables

- 9.9 LS Cable & System

- 9.10 Mitsubishi Electric

- 9.11 Nexans

- 9.12 NKT

- 9.13 Power Plus Cable

- 9.14 Prysmian Group

- 9.15 Riyadh Cables

- 9.16 Southwire Company

- 9.17 Sumitomo Electric Industries

- 9.18 Taihan Cables & Solution

- 9.19 TF Kable

- 9.20 ZMS Cable

- 9.21 ZTT