PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699379

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699379

Soft Tissue Repair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

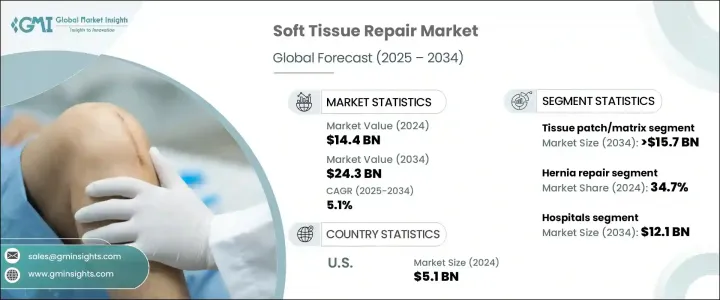

The Global Soft Tissue Repair Market reached USD 14.4 billion in 2024 and is projected to expand at a CAGR of 5.1% from 2025 to 2034. Rising sports injuries, trauma cases, and age-related soft tissue damage are driving demand for surgical solutions. A growing elderly population and increasing obesity rates contribute to higher incidences of hernias and other conditions requiring soft tissue repair. Advances in biocompatible products and synthetic mesh solutions are improving patient outcomes, making surgical interventions more effective. Progress in imaging techniques and minimally invasive procedures enhances recovery times and reduces post-operative complications.

Greater awareness of innovative repair techniques and improved patient outcomes fuel market growth. The expansion of sports medicine and increased youth participation in sports result in higher injury rates, further driving demand. Additionally, government investments in healthcare in emerging markets are creating new growth opportunities. Future developments in regenerative medicine, including platelet-rich plasma (PRP) therapy and stem cell treatments, are expected to revolutionize the field. Increased healthcare spending and insurance coverage for complex surgeries improve access to advanced repair methods. A shift towards outpatient services in ambulatory surgical centers highlights the trend of cost-effective, convenient care, reinforcing market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.4 Billion |

| Forecast Value | $24.3 Billion |

| CAGR | 5.1% |

Soft tissue repair encompasses muscle restoration, fascia suturing, and treatment of ligaments, tendons, and skin tissue damage. This includes perioperative and post-operative interventions such as non-surgical sutures, biological solutions, and regenerative stem cell therapies aimed at pain relief and motion recovery. The market is divided into tissue patch/matrix and tissue fixation devices. The tissue patch/matrix segment, driven by the need for effective scaffolding solutions in surgeries, is expected to grow at a CAGR of 4.9%, reaching over USD 15.7 billion by 2034. Increased cases of traumatic injuries, hernias, and age-related tissue degeneration are boosting demand. Advances in materials science, particularly bioengineered and synthetic patches, enhance patient outcomes due to superior biocompatibility and lower rejection risks.

Modern surgical techniques, such as laparoscopic procedures, support the adoption of tissue patches by reducing complications and recovery periods. The rising incidence of sports injuries and a growing aging population further necessitate efficient tissue repair solutions. Innovations in regenerative medicine, including bioengineered scaffolds that integrate seamlessly with native tissues, expand their applications. Increased healthcare investments and improved insurance coverage for surgical procedures facilitate wider adoption of advanced tissue repair solutions. The focus on outpatient procedures in ambulatory surgical centers accelerates the demand for cost-effective and rapid recovery materials, positioning tissue matrices and patches as preferred options among surgeons.

The market is segmented by application into hernia repair, orthopedic procedures, skin repair, dural repair, and other treatments. Hernia repair accounted for 34.7% of the market in 2024, driven by rising obesity rates, an aging population, and sedentary lifestyles. Increased adoption of laparoscopic and open surgical procedures boosts demand for advanced repair materials, including synthetic and biological meshes that reduce recurrence and improve recovery times. Enhanced patient and surgeon confidence in hernia repair solutions continues to drive market expansion.

End-use segmentation includes hospitals, ambulatory surgical centers, and clinics. Hospitals led the market in 2024, holding a 48.3% share and projected to reach USD 12.1 billion by 2034. The high volume of complex surgical cases, advanced medical infrastructure, and specialized post-operative care make hospitals the primary treatment centers. Rising surgical volumes due to aging populations and lifestyle-related conditions further reinforce hospital dominance in soft tissue repair.

The U.S. soft tissue repair market was valued at USD 4.7 billion in 2023 and USD 5.1 billion in 2024, with strong growth projections. Increased cases of chronic diseases, sports injuries, and age-related tissue degeneration drive demand for advanced repair solutions. The growing adoption of biologics and synthetic meshes enhances the effectiveness of treatments. Minimally invasive laparoscopic techniques, which shorten recovery times and reduce complications, are gaining traction. Favorable reimbursement policies and high healthcare spending enable greater patient access to innovative repair methods. The presence of leading manufacturers fosters continuous product development, strengthening market growth. The shift toward outpatient surgical centers and advanced hospital infrastructure supports broader ado

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising obese population

- 3.2.1.2 Increasing incidence of sports injuries

- 3.2.1.3 Recent advancements in soft tissue repair procedures

- 3.2.1.4 Increasing prevalence of orthopedic conditions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Excessive cost of soft tissue repair procedures

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue patch/Matrix

- 5.2.1 Synthetic mesh

- 5.2.2 Biologic mesh

- 5.2.2.1 Allograft

- 5.2.2.2 Xenograft

- 5.3 Tissue fixation devices

- 5.3.1 Suture anchors

- 5.3.2 Sutures

- 5.3.3 Interference screws

- 5.3.4 Other tissue fixation devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hernia repair

- 6.3 Orthopedic

- 6.4 Skin repair

- 6.5 Dural repair

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Clinics

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anika Therapeutics

- 9.2 Arthrex

- 9.3 Baxter

- 9.4 Becton, Dickinson and Company

- 9.5 Collagen Matrix

- 9.6 CONMED

- 9.7 CryoLife

- 9.8 Depuy Synthes (Johnson & Johnson)

- 9.9 Integra LifeSciences

- 9.10 Medprin

- 9.11 Medtronic

- 9.12 Smith & Nephew

- 9.13 Stryker Corporation

- 9.14 Zimmer Biomet