PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699371

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699371

Curtains and Window Blinds Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

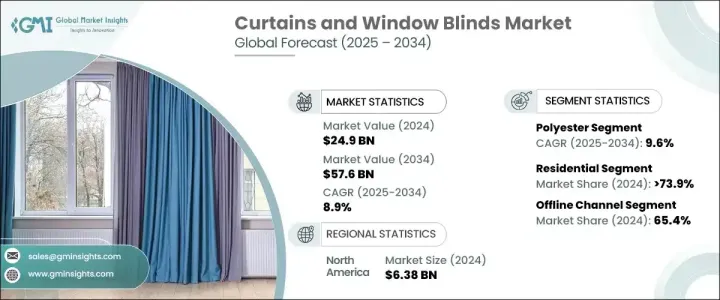

The Global Curtains And Window Blinds Market was valued at USD 24.9 billion in 2024 and is projected to expand at a CAGR of 8.9% from 2025 to 2034, driven by rapid urbanization and increasing demand for modern home decor and energy-efficient solutions. As urban centers continue to grow, more residential and commercial spaces are being developed, fueling the demand for window treatments that offer privacy, light control, and insulation. Rising disposable incomes and a growing emphasis on personalized home decor are also contributing to market expansion, particularly in the Asia-Pacific region, which includes China, India, and Southeast Asia. The global urban population is expected to reach 60% by 2030, further accelerating the demand for window coverings that complement contemporary living spaces.

Energy-efficient window treatments are gaining traction as cities consume more energy. Thermal curtains, blackout blinds, and solar shades help reduce energy costs by improving insulation. Sustainable urban development initiatives in regions like North America and Europe are supporting the adoption of eco-friendly window treatments. Government policies promoting energy efficiency, such as those under the European Green Deal, are further bolstering the market for sustainable products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.9 Billion |

| Forecast Value | $57.6 Billion |

| CAGR | 8.9% |

By material type, the market includes linen, cotton, polyester, wood, PVC, and metal. Polyester led the segment in 2024, generating USD 6.5 billion in revenue, and is expected to grow at a CAGR of 9.6%. Its affordability, durability, and versatility make it the preferred choice for both manufacturers and consumers. Unlike natural fabrics, polyester is cost-effective and can be produced in bulk, making it widely accessible. The fabric is also resistant to wear, wrinkles, and moisture, making it ideal for humid environments. Its adaptability allows it to be blended with other materials, dyed in various colors, and treated for blackout, UV protection, or thermal insulation. The increasing use of recycled polyester, particularly in environmentally conscious regions like Europe and North America, is also shaping the market's future.

The market is segmented by application into residential and commercial sectors. The residential segment dominated in 2024, holding a 73.9% share, and is expected to grow at a CAGR of 9.4% through 2034. The surge in homeownership, home renovations, and interest in interior design is driving this demand. Consumers are investing in window treatments that enhance privacy, control lighting, and improve energy efficiency. High disposable incomes in regions like North America, Europe, and Asia-Pacific are further encouraging the purchase of stylish and functional window furnishings.

By distribution channel, the market is divided into online and offline sales. In 2024, the offline segment held a 65.4% share, as consumers preferred in-person consultations, custom measurements, and installation services. Customers often visit physical stores to assess materials and styles before making a purchase, contributing to the dominance of the offline sector.

Regionally, North America accounted for 25.5% of the global market share in 2024, generating USD 6.38 billion in revenue. Demand for high-end home decor, smart window treatments, and energy-efficient solutions is shaping the industry. The increasing adoption of motorized blinds and government incentives for energy-saving home improvements continue to support market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising urbanization

- 3.10.1.2 Increasing disposable income

- 3.10.1.3 Technological advancements

- 3.10.1.4 Increasing demand for customization

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Intense competition

- 3.10.2.2 Seasonal demand

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Cotton

- 5.3 Linen

- 5.4 Polyester

- 5.5 Wood

- 5.6 PVC

- 5.7 Metal

Chapter 6 Market Estimates & Forecast, By Windowpane Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual operated

- 6.3 Electrically operated

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Offline

- 9.3 Online

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 3 Day Blinds

- 11.2 Advanced Window Blinds

- 11.3 Aluvert Blinds

- 11.4 Aspect Blinds

- 11.5 Budget Blinds

- 11.6 Comfortex Window Fashions

- 11.7 Graber

- 11.8 Hillarys

- 11.9 Hunter Douglas

- 11.10 IKEA

- 11.11 Levolor

- 11.12 Silent Gliss

- 11.13 Somfy

- 11.14 Springs Window Fashions

- 11.15 Stevens

- 11.16 The Shade Store