PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699369

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699369

Refurbished Computers and Laptops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

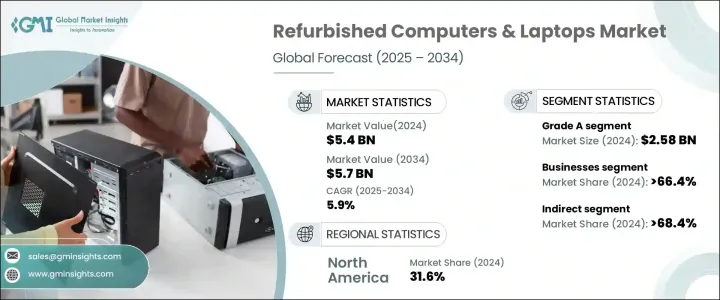

The Global Refurbished Computers and Laptops Market reached USD 5.4 billion in 2024 and is expected to exhibit a CAGR of 5.9% from 2025 to 2034. Rising concerns about environmental sustainability are a major driver as consumers and businesses look for ways to reduce electronic waste. The growing emphasis on cost-effective technology solutions has also fueled demand, with refurbished devices offering high performance at a fraction of the price. Companies and institutions are increasingly opting for refurbished computers and laptops to cut costs while maintaining efficiency. Improved refurbishment techniques and quality checks have further strengthened consumer trust, making these products a viable alternative to new devices.

The Grade A segment generated USD 2.58 billion in 2024 and is anticipated to grow at a CAGR of 6.1%. These devices are lightly used and undergo rigorous quality checks to ensure they function like new, making them highly desirable among budget-conscious buyers. The appeal of Grade A products lies in their minimal wear and tear, making them a cost-effective yet reliable alternative to brand-new computers. Businesses and professionals seeking high-performance devices without the premium price tag prefer Grade A options, driving steady demand in this segment. The availability of high-quality refurbished laptops and desktops with updated software and extended warranties further strengthens consumer confidence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $5.7 Billion |

| CAGR | 5.9% |

Indirect distribution channels segment held a 68.4% share in 2024, with expected growth of 5.8% through 2034. Online platforms and third-party retailers have made it easier for consumers to access certified refurbished computers and laptops, offering convenience and competitive pricing. These platforms ensure that products meet high standards by providing warranties, return options, and quality certifications. Many businesses, educational institutions, and government agencies prefer purchasing from wholesalers and retailers due to bulk order discounts and reliability. Lower operational costs for indirect sellers translate to better pricing and promotional offers, making refurbished devices more attractive to buyers.

North America Refurbished Computers & Laptops Market held a 31.6% share and generated USD 1.7 billion in 2024. High consumer awareness and increasing demand for cost-efficient IT solutions drive market growth in the region. Businesses, schools, and individual consumers recognize the value of refurbished electronics, contributing to their widespread adoption. Strong distribution networks and trusted online platforms make it easy for buyers to find high-quality, certified refurbished devices. With a growing focus on sustainability and affordability, North America remains a key market for refurbished computers and laptops.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Sustainability and environmental awareness

- 3.10.1.2 Growing demand from emerging markets

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Perception of quality and reliability

- 3.10.2.2 Supply chain challenges

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Grade, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Grade A

- 5.3 Grade B

- 5.4 Grade C

- 5.5 Grade D

Chapter 6 Market Estimates & Forecast, By Operating System, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Windows refurbished computers & laptops

- 6.3 Mac refurbished computers & laptops

Chapter 7 Market Estimates & Forecast, By Screen Size, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 11-13 inches

- 7.3 14-16 inches

- 7.4 17 inches and above

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Businesses

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acer

- 11.2 Amazon Renewed

- 11.3 Apple

- 11.4 Arrow Direct

- 11.5 ASUS

- 11.6 Back Market

- 11.7 Best Buy

- 11.8 Blair Tech

- 11.9 Dell

- 11.10 Gazelle

- 11.11 HP

- 11.12 Lenovo

- 11.13 Microsoft

- 11.14 Samsung