PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699362

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699362

High Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

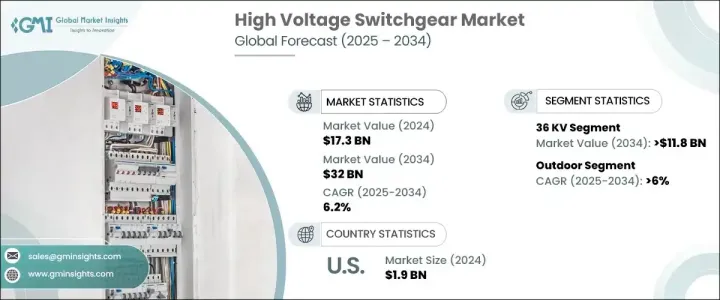

The Global High Voltage Switchgear Market, valued at USD 17.3 billion in 2024, is expected to expand at a CAGR of 6.2% from 2025 to 2034, driven by increasing electricity demand due to urbanization, industrial expansion, and population growth. Investments in clean energy and infrastructure development are fueling the need for advanced switchgear systems across multiple industries. Governments and private entities worldwide are prioritizing the modernization of electrical grids to enhance efficiency, reliability, and sustainability.

Aging electrical infrastructure in developed regions necessitates upgrades, leading to a shift from traditional air-insulated switchgear to more efficient gas-insulated switchgear. As technological advancements improve grid stability, the deployment of high voltage switchgear is becoming critical to ensuring uninterrupted power distribution. Additionally, rising investments in electricity transmission and distribution projects will further strengthen market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.3 Billion |

| Forecast Value | $32 Billion |

| CAGR | 6.2% |

By voltage, the 36 KV segment is expected to generate over USD 11.8 billion by 2034. This surge is largely attributed to government-backed initiatives aimed at strengthening power distribution networks. Rising electricity demand and infrastructure developments are prompting significant investments in high-capacity switchgear solutions. Strategic funding for grid modernization efforts is expected to create substantial growth opportunities for this segment in the coming years.

In terms of installation, the outdoor segment is set to witness a CAGR exceeding 6% through 2034, owing to its widespread adoption in power transmission, distribution networks, and industrial applications. Designed to withstand harsh environmental conditions, outdoor switchgear plays a crucial role in ensuring seamless electricity transmission at high voltage levels. Expanding grid networks and the increasing integration of renewable energy sources continue to drive demand for these systems.

Emerging economies are making considerable financial commitments to develop advanced energy infrastructure, reinforcing the high voltage switchgear industry. Substantial funding for electric grid construction projects is accelerating market expansion, with ongoing initiatives aimed at bolstering the efficiency and reliability of power distribution systems.

The US market has demonstrated consistent growth, with valuations of USD 1.7 billion in 2022, USD 1.8 billion in 2023, and USD 1.9 billion in 2024. As one of the most technologically advanced nations, the country continues to invest significantly in high voltage switchgear to support its expanding energy sector. Government policies, industrial automation, and increased deployment of renewable energy sources are reinforcing the country's strong market presence.

With increasing electrification and grid modernization projects worldwide, the demand for advanced high voltage switchgear solutions is expected to rise steadily. Technological advancements, infrastructure investments, and evolving energy policies will remain pivotal in shaping market dynamics in the years ahead.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 36 kV

- 5.3 72.5 kV

- 5.4 123 kV

- 5.5 145 kV

Chapter 6 Market Size and Forecast, By Installation 2021 – 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Indoor

- 6.3 Outdoor

Chapter 7 Market Size and Forecast, By Breaking Capacity 2021 – 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 25 kA

- 7.3 31.5 kA

- 7.4 40 kA

- 7.5 50 kA

- 7.6 63 kA

Chapter 8 Market Size and Forecast, By Current 2021 – 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 600 A

- 8.3 1200 A

- 8.4 2000 A

- 8.5 3150 A

- 8.6 4000 A

Chapter 9 Market Size and Forecast, By Product 2021 – 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 Dead tank

- 9.3 Live tank

- 9.4 GIS

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 India

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Turkey

- 10.5.4 South Africa

- 10.5.5 Egypt

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bharat Heavy Electricals

- 11.3 CG Power and Industrial Solutions

- 11.4 E + I Engineering

- 11.5 Eaton

- 11.6 Fuji Electric

- 11.7 General Electric

- 11.8 HD Hyundai Electric

- 11.9 Hitachi

- 11.10 Hyosung Heavy Industries

- 11.11 Lucy Group

- 11.12 Mitsubishi Electric

- 11.13 Ormazabal

- 11.14 Schneider Electric

- 11.15 Siemens

- 11.16 Skema

- 11.17 Toshiba