PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766339

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766339

Colorectal Cancer Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

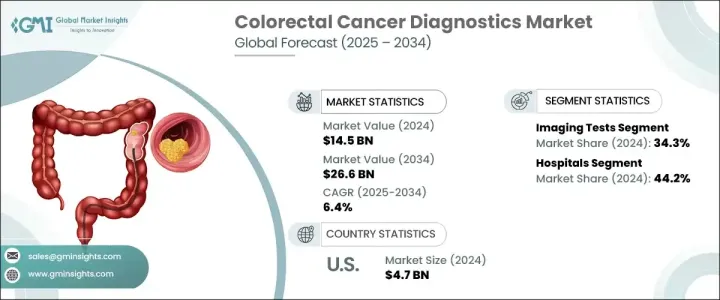

The Global Colorectal Cancer Diagnostics Market was valued at USD 14.5 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 26.6 billion by 2034.

The market growth is driven by the increasing incidence of colorectal cancer, rising public health initiatives for early screening, and continuous technological advancements in diagnostic modalities. Innovations such as liquid biopsy, AI-assisted imaging, and stool-based DNA tests are reshaping the landscape of colorectal cancer detection, offering less invasive, more accurate, and patient-friendly diagnostic options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.5 Billion |

| Forecast Value | $26.6 Billion |

| CAGR | 6.4% |

Growing awareness campaigns and updated screening guidelines, such as lowering the recommended age for routine CRC screening to 45, contribute to early diagnosis rates. Furthermore, an aging global population, combined with lifestyle factors like sedentary behavior and dietary habits, has heightened the global burden of colorectal cancer, underscoring the urgent need for effective and accessible diagnostics. Governments and healthcare organizations worldwide are launching large-scale initiatives to improve access to colorectal cancer screening, while private companies are investing heavily in R&D to bring next-generation diagnostic tools to the market. Artificial intelligence, next-generation sequencing (NGS), and microfluidic technologies are poised to enhance diagnostic precision and patient outcomes significantly.

The colorectal cancer diagnostics market is primarily segmented by test type, with the imaging tests segment holding 34.3% share in 2024. Imaging modalities such as CT colonography, MRI, and PET scans remain crucial for early detection, staging, and treatment planning. Adopting AI-enhanced imaging has improved detection accuracy, helping to identify precancerous lesions at earlier stages. Moreover, imaging tests' non-invasive or minimally invasive nature continues to drive patient acceptance and screening rates.

In terms of end-use, the hospitals segment held 44.2% share in 2024, solidifying its position as the leading end-user for colorectal cancer diagnostics. Hospitals are the primary centers for colorectal cancer detection, diagnosis, staging, and treatment planning, supported by a comprehensive diagnostic infrastructure that includes advanced imaging systems, molecular pathology labs, endoscopic equipment, and surgical oncology units. Their multidisciplinary approach-bringing together oncologists, radiologists, pathologists, gastroenterologists, and surgeons-enables the seamless coordination of care for colorectal cancer patients, from early detection through post-treatment monitoring.

North America Colorectal Cancer Diagnostics Market held a 35.2% share in 2024. The region's dominance stems from a robust healthcare infrastructure, widespread implementation of screening programs, and high adoption rates of advanced diagnostic technologies, such as AI-enabled colonoscopy, liquid biopsies, and molecular biomarker testing. In the United States, initiatives like the Colorectal Cancer Control Program (CRCCP) by the CDC have been instrumental in increasing early screening rates, particularly among underserved populations.

Key market players such as Abbott Laboratories, Exact Sciences Corporation, Siemens Healthineers AG, Guardant Health Inc., F-Hoffmann-La Roche Ltd., and GE HealthCare Technologies, Inc. are heavily investing in expanding their diagnostic portfolios through innovations in liquid biopsy, AI-driven imaging, and molecular diagnostics. Strategic partnerships, mergers and acquisitions, and regulatory approvals for new products remain crucial strategies for these players to strengthen their global presence and drive future market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Test type

- 2.2.2 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence and prevalence of colorectal cancer

- 3.2.1.2 Government initiatives and policies associated with cancer screening tests

- 3.2.1.3 Technological advancements in field of cancer diagnostics

- 3.2.1.4 Growing awareness regarding early diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diagnostic tests and procedures

- 3.2.2.2 Lack of reimbursement policies for diagnostic tests

- 3.2.3 Market Opportunities

- 3.2.3.1 Expansion and Adoption of Non-Invasive and AI-Driven Diagnostic Technologies

- 3.2.3.2 Rapid Market Growth in Emerging Regions

- 3.2.1 Growth drivers

- 3.3 Future market trends

- 3.4 Reimbursement scenario

- 3.5 Consumer behaviour analysis

- 3.6 Growth potential analysis

- 3.7 Technology landscape

- 3.8 Regulatory landscape

- 3.9 Gap analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood tests

- 5.3 Stool tests

- 5.3.1 Fecal occult blood test (FOBT)

- 5.3.2 Fecal biomarker test

- 5.3.3 CRC DNA screening test

- 5.4 Imaging tests

- 5.4.1 CT

- 5.4.2 Ultrasound

- 5.4.3 MRI

- 5.4.4 PET

- 5.4.5 Colonoscopy

- 5.4.6 Other imaging tests

- 5.5 Biopsy

- 5.6 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Cancer research centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 Danaher Corporation

- 8.3 DiaCarta

- 8.4 Exact Sciences Corporation

- 8.5 F-Hoffmann-La Roche

- 8.6 GE HealthCare Technologies

- 8.7 Geneoscopy

- 8.8 Guardant Health

- 8.9 H.U. Group Holdings

- 8.10 New Day Diagnostics

- 8.11 Olympus Corporation

- 8.12 Phase Scientific International

- 8.13 QIAGEN N.V.

- 8.14 Siemens Healthineers

- 8.15 Sysmex Corporation

- 8.16 Thermo Fisher Scientific