PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699354

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699354

Telehandler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

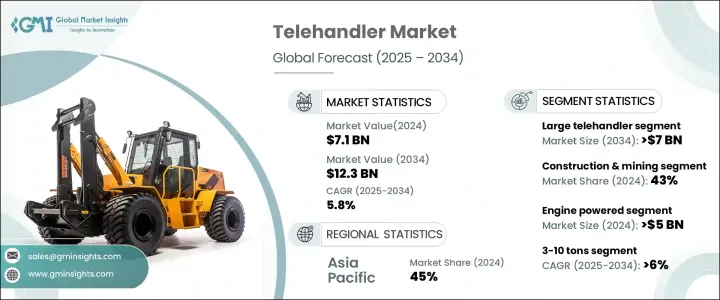

The Global Telehandler Market reached USD 7.1 billion in 2024 and is projected to grow at a CAGR of 5.8% between 2025 and 2034. Increased government investments in infrastructure projects, including highways, public transit systems, airports, and smart city initiatives, are driving demand. Large-scale developments often require state funding, leading to the adoption of advanced construction equipment. Telehandlers are benefiting from these trends, as they are crucial for material handling in infrastructure projects. The rise in agricultural mechanization is another key factor boosting market growth, with telehandlers being widely used for lifting, loading, and stacking farming materials. Unlike conventional tractors, these machines can navigate rough terrains while handling heavier loads, making them essential for farming operations. Their ability to function in tight spaces and under all weather conditions enhances their appeal across industries.

The telehandler market is segmented by product into large and compact models. Large telehandlers accounted for over 60% of the market share in 2024 and are expected to surpass USD 7 billion by 2034. These machines are in high demand for major construction, industrial, and mining operations due to their extended reach and lifting capacity. Compact telehandlers are gaining traction, particularly in urban settings where space constraints require equipment with enhanced maneuverability. Contractors favor these models for residential projects, indoor applications, and construction sites in densely populated areas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.8% |

By application, the market is categorized into rental, construction & mining, agriculture, industrial, and others. The construction & mining segment held a significant 43% market share in 2024. Growing infrastructure projects, including bridges, commercial buildings, and residential complexes, are fueling demand. Telehandlers are widely used in these industries due to their ability to lift heavy materials, operate on uneven terrains, and access elevated work areas. In the mining sector, these machines are essential for transporting heavy loads, performing maintenance, and navigating challenging landscapes.

In terms of type, the market is divided into engine-powered and electric telehandlers. The engine-powered segment was valued at over USD 5 billion in 2024, with widespread usage in construction, mining, and large-scale agricultural operations. These machines are favored for their strong torque, long operational hours, and ability to perform in demanding environments. Their diesel engines eliminate the need for recharging, making them ideal for off-road and remote applications. Electric telehandlers are expected to witness rapid growth due to lower operational costs, minimal maintenance requirements, and advancements in battery technology that improve charging speeds and battery longevity.

By lifting capacity, the market is segmented into below 3 tons, 3-10 tons, and above 10 tons. The 3-10 tons category is set to grow at a CAGR of over 6% through 2034, driven by demand in construction, warehousing, and material handling. These models strike a balance between strength and agility, making them indispensable for logistics centers, manufacturing plants, and urban projects. They are also widely used in agriculture for transporting feed, stacking hay, and moving grain, while warehouses rely on them for inventory management and lifting heavy goods.

Asia Pacific dominated the global market with a 45% share in 2024, with China leading the region. Government-driven infrastructure developments, industrial expansion, and automation trends are key drivers of demand. Policies promoting large-scale construction projects and industrial automation are accelerating the adoption of high-performance material handling equipment across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material & component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 Distributors & dealers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for telehandlers in construction and infrastructure development

- 3.10.1.2 Technological advancements and innovations in telehandlers

- 3.10.1.3 Rising popularity of rental telehandlers

- 3.10.1.4 Growing demand for heavy equipment in agriculture

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial investment and maintenance costs

- 3.10.2.2 Operational complexity and training requirements

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Large telehandler

- 5.3 Compact telehandler

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034($Bn, Units)

- 6.1 Key trends

- 6.2 Engine-powered

- 6.3 Electric

Chapter 7 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 3 tons

- 7.3 3-10 tons

- 7.4 Above 10 tons

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Rental

- 8.3 Construction & mining

- 8.4 Agriculture

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bobcat

- 10.2 Caterpillar

- 10.3 CNH Industrial

- 10.4 CTE Company

- 10.5 Dieci Srl

- 10.6 Faresin Industries

- 10.7 Haulotte Group

- 10.8 JCB

- 10.9 JLG Industries

- 10.10 Liebherr

- 10.11 Manitou

- 10.12 Merlo

- 10.13 Sany

- 10.14 Skyjack

- 10.15 Snorkel

- 10.16 Terex

- 10.17 Teupen

- 10.18 Wacker Neuson

- 10.19 XCMG

- 10.20 Zoomlion