PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699353

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699353

Softgel Capsules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

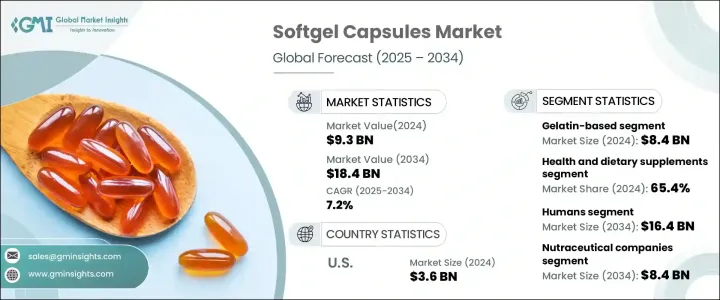

The Global Softgel Capsules Market reached USD 9.3 billion in 2024 and is expected to exhibit a CAGR of 7.2% from 2025 to 2034. Increasing consumption of nutraceuticals such as vitamins, omega-3 fatty acid supplements, and herbal medicines is a primary factor driving market growth. These products offer easier consumption and faster absorption compared to traditional medicines, making them a preferred choice among consumers. Additionally, advancements in softgel capsule manufacturing, such as the introduction of plant-based alternatives like potato starch, hydroxypropyl methylcellulose (HPMC), and pullulan, are further boosting industry growth. With a heightened focus on immune system boosters and dietary supplements, particularly after the pandemic, there has been a surge in demand for softgel capsules. Growing awareness about preventive healthcare and a shift toward healthier lifestyles have contributed to the increased adoption of dietary supplements, adding to the market's growth momentum.

Softgel capsules, also known as soft gelatin capsules, consist of a single-piece shell filled with various compounds in liquid, semi-solid, gel, or paste form. Their advantages include ease of swallowing, improved bioavailability, taste masking, and tamper-proof features, making them ideal for drugs with poor solubility and permeability. Based on type, the market is segmented into vegetarian and gelatin-based capsules, with the gelatin-based segment dominating the market, valued at USD 8.4 billion in 2024. These capsules provide better bioavailability, faster onset of action, and protection against environmental factors like light, air, and moisture, making them preferable over traditional tablets and capsules.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $18.4 Billion |

| CAGR | 7.2% |

The health and dietary supplements segment accounted for 65.4% of the market in 2024 and is projected to grow at a CAGR of 7.5% during the forecast period. Increasing demand for vitamins, minerals, and omega-3 supplements to boost immunity and improve overall health is driving this segment. The trend toward preventive healthcare has led consumers to include supplements in their daily routines to prevent chronic conditions such as cardiovascular diseases and osteoporosis. Rising healthcare costs have also encouraged the adoption of supplements as a cost-effective measure to manage long-term health, further fueling the demand for softgel capsules. Technological advancements have streamlined the manufacturing process, enabling the inclusion of a wider range of ingredients in softgel formulations, contributing to market growth.

The human segment led the market, generating USD 8.4 billion in 2024, and is projected to reach USD 16.4 billion by 2034. An aging population, particularly in developed nations, has fueled demand for easy-to-swallow and convenient medication forms like softgel capsules. The growing popularity of vitamins, minerals, and herbal supplements among health-conscious consumers has further boosted market growth. Pharmaceutical companies continue to embrace softgel formulations for their aesthetic appeal and consumer preference, strengthening the industry's growth trajectory.

Nutraceutical companies held a significant share of the market in 2024 and are expected to reach USD 8.4 billion by 2034. Rising consumer awareness about health and wellness, coupled with the proliferation of direct-to-consumer (DTC) models and e-commerce platforms, has expanded the reach of nutritional supplements, increasing demand for softgel capsules. Regulatory agencies in different regions have supported the use of nutraceuticals by approving various health claims, paving the way for the development of innovative softgel formulations.

In North America, the U.S. held a prominent position in the market, valued at USD 3.6 billion in 2024. Increased consumer inclination toward self-medication and over-the-counter (OTC) supplements, combined with favorable regulatory frameworks and growing research and development funding, has fueled the market's expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for nutraceuticals

- 3.2.1.2 Growing prevalence of chronic ailments globally

- 3.2.1.3 Technological innovation in softgel manufacturing

- 3.2.1.4 Increasing shift towards gelatin free capsules

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative dosage forms

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gelatin based

- 5.3 Vegetarian capsules

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Health and dietary supplements

- 6.2.1 Vitamins

- 6.2.2 Enzymes

- 6.2.3 Omega

- 6.2.4 Minerals

- 6.2.5 Other health and dietary supplements

- 6.3 Prescription medicine

- 6.3.1 Antibiotics and antivirals

- 6.3.2 Anti-inflammatory drugs

- 6.3.3 Cough and cold drugs

- 6.3.4 Other prescription medicines

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Humans

- 7.3 Animals

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Nutraceutical companies

- 8.4 Veterinary industry

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aenova Group

- 10.2 Capsugel (Lonza)

- 10.3 Captek Softgel International

- 10.4 Catalent

- 10.5 Curtis Health Caps

- 10.6 Delpharm Evreux

- 10.7 Estrellas

- 10.8 Eurocaps

- 10.9 Fuji Capsules

- 10.10 Guangdong Yichao Biological

- 10.11 Nutramax Laboratories

- 10.12 Patheon

- 10.13 Procaps Group

- 10.14 Sirio Pharma