PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871302

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871302

Medium Voltage Wire and Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

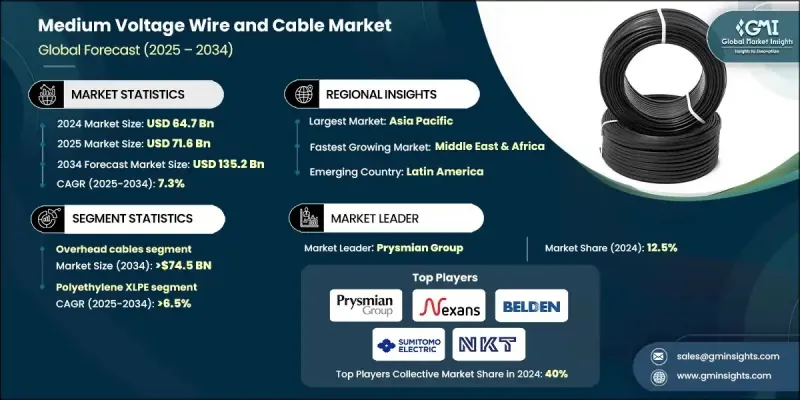

The Global Medium Voltage Wire and Cable Market was valued at USD 64.7 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 135.2 billion by 2034.

The demand for medium voltage cables is driven by significant investments from governments worldwide to modernize and expand energy infrastructure in response to increasing power needs. Advances in cable technology, including improvements in insulation materials, are enhancing the performance and durability of medium voltage cables. These developments, which focus on increasing efficiency and flexibility, make cables more appealing to businesses, governments, and utilities. Additionally, the integration of smart grid technology and digital monitoring systems into medium voltage networks increases energy efficiency, reducing downtime, and further fueling the demand for high-quality MV cables.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $64.7 Billion |

| Forecast Value | $135.2 Billion |

| CAGR | 7.3% |

The overhead cables segment is expected to reach USD 74.5 billion by 2034, driven largely by rising public sector funding aimed at improving and expanding power infrastructure. These cables are favored for their affordability and quick installation, especially in rural and semi-urban regions where underground cabling is less feasible. With lower setup costs and simplified maintenance, overhead lines are often the preferred choice in areas with wide, open terrains and lower population density. Their continued relevance is also tied to their critical role in grid modernization and the integration of renewable energy, particularly in linking power sources like wind farms to the main grid.

The polyethylene cross-linked polyethylene (XLPE) segment is forecasted to grow at a CAGR exceeding 6.5% through 2034. XLPE insulation provides substantial benefits over traditional materials like rubber or PVC, including superior thermal resistance, which supports efficient operation at higher temperatures and extends cable lifespan. The material's strong dielectric properties-such as high dielectric strength and low loss also improve transmission efficiency and safety. Moreover, XLPE's durability, chemical resistance, and mechanical strength make it a reliable choice across multiple environments, including harsh underground conditions and demanding industrial applications.

United States Medium Voltage Wire and Cable Market was valued at USD 5.5 billion in 2024. The country is witnessing substantial investments in both transmission and distribution infrastructure, accelerating global demand for MV wires and cables. As the second-largest global economy, the U.S. accounts for around 15% of worldwide clean energy spending. The robust investments, coupled with ongoing commitments in both renewables and fossil fuels, are expected to fuel demand for MV cables in the coming decades.

Leading players in the Global Medium Voltage Wire and Cable Market include NKT, Sumitomo Electric, Prysmian, Nexans, and Belden. To maintain and strengthen their presence, key companies are focusing on technological innovation, sustainable manufacturing, and strategic partnerships. They are investing in R&D to develop next-generation cables with enhanced performance and energy efficiency, especially those tailored for renewable energy and smart grid applications. Geographic expansion into emerging markets is also a critical growth lever, often supported by mergers, acquisitions, or joint ventures. Additionally, companies are prioritizing environmentally friendly materials and production processes to align with global decarbonization goals, while digital integration, such as IoT-enabled cable diagnostics, helps boost operational value for end users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by Region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Medium Voltage Wire and Cable Market Size and Forecast, By Deployment, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Overhead

- 5.3 Underground

Chapter 6 Medium Voltage Wire and Cable Market Size and Forecast, By Insulation, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Cross-linked Polyethylene (XLPE)

- 6.3 Ethylene Propylene Rubber (EPR)

- 6.4 Others

Chapter 7 Medium Voltage Wire and Cable Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

- 7.5 Utility

Chapter 8 Medium Voltage Wire and Cable Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.1.3 Mexico

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 France

- 8.2.3 Netherlands

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Sweden

- 8.2.7 Denmark

- 8.2.8 Germany

- 8.2.9 Russia

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 South Korea

- 8.3.5 Australia

- 8.3.6 Indonesia

- 8.3.7 Philippines

- 8.3.8 New Zealand

- 8.3.9 Malaysia

- 8.3.10 Thailand

- 8.4 Middle East & Africa

- 8.4.1 Saudi Arabia

- 8.4.2 UAE

- 8.4.3 Iraq

- 8.4.4 Kuwait

- 8.4.5 Qatar

- 8.4.6 South Africa

- 8.4.7 Egypt

- 8.4.8 Nigeria

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Peru

Chapter 9 Company Profiles

- 9.1 alfanar Group

- 9.2 Bahra Cables

- 9.3 BELDEN

- 9.4 Brugg Kabel AG

- 9.5 Ducab

- 9.6 Dynamic Cables

- 9.7 Elsewedy Electric

- 9.8 HELUKABEL

- 9.9 Jeddah Cables

- 9.10 KEI Industries

- 9.11 LS Cables

- 9.12 Nexans

- 9.13 NKT A/S

- 9.14 Prysmian Group

- 9.15 Riyadh Cables

- 9.16 Saudi Cable Company

- 9.17 SSG Cable

- 9.18 Sumitomo Electric Industries

- 9.19 Synergy Cables

- 9.20 Tratos Group

- 9.21 ZTT