PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699348

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699348

Renewable Diesel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

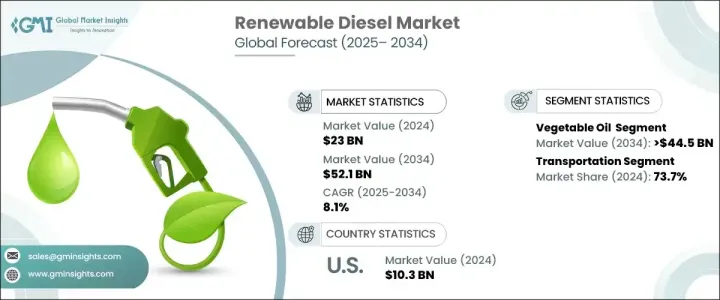

The Global Renewable Diesel Market was valued at USD 23 billion in 2024 and is projected to grow at a CAGR of 8.1% between 2025 and 2034. The push for cleaner energy solutions continues to drive this market as industries and governments worldwide seek alternatives to conventional petroleum-based diesel. Renewable diesel offers significant environmental benefits, including lower greenhouse gas emissions and reduced carbon footprints, making it a preferred choice in the transition toward sustainable fuel sources. Unlike biodiesel, which requires blending, renewable diesel is a direct substitute for petroleum diesel and can be used without modifying existing engines or infrastructure. This advantage is accelerating its adoption across multiple sectors, particularly in transportation, logistics, and heavy-duty applications.

Growing concerns over climate change and stringent regulations targeting carbon emissions are further strengthening the market landscape. Governments across the United States, Canada, and Europe are implementing policies that incentivize the production and use of renewable diesel through tax credits, subsidies, and low-carbon fuel mandates. Additionally, companies operating in transportation, construction, and agriculture are integrating renewable diesel into their operations to align with sustainability goals. The rising demand for carbon-neutral alternatives from both corporate fleets and municipal transit agencies is expected to reinforce market growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23 Billion |

| Forecast Value | $52.1 Billion |

| CAGR | 8.1% |

One of the primary factors propelling this expansion is the increasing utilization of vegetable oils in renewable diesel production, which is projected to generate USD 44.5 billion by 2034. Vegetable oils, including soybean oil, canola oil, and palm oil, offer a renewable and biodegradable feedstock option that enhances fuel efficiency while significantly cutting down emissions. These feedstocks have high energy density, allowing renewable diesel to replicate the performance of traditional diesel in terms of engine power, combustion efficiency, and reliability. As industries strive for cleaner fuel options that do not compromise on operational performance, the use of vegetable oils as key feedstocks is gaining momentum.

The transportation sector remains the dominant application segment, accounting for 73.7% of the total market share in 2024. The rising adoption of renewable diesel by logistics providers, public transit systems, and heavy-duty fleets is driven by its ability to maintain vehicle performance while reducing emissions. The demand for low-carbon fuels in commercial transport is surging as companies respond to sustainability commitments and regulatory requirements. With growing emphasis on ESG (Environmental, Social, and Governance) policies, fleet operators are increasingly investing in renewable diesel to future-proof their operations.

North America renewable diesel market was valued at USD 10.3 billion in 2024, capturing a 47.5% share of the global market. This share is expected to rise by 2034, supported by progressive government initiatives like the Renewable Fuel Standard (RFS) and the Low Carbon Fuel Standard (LCFS). These policies are driving higher adoption across multiple industries, from transportation and agriculture to construction and manufacturing. The region's expanding production capacity, backed by investments from major energy companies and fuel producers, is also fostering a robust supply chain for renewable diesel, ensuring its long-term viability as a cleaner fuel alternative.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 – 2034 (USD Billion & MT)

- 5.1 Key trends

- 5.2 Animal fat

- 5.3 Vegetable oil

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion & MT)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Power generation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MT)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Indonesia

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BP

- 8.2 Chevron

- 8.3 Diamond Green Diesel

- 8.4 Eni

- 8.5 Gevo

- 8.6 Marathon Petroleum

- 8.7 Neste

- 8.8 PBF Energy

- 8.9 Repsol

- 8.10 Shell

- 8.11 Valero

- 8.12 World Energy