PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699343

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699343

Robotic Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

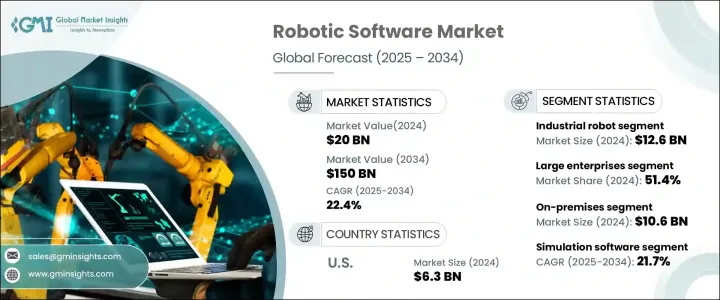

The Global Robotic Software Market was valued at USD 20 billion in 2024 and is expected to expand at a CAGR of 22.4% from 2025 to 2034. This growth is being driven by the increasing integration of artificial intelligence and machine learning into robotic software, as well as the rising demand for collaborative robots across industries. Businesses are investing heavily in intelligent automation solutions to streamline operations, reduce costs, and enhance productivity. AI and ML are transforming robotic systems by enabling them to make data-driven decisions, adapt to dynamic environments, and perform complex tasks with greater precision.

These advancements are particularly evident in sectors such as manufacturing, healthcare, logistics, and agriculture, where automation is optimizing efficiency and improving overall output. The growing reliance on robotics for labor-intensive and repetitive processes is fueling the demand for advanced software solutions capable of managing, analyzing, and enhancing robot performance. Additionally, governments and enterprises worldwide are ramping up investments in smart robotics, further accelerating market expansion. The rise of cloud-based robotics, enhanced connectivity, and seamless software integration is making robotic applications more scalable and accessible, opening new opportunities for businesses of all sizes to leverage automation for competitive advantage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20 Billion |

| Forecast Value | $150 Billion |

| CAGR | 22.4% |

The market is segmented based on the type of robot, with industrial robots and service robots being the two primary categories. In 2024, industrial robot software dominated the market, accounting for USD 12.6 billion. These systems are essential for automating manufacturing and assembly processes, reducing errors, and improving operational efficiency. Industrial robot software incorporates powerful data analytics tools that provide real-time insights into robotic operations, allowing businesses to optimize performance, minimize downtime, and enhance product quality. Additionally, features such as simulation and visualization tools enable users to anticipate and mitigate potential issues before deployment, ensuring seamless integration into production environments. As industries increasingly prioritize automation to meet growing demands and maintain a competitive edge, the adoption of industrial robot software is set to rise significantly.

Enterprise size is another crucial segment shaping the robotic software market, encompassing both large enterprises and small and medium-sized enterprises (SMEs). Large enterprises accounted for a 51.4% market share in 2024, highlighting their dominant role in adopting robotic solutions. These organizations operate multiple production lines, warehouses, and logistics centers, necessitating advanced software for seamless coordination, task management, and process optimization. Robotic software enables large companies to monitor performance, automate repetitive tasks, and enhance scalability, ultimately leading to higher efficiency and cost savings. Meanwhile, SMEs are also increasingly investing in robotic automation to improve operational agility, minimize labor costs, and compete more effectively in an evolving business landscape.

The U.S. robotic software market was valued at USD 6.3 billion in 2024, reflecting the country's leadership in automation and advanced robotics adoption. With industries such as manufacturing, healthcare, and logistics embracing intelligent automation, demand for robotic software solutions continues to surge. The push for cost-effective, efficient, and precise manufacturing processes is driving businesses to implement AI-powered robotics to enhance production quality and reduce human intervention. As American companies seek to optimize operations through intelligent automation, the U.S. remains a key player in shaping the global robotic software landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing integration of AI and ML into robotic software

- 3.6.1.2 Rising demand for collaborative robots

- 3.6.1.3 Increased automation across industries

- 3.6.1.4 Raising the adoption of robots across various sectors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investments

- 3.6.2.2 Complexes in integration with existing systems

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Software Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Simulation software

- 5.3 Navigation and mapping software

- 5.4 Data analytics and management software

- 5.5 Vision software

- 5.6 Predictive maintenance software

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Robot Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Industrial robot

- 6.3 Service robot

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Large enterprise

- 8.3 Small and Medium Enterprises (SME)

Chapter 9 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Manufacturing

- 9.3 Automotive

- 9.4 Healthcare

- 9.5 Transportation and logistics

- 9.6 BFSI

- 9.7 Retail & e-commerce

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB Ltd

- 11.2 Amazon Robotics (Amazon.com, Inc.)

- 11.3 Autodesk, Inc.

- 11.4 Blue Prism Group plc

- 11.5 Boston Dynamics

- 11.6 Clearpath Robotics

- 11.7 Cognex Corporation

- 11.8 Denso Corporation

- 11.9 FANUC Corporation

- 11.10 Hanson Robotics

- 11.11 iRobot Corporation

- 11.12 KUKA AG

- 11.13 Mitsubishi Electric Corporation

- 11.14 NVIDIA Corporation

- 11.15 Omron Corporation

- 11.16 Open Robotics (OSRF)

- 11.17 Rockwell Automation, Inc.

- 11.18 Siemens AG

- 11.19 SoftBank Robotics

- 11.20 Teradyne Inc.

- 11.21 UiPath Inc.

- 11.22 Universal Robots A/S

- 11.23 Vecna Robotics

- 11.24 Yaskawa Electric Corporation