PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699342

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699342

Wide Bandgap Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

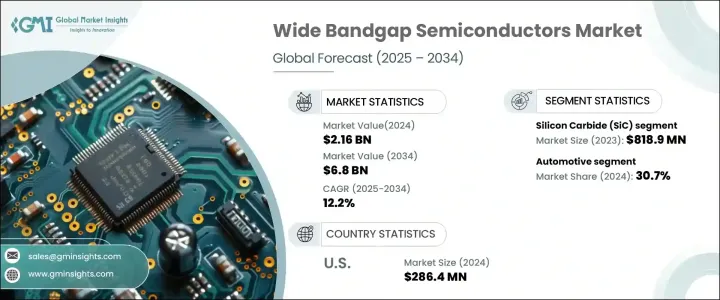

The Global Wide Bandgap Semiconductors Market was valued at USD 2.16 billion in 2024 and is projected to grow at a CAGR of 12.2% from 2025 to 2034. This remarkable expansion is fueled by the rising adoption of power electronics across industries and the global transition toward electric vehicles. As industries demand high-performance solutions for energy efficiency, the need for wide bandgap semiconductors, known for their superior ability to operate at high voltages and temperatures, is set to surge.

The proliferation of renewable energy systems, growing electrification in the automotive sector, and increasing advancements in semiconductor technologies are key factors propelling market growth. Government initiatives promoting clean energy, stringent efficiency regulations, and the accelerating rollout of 5G infrastructure are also driving demand for these high-power semiconductors. Technological innovations continue to expand the application scope of wide bandgap semiconductors, making them indispensable for power-hungry industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.16 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 12.2% |

The market is primarily segmented by material type, with Silicon Carbide (SiC) and Gallium Nitride (GaN) leading the industry. SiC generated USD 818.9 million in 2023, owing to its exceptional characteristics such as high thermal conductivity, high breakdown voltage, and wide bandgap properties. Compared to traditional silicon, SiC delivers superior efficiency, withstanding higher temperatures and voltage levels, making it a preferred choice for power electronics in electric vehicles and renewable energy applications. As manufacturers strive to develop high-performance semiconductor solutions, SiC continues to dominate high-power and high-frequency applications. GaN, another prominent material, is gaining traction due to its rapid switching capabilities and energy efficiency, particularly in RF and microwave applications.

The market is further segmented based on end-use industries, including automotive, telecommunications, consumer electronics, energy, aerospace, and defense. The automotive sector accounted for a 30.7% market share in 2024, driven by the widespread adoption of electric vehicles. SiC and GaN-based power electronics enhance energy efficiency in EVs, reducing power losses and enabling faster switching speeds. As automakers increasingly integrate wide bandgap semiconductors into vehicle systems, these components play a pivotal role in meeting energy efficiency goals and achieving longer battery life. The rising demand for advanced driver assistance systems (ADAS) and fast-charging infrastructure further accelerates the adoption of these high-power semiconductors in the automotive industry.

The U.S. wide bandgap semiconductors market was valued at USD 286.4 million in 2024 and is expected to experience robust growth as the country strengthens its position in semiconductor manufacturing. The focus on energy conservation, coupled with ongoing advancements in semiconductor fabrication, positions the U.S. as a key player in the global market. With government-backed incentives for domestic semiconductor production and increasing investments in research and development, U.S. manufacturers gain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for energy-efficient solutions

- 3.6.1.2 Expansion of electric vehicle market

- 3.6.1.3 Deployment of 5G and advanced communications

- 3.6.1.4 Government support and investment initiatives

- 3.6.1.5 Rising industrial automation and electrification

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs and complex manufacturing

- 3.6.2.2 Supply chain constraints and material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Silicon Carbide (SiC)

- 5.3 Gallium Nitride (GaN)

- 5.4 Aluminum Nitride (AlN)

- 5.5 Diamond

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End-use Industry, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Consumer electronics

- 6.4 Telecommunications

- 6.5 Energy & utility

- 6.6 Aerospace & defense

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 CISSOID

- 8.2 Diodes Incorporated

- 8.3 Fuji Electric Co., Ltd.

- 8.4 Navitas Semiconductor

- 8.5 Infineon Technologies AG

- 8.6 Littelfuse, Inc.

- 8.7 Microsemi Corporation.

- 8.8 Mitsubishi Electric Corporation

- 8.9 Nexperia

- 8.10 Renesas Electronics Corporation

- 8.11 ROHM Semiconductor

- 8.12 SEMIKRON

- 8.13 STMicroelectronics N.V.

- 8.14 Texas Instruments Inc.

- 8.15 Toshiba Electronic Devices & Storage Corporation

- 8.16 Vishay Intertechnology Inc.

- 8.17 Wolfspeed, Inc.