PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699340

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699340

Antiviral Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

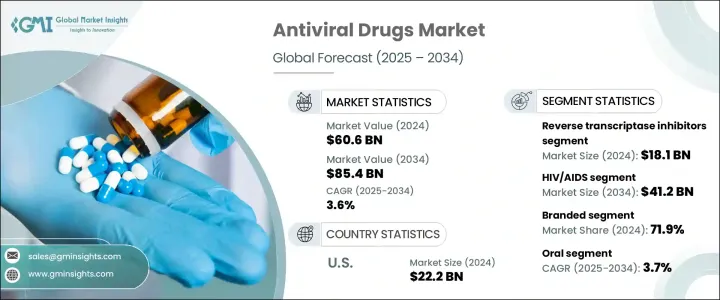

The Global Antiviral Drugs Market, estimated at USD 60.6 billion in 2024, is set to grow at a CAGR of 3.6% from 2025 to 2034. Increasing cases of viral infections, including HIV/AIDS, hepatitis B and C, and influenza, are driving demand for antiviral medications. Greater awareness, combined with government funding for drug approvals and clinical research, is fostering market growth. Companies are expanding manufacturing capacities to cater to a rising patient base, contributing to increased market penetration.

Antiviral drugs inhibit viral replication, playing a crucial role in treating infections such as HIV/AIDS, hepatitis, and influenza. The market is segmented by drug class, with reverse transcriptase inhibitors holding 29.9% of the share at USD 18.1 billion in 2024. These inhibitors are key in antiretroviral therapy, with nucleoside and non-nucleoside reverse transcriptase inhibitors driving their widespread use. Government-backed HIV treatment programs and their cost-effectiveness enhance adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $60.6 Billion |

| Forecast Value | $85.4 Billion |

| CAGR | 3.6% |

By indication, the HIV/AIDS segment dominates the market and is expected to reach USD 41.2 billion by 2034. A rising number of infections, along with antiretroviral therapy's long-term necessity, is fueling segment growth. Regulatory bodies are streamlining drug development, further boosting expansion.

Branded antiviral drugs accounted for 71.9% of the market in 2024, supported by rigorous clinical trials ensuring efficacy and safety. Branded drugs remain preferred for treating chronic infections due to better therapeutic outcomes. Pharmaceutical companies continue to enhance accessibility, increasing market adoption.

Oral antiviral drugs led in 2024 and are projected to grow at a 3.7% CAGR. Their ease of administration and non-invasive nature make them a preferred choice for long-term treatment. Advances in oral drug formulations are improving patient adherence and treatment effectiveness, further strengthening demand.

By age group, the geriatric segment, valued at USD 26.9 billion in 2024, is expected to reach USD 37.5 billion by 2032. An aging global population with a higher susceptibility to viral infections is driving demand. Increased use of antiviral medications and vaccines among older adults is supporting market expansion.

Hospital pharmacies captured 46.7% of the market share in 2024 and are anticipated to grow at a 3.3% CAGR. Hospitals remain the primary treatment centers for severe viral infections, ensuring easy drug accessibility. The availability of diverse antiviral formulations and the need for hospitalization in critical cases are reinforcing segment dominance.

The U.S. antiviral drugs market stood at USD 22.2 billion in 2024, up from USD 21.9 billion in 2023 and USD 21.5 billion in 2022. Growing government initiatives and rising infection rates are driving demand. Policies focused on eliminating viral diseases and intensifying prevention efforts are further strengthening market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of viral infections

- 3.2.1.2 Increasing number of product launches for HIV treatment

- 3.2.1.3 High investment in R&D activities and presence of pipeline products

- 3.2.1.4 Increasing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Emerging drug resistance

- 3.2.2.2 High development cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reverse transcriptase inhibitors

- 5.3 DNA polymerase inhibitors

- 5.4 Protease inhibitors

- 5.5 Neuraminidase inhibitors

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 HIV/AIDS

- 6.3 Hepatitis

- 6.4 Coronavirus infection

- 6.5 Herpes simplex virus (HSV)

- 6.6 Influenza

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generic

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Topical

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Geriatric

- 9.3 Adult

- 9.4 Pediatric

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Aurobindo Pharma Limited

- 12.3 Bristol-Myers Squibb

- 12.4 Cipla

- 12.5 Dr. Reddy's Laboratories

- 12.6 Gilead Sciences

- 12.7 GlaxoSmithKline

- 12.8 Janssen Pharmaceutical (Johnson & Johnson)

- 12.9 Merck

- 12.10 Mylan

- 12.11 Pfizer

- 12.12 Sun Pharmaceutical Industries