PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699320

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699320

Inspection Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

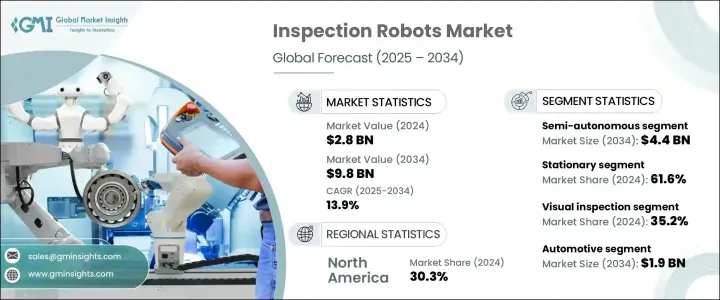

The Global Inspection Robots Market, valued at USD 2.8 billion in 2024, is set to expand at a CAGR of 13.9% from 2025 to 2034. The growth is driven by increasing adoption across industries seeking to enhance efficiency, reduce operational risks, and comply with evolving safety regulations. Businesses across manufacturing, energy, and infrastructure sectors are integrating inspection robots into their operations to streamline workflows, minimize downtime, and ensure compliance with stringent industry standards.

With industries prioritizing automation and precision, inspection robots are playing a critical role in maintenance and quality control. These advanced systems offer enhanced accuracy and reliability, eliminating the limitations associated with manual inspections. Organizations are leveraging robotics to meet growing demands for non-destructive testing, real-time analytics, and predictive maintenance. Increasing investments in artificial intelligence (AI) and machine learning (ML) technologies are further driving innovation in robotic inspection systems, enabling autonomous decision-making and adaptive learning. The need for continuous monitoring in hazardous and hard-to-reach environments is accelerating demand as companies aim to improve workplace safety while optimizing operational performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 13.9% |

Market segmentation by type includes non-autonomous, semi-autonomous, and fully autonomous robots. The semi-autonomous segment is expected to reach USD 4.4 billion by 2034, witnessing significant adoption due to its ability to strike a balance between automation and human oversight. These systems are particularly valuable in high-risk industries, where AI-assisted decision-making allows human operators to intervene only when necessary. Their ability to function in complex environments without constant supervision makes them an attractive choice for businesses seeking to enhance efficiency while maintaining control over critical operations.

Based on technology, the market is segmented into stationary and mobile inspection robots. In 2024, stationary systems accounted for 61.6% of the market share, gaining traction due to their high precision and seamless integration into automated manufacturing environments. These robots play an essential role in industries that demand meticulous quality control, offering high-accuracy defect detection and real-time performance monitoring. The growing emphasis on non-destructive testing and high-speed evaluation techniques is further fueling adoption. Manufacturers are prioritizing error reduction and operational efficiency, making stationary inspection robots indispensable across modern production lines.

The US inspection robots market is poised for substantial growth, projected to reach USD 2.8 billion by 2034. Increasing reliance on automation in manufacturing, coupled with a strong focus on defect detection and quality assurance, is accelerating the deployment of robotic inspection systems. Companies are investing in advanced robotic technologies to enhance productivity, minimize downtime, and optimize operational efficiency. As automation continues to transform industrial workflows, robotic inspection systems are emerging as an essential component in ensuring consistent quality and operational excellence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased sales and adoption of service robots

- 3.2.1.2 Increasing use of drones and mobile robots for remote inspections

- 3.2.1.3 Growth in smart manufacturing and industry 4.0 initiatives

- 3.2.1.4 Expansion of the oil & gas and energy sectors

- 3.2.1.5 Stringent safety and quality regulations across industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High deployment cost for SME

- 3.2.2.2 Complexity & integration difficulties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Non-autonomous

- 5.3 Semi-autonomous

- 5.4 Fully autonomous

Chapter 6 Market Estimates and Forecast, By Technology , 2021 – 2034 (USD Bn)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Visual inspection

- 7.3 Ultrasonic inspection

- 7.4 Laser scanning inspection

- 7.5 Thermal inspection

- 7.6 Quality inspection

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Construction

- 8.4 Food & beverages

- 8.5 Manufacturing

- 8.6 Oil & gas

- 8.7 Power

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Cognex

- 10.3 Denso Wave

- 10.4 DSI Robotics

- 10.5 Energy Robotics

- 10.6 Fanuc

- 10.7 Honeybee Robotics

- 10.8 Innok Robotics

- 10.9 JH Robotics

- 10.10 Kuka

- 10.11 Mitsubishi Heavy Industries

- 10.12 Nexxis

- 10.13 Robotnik Automation

- 10.14 Staubli

- 10.15 Superdroid Robotics

- 10.16 Universal Robots