PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699319

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699319

Direct-to-chip Liquid Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

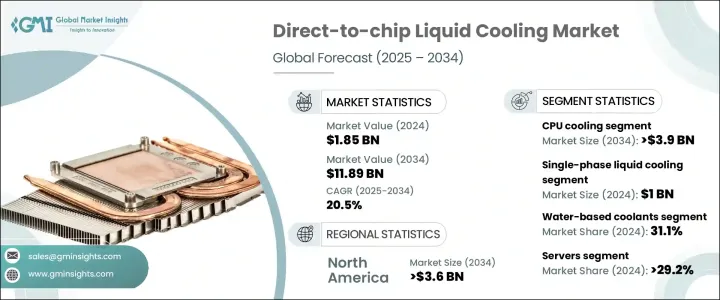

The Global Direct-To-Chip Liquid Cooling Market, valued at USD 1.85 billion in 2024, is on track to expand at a CAGR of 20.5% from 2025 to 2034 as enterprises increasingly prioritize high-performance computing, energy efficiency, and sustainable data center solutions. The rapid proliferation of artificial intelligence (AI), machine learning (ML), and cloud computing is driving an unprecedented surge in data processing demands, making conventional cooling methods less effective in managing the rising thermal loads of advanced processors. Organizations worldwide are shifting toward direct-to-chip liquid cooling solutions to enhance system reliability, prevent thermal throttling, and optimize power consumption. The growing emphasis on green data centers and carbon footprint reduction further accelerates adoption, positioning liquid cooling as an essential innovation in next-generation computing infrastructure.

As high-performance computing (HPC) environments push the boundaries of processing power, traditional air-based cooling struggles to keep pace with the heat dissipation needs of CPUs, GPUs, and memory modules. Direct-to-chip liquid cooling, which enables precise thermal management by transferring heat directly from the chip to a liquid coolant, is emerging as a game-changer in data center optimization. Cloud service providers, hyperscale data centers, and enterprises deploying AI-driven workloads are integrating liquid cooling technologies to maximize efficiency and minimize operational costs. The demand for real-time data analytics, high-density computing clusters, and 5G infrastructure deployment is further reinforcing the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.85 Billion |

| Forecast Value | $11.89 Billion |

| CAGR | 20.5% |

Segmented by component cooling, the market encompasses GPU cooling, CPU cooling, memory cooling, ASIC cooling, and other component-specific solutions. The CPU cooling segment is projected to reach USD 3.9 billion by 2034, driven by the widespread adoption of AI and cloud-based applications that significantly increase processor power consumption. Advanced CPUs generate substantial heat loads, requiring cutting-edge thermal management solutions to maintain system stability and prevent performance degradation. Direct-to-chip liquid cooling delivers superior heat dissipation, ensuring sustained performance even under extreme computational workloads.

The market is also categorized by liquid coolant type, including water-based coolants, dielectric fluids, mineral oils, and engineered fluids. Water-based coolants, which held a 31.1% market share in 2024, are gaining traction due to their exceptional thermal conductivity and cost-effectiveness. As enterprises focus on sustainability, these coolants are becoming a preferred choice for reducing energy consumption while maintaining high-performance standards. Their superior heat transfer properties make them an ideal solution for modern data centers striving to balance efficiency and environmental responsibility.

North America is set to dominate the direct-to-chip liquid cooling market, with projections indicating a valuation of USD 3.6 billion by 2034. The region's rapid data center expansion, growing cloud computing ecosystem, and escalating demand for HPC solutions are driving widespread adoption. The United States, which held a commanding 78.4% market share in 2024, is witnessing soaring investments in data infrastructure, fueling the need for advanced cooling systems. With AI-driven applications and hyperscale cloud services pushing the limits of computing power, the demand for high-efficiency thermal management solutions continues to surge, reinforcing the U.S. market's leadership in the evolving data center landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-performance computing (HPC)

- 3.2.1.2 Increasing data center density

- 3.2.1.3 Increased focus on sustainability

- 3.2.1.4 Rising demand for high-performance computing

- 3.2.1.5 Growing focus on energy efficiency and sustainability in data centers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complexity of maintenance and operations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Cooling Solution Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Single-phase liquid cooling

- 5.3 Two-phase liquid cooling

Chapter 6 Market Estimates and Forecast, By Component Cooling, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 CPU cooling

- 6.3 GPU cooling

- 6.4 ASIC cooling

- 6.5 Memory cooling

- 6.6 Other component cooling

Chapter 7 Market Estimates and Forecast, By Liquid Coolant Type, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 Water-based coolants

- 7.3 Dielectric fluids

- 7.4 Mineral oils

- 7.5 Engineered fluids

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Servers

- 8.3 Workstations

- 8.4 Edge computing devices

- 8.5 Supercomputers

- 8.6 Gaming PCs

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 Data centers

- 9.3 High-performance computing (HPC)

- 9.4 Artificial intelligence/machine learning systems

- 9.5 Gaming and eSports

- 9.6 Telecommunications

- 9.7 Financial services

- 9.8 Healthcare and life sciences

- 9.9 Oil and gas

- 9.10 Automotive (for electric vehicle batteries)

- 9.11 Aerospace and defense

- 9.12 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Asetek

- 11.2 Alfa Laval

- 11.3 Castrol

- 11.4 Cisco Systems, Inc.

- 11.5 CoolIT Systems

- 11.6 DCX The Liquid Cooling Company

- 11.7 Danfoss A/S

- 11.8 DUG Technology

- 11.9 Equinix, Inc.

- 11.10 Fujitsu Limited

- 11.11 Green Revolution Cooling (GRC)

- 11.12 Huawei Technologies Co., Ltd.

- 11.13 Iceotope Technologies Ltd.

- 11.14 Inspur Systems

- 11.15 LiquidCool Solutions

- 11.16 LiquidStack

- 11.17 Rittal GmbH & Co. KG

- 11.18 Schneider Electric

- 11.19 STULZ GmbH

- 11.20 Submer Technologies

- 11.21 Super Micro Computer, Inc.

- 11.22 Vertiv Group Corp.

- 11.23 ZutaCore