PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699314

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699314

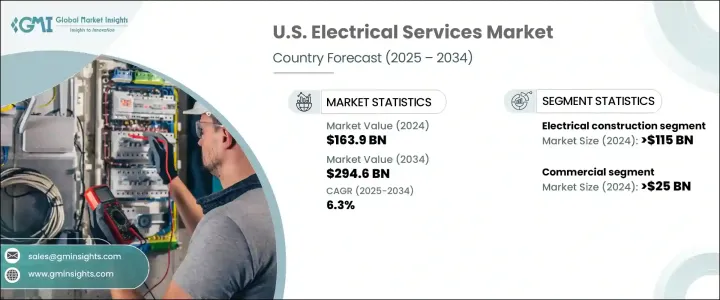

U.S. Electrical Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

U.S. Electrical Services Market stood at USD 163.9 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. Federal initiatives aimed at modernizing the grid, coupled with increasing incentives for energy-efficient electrical systems, are driving market growth. The shift toward smart grids, digital substations, and automation solutions is revolutionizing service offerings, allowing for real-time monitoring and predictive maintenance. This technological evolution is improving operational efficiency and minimizing downtime, reinforcing the industry's upward trajectory.

The industry is categorized by service type into electrical construction, instrument and technical services, and maintenance and repair. The demand for smart grid integration, alongside other electrical advancements, is significantly influencing industry growth. Electrical construction segment generated USD 115 billion in 2024, driven by the increasing need for infrastructure projects spanning clean energy, commercial developments, and urban expansion. The growing emphasis on high-performance electrical systems is fueling the need for specialized services, including upgraded power distribution and backup power installations, particularly within data centers and the technology sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $163.9 Billion |

| Forecast Value | $294.6 Billion |

| CAGR | 6.3% |

The market is further divided by application into commercial, industrial, and utility sectors. The commercial segment reached a valuation of USD 25 billion by 2024 as educational institutions and commercial construction projects continued to grow. Businesses are increasingly integrating smart building technologies, such as automated lighting, HVAC controls, and energy management systems, to optimize power consumption and enhance operational efficiency. This growing focus on sustainability and smart infrastructure is accelerating industry penetration.

The utility segment is expected to generate USD 135 billion in 2034 as investments in grid modernization continue to rise. Utility providers are enhancing infrastructure with automated distribution networks, smart substations, and high-voltage transmission systems to improve grid efficiency. The need for resilient power solutions is increasing as extreme weather events, including winter storms, hurricanes, and wildfires, push utilities to strengthen infrastructure. The sector is prioritizing reliability and sustainability to meet growing energy demands while minimizing environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's Analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL Analysis

Chapter 3 Competitive Landscape, 2024

- 3.1 Introduction

- 3.2 Strategic outlook

- 3.3 Innovation & sustainability landscape

Chapter 4 Market Size and Forecast, By Service Type, 2021 – 2034 (USD Billion)

- 4.1 Key trends

- 4.2 Electrical construction

- 4.3 Instrument & technical services

- 4.4 Maintenance & repair

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Commercial

- 5.3 Industrial

- 5.4 Utility

Chapter 6 Company Profiles

- 6.1 APi Group

- 6.2 Artera

- 6.3 Bergelectric

- 6.4 Brand Industrial Services

- 6.5 Centuri Group

- 6.6 Comfort Systems

- 6.7 EMCOR Group

- 6.8 Facility Solutions Group

- 6.9 General Electric

- 6.10 Helix Electric

- 6.11 H&M Shared Services

- 6.12 Hunt Electric Corporation

- 6.13 IES Electrical

- 6.14 M.C. Dean

- 6.15 MasTec

- 6.16 Everus

- 6.17 MMR Group

- 6.18 MYR Group

- 6.19 Power Design

- 6.20 Primoris Services Corporation

- 6.21 Quanta Services

- 6.22 Redwood Electric Group

- 6.23 Rosendin Electric

- 6.24 The Newtron Group

- 6.25 Walker Engineering