PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699295

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699295

Radio Access Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

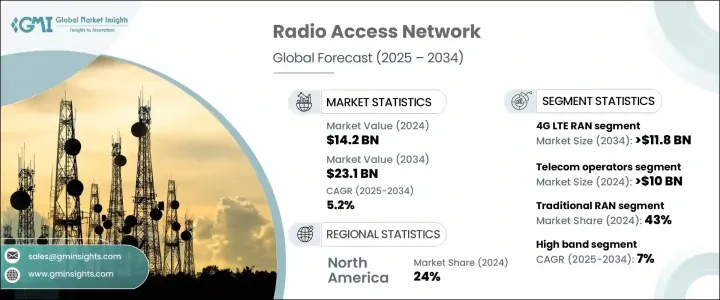

The Global Radio Access Network Market was valued at USD 14.2 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. Increasing demand for seamless connectivity, rapid expansion of mobile networks, and continuous investments in telecommunications infrastructure are fueling market growth. As mobile data consumption surges worldwide, network providers are prioritizing coverage, capacity, and efficiency to support a growing number of mobile users. The rise of digital transformation, smart city initiatives, and the proliferation of IoT-based applications are pushing telecom companies to upgrade their network capabilities and deploy cutting-edge technologies.

The widespread adoption of 5G technology, though still in its early stages, is accelerating advancements in network infrastructure. However, 4G LTE remains the dominant technology, ensuring consistent connectivity for billions of users. The demand for high-speed internet, low-latency communication, and superior network reliability is pushing telecom giants to expand their infrastructure through strategic partnerships and investments. Governments and regulatory bodies worldwide are supporting network expansion with favorable policies, spectrum allocation, and funding initiatives, further driving market expansion. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) into network operations is improving efficiency and reducing latency, making modern RAN solutions more robust and adaptive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 5.2% |

The 4G LTE RAN segment held a 54% market share in 2024 and is expected to generate USD 11.8 billion by 2034. This dominance is attributed to the extensive coverage and reliability of 4G networks, which have been operational for over a decade. Despite 5G deployment, the majority of mobile users continue to rely on 4G LTE due to its accessibility and stability. Mobile network operators are heavily investing in optimizing and expanding 4G infrastructure to ensure superior performance across urban and rural areas. Given that 5G coverage is still limited in many regions, 4G LTE remains the most widely used and dependable option for mobile connectivity.

The telecom operators segment generated USD 10 billion in 2024, maintaining a leading position due to massive investments in RAN infrastructure. These operators play a critical role in building, upgrading, and maintaining cellular networks, forming the backbone of the telecommunications industry. Investments in spectrum acquisition, base stations, and network expansion continue to drive industry growth. As demand for high-speed connectivity rises, telecom companies are allocating substantial resources to enhance network performance, ensure low-latency communication, and support the transition toward 5G. Ongoing advancements in mobile technology will further sustain investment in RAN infrastructure, with operators focusing on long-term network reliability and scalability.

North America's access network market accounted for a 24% share, generating USD 2.92 billion in 2024. The region remains at the forefront of telecommunications infrastructure investments, particularly in the expansion of 5G networks. Ongoing developments in standalone 5G and fixed wireless access technologies are reinforcing North America's position as a leader in the global RAN market. With major telecom players focusing on innovation and large-scale deployment of next-generation networks, North America continues to set benchmarks in advanced connectivity solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Manufacturers

- 3.1.3 Technology providers

- 3.1.4 End Use

- 3.1.5 Profit margin analysis

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Use cases

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing adoption of 5G networks

- 3.6.1.2 Rising mobile data traffic and IoT expansion

- 3.6.1.3 Government initiatives and 5G spectrum allocation

- 3.6.1.4 Increasing adoption of open RAN and virtualized RAN

- 3.6.1.5 Growth in private 5G networks for enterprises

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High infrastructure costs

- 3.6.2.2 Spectrum allocation and regulatory issues

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 2G RAN

- 5.3 3G RAN

- 5.4 4G LTE RAN

- 5.5 5G RAN

Chapter 6 Market Estimates & Forecast, By Infrastructure, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Traditional RAN

- 6.3 Cloud RAN

- 6.4 Open RAN

- 6.5 Virtualized RAN

Chapter 7 Market Estimates & Forecast, By Frequency Band, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Low band (Below 1 GHz)

- 7.3 Mid band (1-6 GHz)

- 7.4 High band (mmWave, 24 GHz and above)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Telecom operators

- 8.3 Enterprises

- 8.4 Smart cities & public sector

- 8.5 Defense & security

- 8.6 Industrial & manufacturing

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airspan Networks

- 10.2 Altiostar Networks

- 10.3 ASOCS

- 10.4 AT&T

- 10.5 Cisco

- 10.6 CommScope

- 10.7 Ericsson

- 10.8 Fujitsu Limited

- 10.9 Huawei

- 10.10 Intel

- 10.11 Juniper Networks

- 10.12 Mavenir

- 10.13 NEC

- 10.14 Nokia

- 10.15 Parallel Wireless

- 10.16 Radisys

- 10.17 Rakuten Symphony

- 10.18 Samsung Electronics

- 10.19 Verizon Communications

- 10.20 ZTE