PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699287

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699287

Cosmetic Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

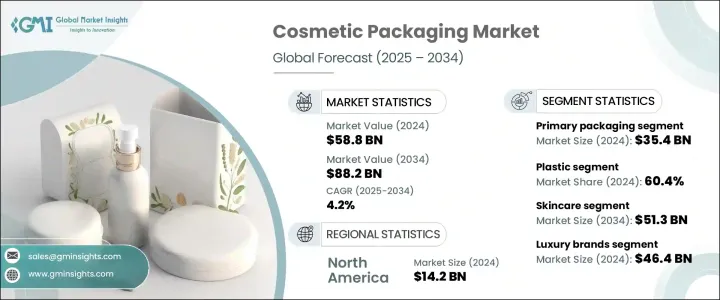

The Global Cosmetic Packaging Market reached USD 58.8 billion in 2024 and is expected to grow at a CAGR of 4.2% between 2025 and 2034. The market's steady growth is driven by the increasing popularity of e-commerce platforms that offer consumers easy access to a wide range of cosmetic products. As online shopping becomes more prevalent, brands are focusing on delivering appealing and durable packaging solutions that maintain product integrity during transit. Additionally, rising consumer awareness about environmental sustainability is prompting manufacturers to adopt innovative, eco-friendly designs that align with evolving preferences. Advanced packaging technologies are also driving industry innovation, allowing companies to enhance product appeal while maintaining durability. The trend toward premium and aesthetically pleasing packaging is pushing brands to invest in unique designs that not only capture consumer attention but also reinforce brand identity.

The market is categorized by packaging type, including primary, secondary, and tertiary packaging. Primary packaging, which safeguards the product directly, dominated the market with a value of USD 35.4 billion in 2024. Consumers are showing increased interest in intricate and visually appealing containers, driving the demand for advanced designs and high-quality materials. Industry players are leveraging cutting-edge technologies to introduce creative packaging solutions that meet the ever-changing demands of beauty enthusiasts. Secondary and tertiary packaging solutions continue to play a crucial role in protecting cosmetic products during storage and transportation, ensuring they remain intact until they reach the end consumer.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $58.8 Billion |

| Forecast Value | $88.2 Billion |

| CAGR | 4.2% |

Material selection plays a vital role in market dynamics, with plastic, glass, metal, paper cardboard, wood, and other materials being widely utilized for cosmetic packaging. The plastic segment led the market in 2024, holding a 60.4% share due to its lightweight properties, durability, and cost-effectiveness. Its versatility in being molded into various shapes makes it an ideal choice for mass production in the cosmetics industry. However, rising concerns about environmental pollution have prompted companies to explore bio-based plastic alternatives and Post-Consumer Recycled (PCR) materials. This shift reflects a growing trend toward sustainable packaging solutions that reduce the environmental impact while meeting consumer expectations for responsible practices.

North America Cosmetic Packaging Market reached USD 14.2 billion in 2024, driven by the increasing demand for beauty and personal care products. Consumers in the region are becoming more conscious of the materials used in packaging, encouraging brands to prioritize eco-friendly solutions. As sustainability becomes a top priority, industry players are responding with innovative designs that balance environmental responsibility with consumer appeal. The region's strong market growth is expected to continue as brands adopt packaging solutions that align with these evolving preferences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable packaging

- 3.2.1.2 Growing e-commerce sectors

- 3.2.1.3 Technological advancements in the cosmetic packaging

- 3.2.1.4 Increasing consumer needs for personalization

- 3.2.1.5 Adoption of premium cosmetic products with innovative designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of sustainable materials

- 3.2.2.2 High risk of counterfeiting

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn & ‘000 Tons)

- 5.1 Key trends

- 5.2 Primary packaging

- 5.2.1 Jars

- 5.2.2 Tubes

- 5.2.3 Bottles

- 5.2.4 Pumps and dispensers

- 5.2.5 Others

- 5.3 Secondary packaging

- 5.3.1 Cartons

- 5.3.2 Blisters

- 5.3.3 Pouches

- 5.3.4 Others

- 5.4 Tertiary packaging

- 5.4.1 Pallets

- 5.4.2 Crates

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 – 2034 ($ Mn & ‘000 Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Glass

- 6.4 Metal

- 6.5 Paper and cardboard

- 6.6 Wood

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn & ‘000 Tons)

- 7.1 Key trends

- 7.2 Skincare

- 7.3 Haircare

- 7.4 Nailcare

- 7.5 Fragrances

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn & ‘000 Tons)

- 8.1 Key trends

- 8.2 Luxury brands

- 8.3 Mass market brands

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & ‘000 Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Albéa Group

- 10.2 Amcor plc

- 10.3 Anomatic Corporation

- 10.4 AptarGroup, Inc.

- 10.5 AREXIM Packaging

- 10.6 Berry Global Group, Inc.

- 10.7 Cosmopak

- 10.8 Fusion Packaging

- 10.9 Gerresheimer AG

- 10.10 Graham Packaging Company

- 10.11 HCP Packaging

- 10.12 Libo Cosmetics Company Ltd.

- 10.13 Lumson S.p.A.

- 10.14 Quadpack

- 10.15 Seidel GmbH & Co. KG

- 10.16 Silgan Holdings Inc.

- 10.17 Toly Group

- 10.18 WWP Beauty

- 10.19 Yonwoo Co., Ltd.