PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699281

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699281

Viscosupplementation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

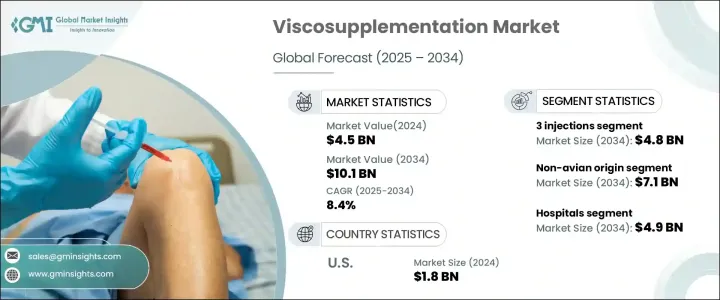

The Global Viscosupplementation Market reached USD 4.5 billion in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2034. The rising prevalence of osteoarthritis, particularly knee osteoarthritis, continues to drive the demand for advanced treatment solutions. As a non-surgical intervention, viscosupplementation is gaining widespread recognition for its ability to improve joint mobility, alleviate pain, and delay the need for invasive procedures. The market is witnessing rapid expansion due to the aging population, as older individuals are more susceptible to joint degeneration and osteoarthritis-related complications.

With osteoarthritis cases surging globally, healthcare providers and patients alike are increasingly turning to viscosupplementation for long-term symptom management. The procedure involves injecting hyaluronic acid into the affected joints to restore lubrication, reduce stiffness, and enhance mobility. Patients prefer this treatment for its minimal recovery time and reduced dependence on pain medication. Meanwhile, ongoing advancements in formulation technologies and product purity are expanding adoption across diverse patient groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 8.4% |

The introduction of next-generation viscosupplements with extended efficacy and improved biocompatibility is further fueling market growth. Manufacturers are continuously innovating to enhance product performance, ensuring that viscosupplementation remains a preferred choice for osteoarthritis management. Additionally, supportive government initiatives, rising healthcare expenditure, and increasing awareness about non-surgical treatment alternatives are accelerating the market's trajectory.

The viscosupplementation market is segmented by product type into single injection, three injections, and five injections. Among these, the three-injection segment dominated the market with USD 2.1 billion in revenue in 2024 and is expected to reach USD 4.8 billion by 2034, registering a CAGR of 8.5%. Its effectiveness in managing osteoarthritis symptoms and restoring joint function has made it the standard treatment approach. Physicians favor this regimen due to its structured dosing schedule, which provides sustained symptom relief while minimizing the need for frequent medical visits. The segment's popularity continues to rise due to its ease of administration, balanced treatment duration, and consistent clinical outcomes.

By source, the market is categorized into avian-origin and non-avian-origin viscosupplements, with non-avian-origin products accounting for 71.6% of the market share in 2024. This segment is projected to reach USD 7.1 billion by 2034, driven by growing concerns over allergic reactions, ethical considerations, and improved product consistency. Non-avian-origin viscosupplements offer enhanced purity and a lower risk of immune response, making them increasingly preferred by both patients and healthcare providers. The transition toward synthetic and bioengineered alternatives is further shaping the market as manufacturers focus on developing allergen-free, high-purity formulations.

North America viscosupplementation market reached USD 1.8 billion in 2024, as osteoarthritis cases continue to rise across the region. Studies indicate that arthritis remains the most common joint disorder, affecting millions of individuals, with osteoarthritis being the leading cause of disability among aging populations. Research shows that 43% of individuals aged 65 and above suffer from osteoarthritis, primarily due to cartilage degeneration, joint deterioration, and reduced resilience. As demand for effective, minimally invasive solutions grows, viscosupplementation continues to cement its position as a key treatment option in osteoarthritis care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population prone to osteoarthritis

- 3.2.1.2 Rising demand for minimally invasive treatments

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing sport-related injuries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Single injection

- 5.3 3 injections

- 5.4 5 injections

Chapter 6 Market Estimates and Forecast, By Source of Origin, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Avian origin

- 6.3 Non-avian origin

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Orthopedic clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anika Therapeutics

- 9.2 APTISSEN

- 9.3 Avanos

- 9.4 Biotech Healthcare

- 9.5 Bioventus

- 9.6 Ferring Pharmaceuticals

- 9.7 Fidia Pharma

- 9.8 Premier Surgical

- 9.9 Sanofi

- 9.10 Seikagaku Corporation

- 9.11 Stellar Pharmaceuticals

- 9.12 TRB Pharma

- 9.13 Zimmer Biomet