PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699275

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699275

Vacuum Circuit Breaker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

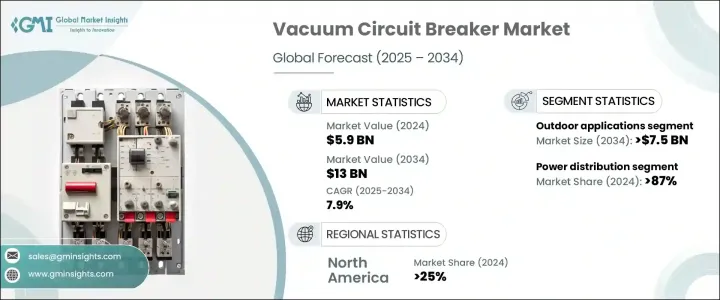

The Global Vacuum Circuit Breaker Market was valued at USD 5.9 billion in 2024 and is projected to expand at a CAGR of 7.9% from 2025 to 2034. This growth is fueled by the rising demand for reliable and efficient power distribution across utility, industrial, and commercial sectors. The increasing adoption of renewable energy, smart grids, and digital substations is accelerating the market expansion. Vacuum circuit breakers offer higher operational efficiency, superior arc-extinguishing capabilities, and lower maintenance compared to traditional circuit breakers. The ongoing electrification initiatives and modernization of transmission and distribution infrastructure further boost demand.

Industry players are focusing on integrating real-time monitoring, IoT connectivity, and predictive maintenance to enhance equipment reliability and performance. The Asia-Pacific region, led by India and China, dominates the market due to rapid industrialization and large-scale infrastructure projects. However, the integration of vacuum circuit breakers into existing grid systems presents challenges, primarily due to initial investment costs. Despite this, advancements in technology, government incentives for energy-efficient projects, and the shift toward smart power systems help mitigate these obstacles. Regulatory measures promoting sustainable energy solutions are also driving market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $13 Billion |

| CAGR | 7.9% |

The outdoor vacuum circuit breaker segment is expected to surpass USD 7.5 billion by 2034. These breakers are widely used in power transmission and distribution networks, ensuring grid reliability and resilience. The expansion of outdoor installations is driven by rural electrification, grid modernization, and the increasing deployment of renewable energy projects. Engineered to function under extreme environmental conditions, these breakers play a crucial role in substations and large-scale renewable power plants. The development of weather-resistant materials and smart grid interfacing technologies has further enhanced their durability and efficiency. Utilities prioritize network stability, supporting steady demand for outdoor vacuum circuit breakers.

Indoor vacuum circuit breakers are gaining popularity in commercial and industrial applications due to their low maintenance requirements and environmentally friendly design. The proliferation of smart buildings and digital substations is increasing the adoption of indoor breakers, which enable automated predictive maintenance, remote supervision, and enhanced operational safety. Additionally, industries prefer indoor installations to minimize exposure to harsh environmental conditions, reducing equipment degradation over time. While both indoor and outdoor segments continue to expand, the preference depends on the specific operational and environmental requirements of end users.

Power distribution holds a dominant market share, accounting for over 87% in 2024, and is expected to see further growth. The rising demand for electricity, combined with advancements in smart grids and digital substations, is driving the adoption of vacuum circuit breakers in this segment. These breakers are widely integrated into medium-voltage switchgear for industries, commercial establishments, and residential complexes. Government and utility investments in grid modernization further support market expansion, as vacuum circuit breakers offer efficient arc-extinguishing capabilities, reduced maintenance, and environmental benefits.

The U.S. market witnessed significant growth, reaching USD 0.9 billion in 2022, USD 1 billion in 2023, and USD 1.1 billion in 2024. The transition toward SF6-free solutions and the rising demand for reliable medium-voltage power distribution equipment are key factors contributing to this expansion. The increasing number of industrial facilities, data centers, and EV charging infrastructure further fuels market demand, positioning vacuum circuit breakers as essential components in modern electrical networks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Rated Current, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 500 A

- 5.3 500 to 1,500 A

- 5.4 1,500 to 2,500 A

- 5.5 2,500 to 4,500 A

- 5.6 > 4,500 A

Chapter 6 Market Size and Forecast, By Installation, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Indoor

- 6.3 Outdoor

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Power distribution

- 7.3 Power transmission

Chapter 8 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

- 8.5 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 Germany

- 9.3.3 Italy

- 9.3.4 UK

- 9.3.5 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Kuwait

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Eaton Corporation

- 10.3 General Electric

- 10.4 HD Hyundai Electric & Energy System

- 10.5 Kirloskar Electric

- 10.6 LS Electric

- 10.7 Mitsubishi Electric Corporation

- 10.8 Powell Industries

- 10.9 Schneider Electric

- 10.10 Siemens Energy

- 10.11 Toshiba International Corporation

- 10.12 WEG