PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699267

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699267

Salmon Fish Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

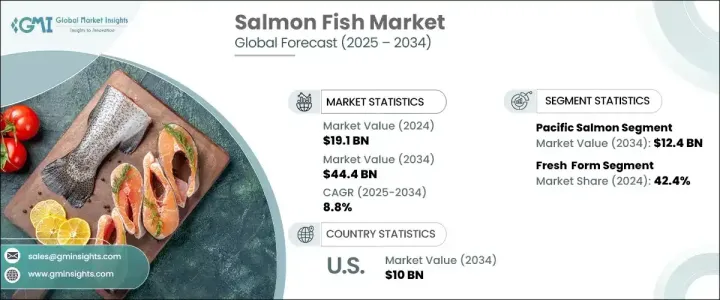

The Global Salmon Fish Market reached USD 19.1 billion in 2024 and is expected to expand at a CAGR of 8.8% from 2025 to 2034. Increasing consumer preference for nutritious, high-quality seafood, particularly rich in proteins and omega-3 fatty acids, is a major driver. Sustainability is also becoming a core focus, pushing advancements in aquaculture. Technologies such as recirculating aquaculture systems and sustainable feeds are making production more efficient while reducing environmental impact. However, challenges such as overfishing, habitat destruction, climate change, and pollution are putting pressure on wild populations, affecting biodiversity and species dependent on salmon for survival. Despite these concerns, innovations in farming and regulatory efforts are helping stabilize supply and meet rising global demand.

By species, the market is divided into Atlantic and Pacific salmon. The Atlantic segment is projected to hold 72.9% of the market due to its high protein and omega-3 content. Emerging markets are expected to contribute significantly to its growth. Meanwhile, the Pacific segment, valued at USD 5.1 billion in 2024, is forecasted to reach USD 12.4 billion by 2034, with a CAGR of 9.2%. While known for its superior taste and nutritional profile, overfishing and climate change are impacting wild stocks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.1 Billion |

| Forecast Value | $44.4 Billion |

| CAGR | 8.8% |

By form, fresh salmon is anticipated to account for 42.4% of the market in 2024, expanding at a CAGR of 8.5%. Consumers prioritize fresh options for their nutritional value, with fillets and steaks being popular choices. The frozen segment is set to grow at a CAGR of 8.6% due to its extended shelf life and convenience, making it a preferred option for large-scale processors and retailers. Smoked salmon remains a premium product with strong demand, particularly in high-income regions. Canned salmon, available in various types, is a budget-friendly option widely accepted in North America and Europe. Other forms, including salmon roe, jerky, and ready-to-eat meals, cater to convenience-focused consumers seeking high-protein alternatives.

By distribution channel, supermarkets are expected to dominate with a 54.2% share in 2024, offering an extensive selection of fresh, frozen, and canned salmon. Convenience stores, growing at a CAGR of 9.5%, are seeing rising demand for ready-to-eat and packaged salmon products. Online retail, valued at USD 3.7 billion in 2024, is projected to reach USD 8.5 billion by 2034, driven by subscription models and bulk discounts.

The United States remains a key market, with an estimated value of USD 5.1 billion in 2024, set to grow to USD 10 billion by 2034. Farmed Atlantic salmon continues to gain traction due to its year-round availability and lower cost compared to wild-caught options. Shipments of fresh and frozen salmon have seen a notable increase, indicating strong market momentum.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for healthy & omega 3 rich protein

- 3.6.1.2 Advances in aquaculture technology

- 3.6.1.3 Sustainability and Eco conscious consumer trends

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Decline of wild salmon population

- 3.6.2.2 Environmental impact on salmon farming

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Species, 2021 – 2034 (USD Bn) (Kg)

- 5.1 Key trends

- 5.2 Atlantic salmon

- 5.3 Pacific salmon

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034(USD Bn) (Kg)

- 6.1 Key trends

- 6.2 Freshed

- 6.3 Frozen

- 6.4 Smoked

- 6.5 Canned

- 6.6 Other

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 –2034 (USD Bn) (Kg)

- 7.1 Key trends

- 7.2 Supermarket / Hypermarket

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Kg)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Leroy

- 9.2 Salmar

- 9.3 Cermaq

- 9.4 Mowi ASA

- 9.5 Bakkafrost

- 9.6 SEA DELIGHT GROUP

- 9.7 Nordlaks Produkter

- 9.8 Atlantic Sapphire

- 9.9 Ideal Foods Ltd

- 9.10 BluGlacier