PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699264

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699264

Dual-energy X-ray Absorptiometry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

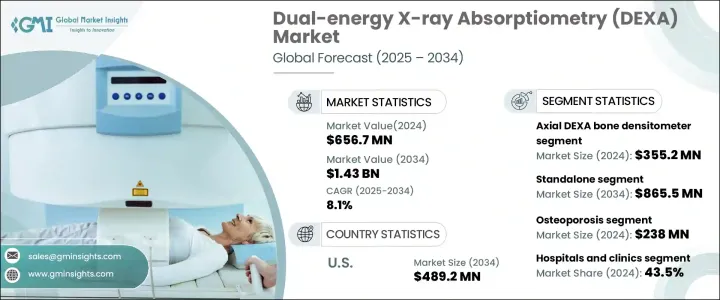

The Global Dual-Energy X-Ray Absorptiometry Market was valued at USD 656.7 million in 2024 and is projected to expand at a CAGR of 8.1% from 2025 to 2034. DEXA is a widely used medical imaging technology designed to assess bone mineral density (BMD) and body composition. Its primary application is in diagnosing osteoporosis and tracking bone health over time. The rising prevalence of osteoporosis and an aging global population are key drivers behind the increasing demand for these systems. With a higher risk of fractures and reduced BMD among older adults, the need for early detection and continuous monitoring is growing. DEXA systems are becoming more prevalent in hospitals, diagnostic centers, and specialty clinics due to their precision in evaluating fracture risks and measuring bone health. The emphasis on preventive healthcare and advancements in medical imaging technologies are further accelerating market growth.

The market is divided into total axial and peripheral DEXA bone densitometers. In 2024, the axial DEXA segment led the market, generating USD 355.2 million in revenue. This segment is favored for its high accuracy in diagnosing osteoporosis and assessing BMD in crucial skeletal regions like the hip and spine. Compared to peripheral systems, axial DEXA provides superior precision in detecting early signs of osteoporosis and monitoring treatment progress. Its extensive use in sports medicine and obesity management also contributes to its market dominance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $656.7 Million |

| Forecast Value | $1.43 Billion |

| CAGR | 8.1% |

Another segmentation of the market is based on product type, which includes standalone and portable DEXA systems. The standalone segment accounted for 59.4% of the market share in 2024, with a projected value of USD 865.5 million by 2034. These systems are primarily installed in hospitals, diagnostic centers, and research institutions, where they offer high imaging strength and accuracy in bone density assessment. Their ability to provide precise diagnostics and support metabolic health evaluations makes them a preferred choice in medical facilities. Leading industry players are integrating low-dose radiation features to enhance patient safety without compromising diagnostic efficiency.

Regarding applications, the DEXA market encompasses osteoporosis diagnosis, body composition analysis, fracture management, bone densitometry, and other medical uses. The osteoporosis segment generated USD 238 million in 2024, maintaining a leading position due to the increasing prevalence of the disease. As bone health awareness grows, more patients and healthcare providers are prioritizing early detection and routine assessments.

Hospitals and clinics emerged as the top end-use segment, capturing 43.5% of the market share in 2024. These institutions serve as primary healthcare providers, conducting DEXA scans for accurate osteoporosis diagnosis and patient monitoring. The combination of advanced medical equipment and skilled professionals in these facilities contributes to the widespread adoption of these systems.

The U.S. market has seen substantial revenue growth, reaching USD 212.6 million in 2023, and is projected to hit USD 489.2 million by 2034. High osteoporosis prevalence and insurance coverage for bone density tests are key factors fueling market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in incidence of osteoporosis and vitamin D deficiency

- 3.2.1.2 Technological advancements in the bone densitometry

- 3.2.1.3 Increasing elderly population worldwide

- 3.2.1.4 Growing awareness of osteoporosis and its impact on bone health

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of bone densitometers

- 3.2.2.2 Risk associated with bone densitometers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Axial DEXA bone densitometer

- 5.3 Peripheral DEXA bone densitometer

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standalone

- 6.3 Portable

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Osteoporosis

- 7.3 Body composition analysis

- 7.4 Fracture management

- 7.5 Bone densitometry

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Diagnostic centers

- 8.4 Specialty centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aurora Spine

- 10.2 BeamMed

- 10.3 DMS

- 10.4 Fonar

- 10.5 Fujifilm

- 10.6 Furuno Electric

- 10.7 GE Healthcare

- 10.8 Hologic

- 10.9 Medilink International

- 10.10 Medonica

- 10.11 Osteometer Meditech

- 10.12 OSTEOSYS

- 10.13 Scanflex Healthcare

- 10.14 Shenzhen XRAY Electric

- 10.15 Swissray Medical

- 10.16 Xingaoyi