PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699263

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699263

High Potency Active Pharmaceutical Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

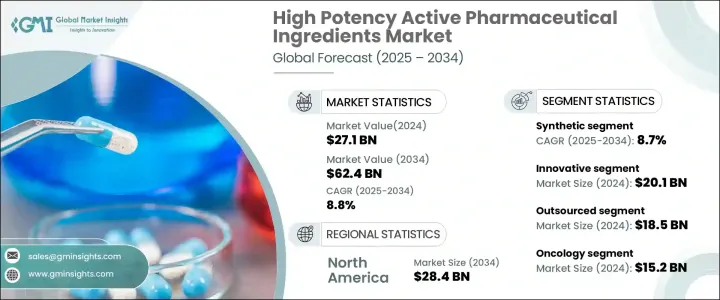

The Global High Potency Active Pharmaceutical Ingredients Market was valued at USD 27.1 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2034. HPAPIs are specialized pharmaceutical compounds that produce strong biological effects at minimal doses, necessitating strict handling and manufacturing processes due to their potency. These ingredients play a crucial role in modern targeted therapies, particularly cancer treatments, as they enable more effective drug delivery while reducing systemic toxicity. With the rising demand for precision medicine, pharmaceutical companies are focusing on expanding HPAPI production capabilities to cater to the growing need for advanced therapies.

The market is divided into synthetic and biotech HPAPIs, with the synthetic segment generating USD 18 billion in revenue in 2024 and expected to grow at a CAGR of 8.7%. Synthetic HPAPIs are widely preferred due to their scalable manufacturing processes, making them more efficient for large-scale production. Unlike biotech HPAPIs, which require complex processes like cell culture and fermentation, synthetic alternatives are produced using well-established chemical procedures, accelerating drug development timelines. With an increasing global prevalence of chronic diseases, synthetic HPAPIs continue to dominate the market due to their ability to deliver targeted therapeutic effects with precise dosage control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.1 Billion |

| Forecast Value | $62.4 Billion |

| CAGR | 8.8% |

Based on drug type, the HPAPI market is categorized into innovative and generic drugs. The innovative segment accounted for USD 20.1 billion in 2024, representing 74.3% of the market. The growing demand for advanced treatments for cancer, autoimmune diseases, and other complex conditions has led to increased investment in high-efficacy HPAPIs. Ongoing technological advancements in containment systems and continuous manufacturing processes are streamlining production while ensuring compliance with stringent regulatory requirements. Additionally, the adoption of sustainable manufacturing techniques is reducing production costs and enhancing safety in HPAPI development.

The market is also segmented by manufacturer type, with in-house and outsourced production. The outsourced segment led the market with USD 18.5 billion in revenue in 2024. The high costs associated with specialized containment facilities have driven many pharmaceutical companies to rely on contract manufacturing organizations (CMOs) for HPAPI production. This allows pharmaceutical firms to focus on drug research, development, and commercialization while leveraging the expertise of CMOs to meet stringent industry standards. As a result, outsourcing has become a strategic move to enhance production efficiency and maintain cost-effectiveness.

In terms of applications, oncology remained the dominant segment, contributing USD 15.2 billion in revenue in 2024. HPAPIs play a vital role in cancer treatments, particularly in chemotherapy and targeted therapies, due to their ability to attack cancer cells with minimal impact on healthy tissues. Their application in advanced drug formulations, including antibody-drug conjugates and immunotherapy, is further driving market demand.

Geographically, North America accounted for USD 12.4 billion in 2024 and is projected to reach USD 28.4 billion by 2034. The U.S. led the region with USD 11.3 billion in revenue, driven by increasing cancer cases and stringent regulatory requirements that support the development of high-potency pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer

- 3.2.1.2 Growing adoption of targeted therapies

- 3.2.1.3 Growing application of high potency active pharmaceutical ingredients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing cost

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Patent analysis

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.8 Technological landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Innovative

- 6.3 Generic

Chapter 7 Market Estimates and Forecast, By Manufacturer Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Hormonal imbalance

- 8.4 Glaucoma

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Albany Molecular Research

- 10.2 Agilent Technologies

- 10.3 Axplora

- 10.4 BASF

- 10.5 Boehringer Ingelheim International

- 10.6 Bristol-Myers Squibb Company

- 10.7 CARBOGEN AMCIS

- 10.8 Cipla

- 10.9 CordenPharma

- 10.10 Dr. Reddy’s Laboratories

- 10.11 F. Hoffmann-La Roche

- 10.12 Lonza

- 10.13 Merck & Co.

- 10.14 Novartis

- 10.15 Pfizer

- 10.16 Sanofi

- 10.17 Sun Pharmaceutical Industries

- 10.18 Teva Pharmaceutical Industries