PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699246

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699246

Tactile Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

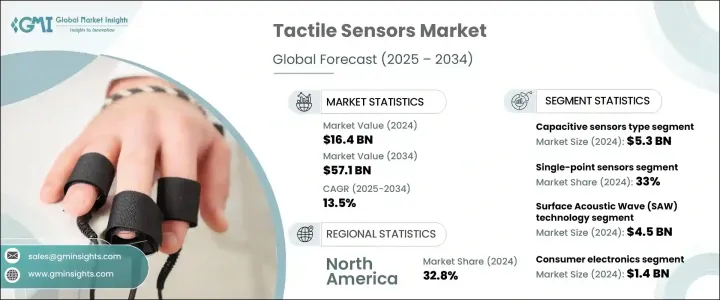

The Global Tactile Sensors Market was valued at USD 16.4 billion in 2024 and is projected to expand at a CAGR of 13.5% from 2025 to 2034. This growth is driven by the increasing adoption of consumer electronic devices, the rising use of tactile sensors in the automotive sector, and the growing inclination toward automation and robotics. These sensors, designed to replicate the human sense of touch, are gaining traction across multiple industries, enhancing functionality and efficiency. Their role in improving user interfaces and enabling smarter, more interactive systems is fueling demand. The expanding footprint of artificial intelligence, machine learning, and IoT technologies is further accelerating adoption, particularly in high-tech industries. Additionally, ongoing advancements in sensor accuracy, sensitivity, and durability are enabling broader applications in medical devices, industrial automation, and defense sectors. The integration of AI-powered tactile sensors into smart devices and autonomous systems is becoming a key trend, prompting companies to invest in advanced sensor technologies to enhance performance and efficiency.

Based on type, capacitive sensors accounted for USD 5.3 billion in 2024. Their superior accuracy, longer lifespan, and higher sensitivity compared to resistive and inductive sensors have contributed to their widespread use. The increasing demand for multi-touch interfaces with functions such as pinch-to-zoom is also supporting segment expansion. As consumer electronics continue to evolve with sophisticated touch-sensitive features, capacitive sensors remain a preferred choice for manufacturers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.4 billion |

| Forecast Value | $57.1 billion |

| CAGR | 13.5% |

The product segment includes integrated sensors, array sensors, single-point sensors, and hybrid sensors. In 2024, the single-point sensors segment held a 33% share of the global market. Their ability to provide precise force and pressure detection has made them essential in industrial automation, robotics, and wearable technologies. Demand for these sensors is rising as industries seek more advanced touch-sensitive solutions in applications ranging from assistive technologies to smart wearables.

The market is segmented by technology into Surface Acoustic Wave (SAW), Electroactive Polymers (EAP), Micro-electromechanical Systems (MEMS), and others. SAW technology led the market with USD 4.5 billion in 2024. The growing need for cost-effective, compact, and highly efficient sensor components has driven its adoption, particularly with the rise of 5G and IoT technologies. Miniaturized electronics and mobile devices are increasingly incorporating SAW-based sensors, further propelling growth.

Application-wise, the market spans consumer electronics, automotive, healthcare, industrial automation, aerospace, and others. Consumer electronics dominated with USD 1.4 billion in 2024, driven by the widespread adoption of smartphones, tablets, and advanced haptic feedback technologies. Tactile sensors enhance user experience by simulating touch, making them integral to modern electronic devices.

Regionally, North America accounted for 32.8% of the market's revenue share in 2024, supported by substantial investments in R&D and stringent industrial automation safety regulations. The U.S. market alone was valued at USD 3.5 billion, with strong demand stemming from advancements in robotics, medical wearables, and prosthetic technologies. The presence of leading sensor manufacturers is further fostering innovation and product development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of consumer electronic devices

- 3.6.1.2 Emerging use of tactile sensors in automotive industry

- 3.6.1.3 Rising inclination towards automation and robotics

- 3.6.1.4 Increasing technological developments

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complexities associated with designing and testing

- 3.6.2.2 Growing concerns regarding power consumption

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Capacitive sensors

- 5.3 Resistive sensors

- 5.4 Piezoelectric sensors

- 5.5 Optical sensors

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Single-point sensors

- 6.3 Array sensors

- 6.4 Integrated sensors

- 6.5 Hybrid sensors

Chapter 7 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Surface Acoustic Wave (SAW)

- 7.3 Electroactive Polymers (EAP)

- 7.4 Micro-electromechanical Systems (MEMS)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Healthcare & medical devices

- 8.5 Robotics

- 8.6 Industrial automation

- 8.7 Aerospace & defense

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airmar Technology Corporation

- 10.2 Analog Devices, Inc.

- 10.3 Bosch Sensortec GmbH

- 10.4 Cypress Semiconductor Corporation

- 10.5 Honeywell International Inc.

- 10.6 Infineon Technologies AG

- 10.7 Melexis NV

- 10.8 Microchip Technology Inc.

- 10.9 Murata Manufacturing Co., Ltd.

- 10.10 NXP Semiconductors

- 10.11 Omron Corporation

- 10.12 Panasonic Corporation

- 10.13 Pepperl+Fuchs SE

- 10.14 Renesas Electronics Corporation

- 10.15 STMicroelectronics

- 10.16 TE Connectivity Ltd.

- 10.17 Texas Instruments Incorporated