PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699244

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699244

Europe Solar EPC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

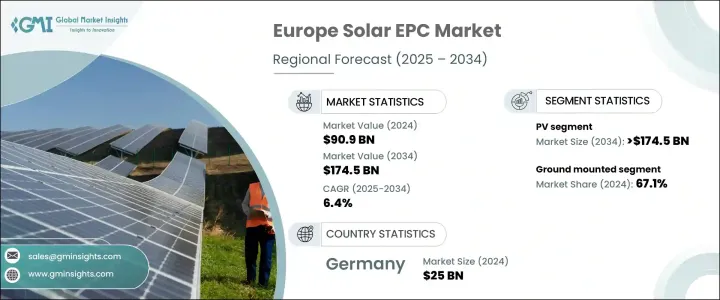

Europe Solar EPC Market was valued at USD 90.9 billion in 2024 and is expected to expand at a CAGR of 6.4% from 2025 to 2034. Increasing emphasis on renewable energy procurement as part of corporate sustainability strategies, along with the growing adoption of solar-plus-storage solutions, is driving market expansion. EPC providers are continuously enhancing their service offerings to align with evolving customer demands and grid requirements. Rising energy costs and concerns over energy security are prompting businesses and homeowners to invest in rooftop solar installations, reducing dependency on traditional power grids and mitigating price volatility.

The region's commitment to lowering greenhouse gas emissions and transitioning to sustainable energy sources is further accelerating investment in solar energy projects. Additionally, the adoption of hybrid solar systems that integrate multiple renewable energy sources is gaining traction. The growing prominence of community solar projects, where multiple stakeholders invest in shared installations, is reshaping the business landscape. Government initiatives, including feed-in tariffs, competitive bidding, and environmental protection regulations, are fostering the development of utility-scale and commercial solar photovoltaic (PV) projects across Western and Eastern Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.9 Billion |

| Forecast Value | $174.5 Billion |

| CAGR | 6.4% |

The PV technology segment is projected to surpass USD 174.5 billion by 2034, driven by declining costs of photovoltaic panels, making installations more affordable for a wider customer base. Financing solutions such as power purchase agreements (PPAs), solar leases, and loan schemes are further encouraging solar adoption among residential and commercial users. The increasing development of high-efficiency solar panels with greater power output per unit area is boosting demand for EPC services. Meanwhile, the concentrated solar power (CSP) segment is set to exceed USD 222 billion by 2034, supported by the integration of thermal energy storage systems and advancements in hybrid CSP technologies. Ongoing innovation in CSP technology is reducing costs and improving efficiency, strengthening market growth.

The ground-mounted solar segment accounted for over 67.1% of the market in 2024, benefiting from improvements in solar PV efficiency and affordability. The integration of tracking systems to enhance energy yield, alongside the use of recycled and sustainable materials, is reducing the carbon footprint of mounting systems. Increasing deployment of energy storage solutions in ground-mounted solar projects, along with favorable government policies and incentives, is further boosting business momentum. The rooftop solar segment is expected to expand at a CAGR of over 6% through 2032, fueled by advancements in technology, policy incentives, and the rising awareness of clean energy benefits. Tax credits, rebates, feed-in tariffs, and net metering policies are driving installations, strengthening the market outlook.

Germany solar EPC market recorded USD 10.4 billion in 2022, USD 20.2 billion in 2023, and USD 25 billion in 2024. Supportive government policies, continuous advancements in technology, and economic incentives are reinforcing growth. The focus on sustainability in EPC processes, including the use of environmentally friendly materials, is expected to further enhance market dynamics in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Unpaid sources

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.1.1 Vendor matrix

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive landscape, 2024

- 3.1 Introduction

- 3.2 Strategic dashboard

- 3.3 Innovation & sustainability landscape

Chapter 4 Europe Solar EPC Market Size and Forecast, By Technology, 2021 – 2034 (MW & USD Billion)

- 4.1 Key trends

- 4.2 PV

- 4.3 CSP

Chapter 5 Europe Solar EPC Market Size and Forecast, By Classification, 2021 – 2034 (MW & USD Billion)

- 5.1 Key trends

- 5.2 Rooftop

- 5.2.1 Up to 1 kW

- 5.2.2 1 to 10 kW

- 5.2.3 10 to 50 kW

- 5.2.4 50 kW to 1 MW

- 5.3 Ground Mounted

- 5.3.1 1 to 3 MW

- 5.3.2 3 to 10 MW

- 5.3.3 10 to 50 MW

- 5.3.4 > 50 MW

Chapter 6 Europe Solar EPC Market Size and Forecast, By End Use, 2021 – 2034 (MW & USD Billion)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial & industrial

- 6.4 Utility

Chapter 7 Europe Solar EPC Market Size and Forecast, By Country, 2021 – 2034 (MW & USD Billion)

- 7.1 Key trends

- 7.2 Austria

- 7.3 Norway

- 7.4 Denmark

- 7.5 Finland

- 7.6 France

- 7.7 Germany

- 7.8 Italy

- 7.9 Switzerland

- 7.10 Spain

- 7.11 Sweden

- 7.12 UK

- 7.13 Netherlands

- 7.14 Poland

- 7.15 Belgium

- 7.16 Ireland

- 7.17 Baltics

- 7.18 Portugal

Chapter 8 Company Profiles

- 8.1 AE Solar

- 8.2 BELECTRIC

- 8.3 Comal SpA

- 8.4 CJR Renewables

- 8.5 Chint Solar (Zhejiang)

- 8.6 Equans

- 8.7 Elmya EPC

- 8.8 Fraunhofer CSP

- 8.9 Goldbeck Solar

- 8.10 Iqony Solar Energy Solutions

- 8.11 INTEC Energy Solutions

- 8.12 ISG Renewables

- 8.13 JUWI

- 8.14 Scatec ASA

- 8.15 Strom-Forschung.de

- 8.16 Sterling and Wilson Renewable Energy Limited

- 8.17 Sunel Group