PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699243

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699243

Computer Microchips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

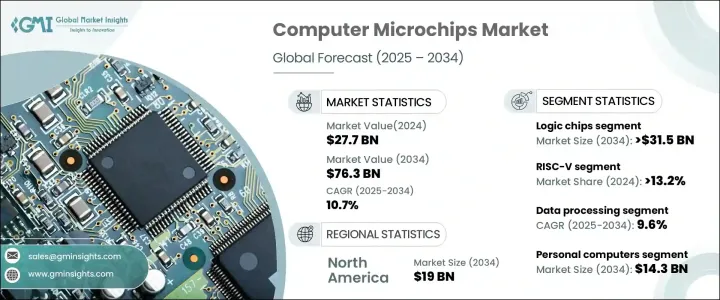

The Global Computer Microchips Market was valued at USD 27.7 billion in 2024 and is projected to expand at a CAGR of 10.7% from 2025 to 2034. Increasing adoption of artificial intelligence, machine learning, and cloud computing is fueling demand for high-performance, low-power microchips. With businesses and consumers increasingly relying on digital transformation, the need for advanced processors, memory chips, and networking components continues to rise. Companies are focusing on scalable and energy-efficient chips to support AI-driven applications, data-intensive workloads, and cloud-based operations. Expanding data center infrastructure is also accelerating the market's growth as firms invest in advanced microchips to optimize power efficiency and reduce operational costs. Innovations in semiconductor manufacturing and the rise of AI-optimized chips are shaping the industry's evolution.

Manufacturers are prioritizing high-performance, low-power chips tailored for AI and cloud computing applications. AI workloads require specialized processors designed for deep learning, neural networks, and big data analytics. The growing emphasis on faster, more efficient computing is driving innovation in microchip architecture.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.7 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 10.7% |

By chip type, the market is segmented into memory chips, logic chips, SoCs, and ASICs. The logic chips segment is expected to witness substantial expansion, driven by advancements in semiconductor technology and the increasing use of 5G and IoT. The market for logic chips is projected to exceed USD 31.5 billion by 2034, with rising demand for smartphones, tablets, laptops, and gaming devices contributing to its growth. System-on-chip (SoC) architectures that integrate multiple processing functions into a single unit are enhancing the performance of mobile and wearable devices.

Market segmentation by architecture includes x86, ARM, RISC-V, and others. The RISC-V segment is experiencing rapid growth due to its open-source framework, flexibility, and cost benefits. In 2024, RISC-V accounted for over 13.2% of the market. Its open-source nature allows companies to develop custom chip designs without licensing fees, offering significant cost savings and avoiding vendor dependency.

By application, the market is categorized into data processing, graphics rendering, AI and machine learning, networking, sensor integration, encryption, and security. The data processing segment is forecasted to grow at a CAGR of 9.6% by 2034. Expanding demand for AI-based analytics, big data, cloud computing, and high-performance computing is boosting the requirement for sophisticated chips that can handle large-scale computational workloads.

The end-use segmentation includes personal computers, servers and data centers, smartphones and tablets, gaming consoles, and others. The personal computers segment is expected to reach USD 14.3 billion by 2034, driven by increasing demand for remote work, online education, and digital content creation. The growing adoption of AI-powered laptops and ARM-based processors is reshaping the PC industry.

Regionally, North America is forecasted to reach USD 19 billion by 2034, benefiting from strong R&D investments, an advanced semiconductor supply chain, and rising demand for AI and cloud-based technologies. The U.S. market alone is expected to hit USD 16.7 billion, supported by government initiatives to expand domestic semiconductor production and reduce reliance on external supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancements in AI and machine learning

- 3.2.1.2 Growth in consumer electronics

- 3.2.1.3 Expansion of cloud computing and data centres

- 3.2.1.4 Increasing demand for semiconductors

- 3.2.1.5 Rise in electric vehicles (EVs) and autonomous cars

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Global semiconductor supply chain disruptions

- 3.2.2.2 Rising complexity and manufacturing costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Chip Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Logic chips

- 5.3 Memory chips

- 5.4 ASICs

- 5.5 SoCs

Chapter 6 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 x86

- 6.3 ARM

- 6.4 RISC-V

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Data processing

- 7.3 Graphics rendering

- 7.4 Artificial intelligence and machine learning

- 7.5 Networking and connectivity

- 7.6 Sensor integration

- 7.7 Encryption and security

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By End-use, 2021– 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Personal computers

- 8.3 Servers and data centers

- 8.4 Smartphones and tablets

- 8.5 Gaming consoles

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices

- 10.2 Analog Devices

- 10.3 Arm Holdings

- 10.4 Broadcom

- 10.5 Espressif Systems

- 10.6 Infineon Technologies

- 10.7 Intel

- 10.8 Kioxia Holdings

- 10.9 Marvell Technology Group

- 10.10 Microchip Technology

- 10.11 Micron Technology

- 10.12 NVIDIA

- 10.13 NXP Semiconductors

- 10.14 Qualcomm

- 10.15 Renesas Electronics

- 10.16 Samsung Electronics

- 10.17 STMicroelectronics

- 10.18 Taiwan Semiconductor Manufacturing Company

- 10.19 Texas Instruments