PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699242

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699242

Disposable Thermometer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

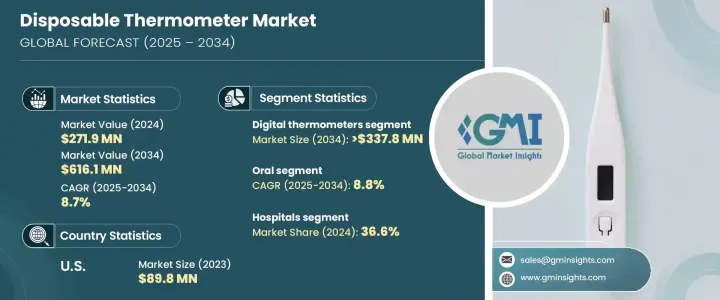

The Global Disposable Thermometer Market was valued at USD 271.9 million in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2034. Increasing healthcare demands, advancements in medical technology, and the growing focus on infection control are key drivers of market expansion. Hospitals and clinics are increasingly adopting single-use thermometers to prevent hospital-acquired infections. The demand for disposable thermometers surged during the COVID-19 pandemic, reinforcing their importance in infection prevention. With aging populations and rising chronic disease cases, more people are relying on disposable thermometers for routine health monitoring.

These devices are now more accurate and user-friendly due to technological advancements, making them a preferred choice for both clinical and home healthcare settings. As home-based medical care gains traction, particularly in developed nations, disposable thermometers are becoming essential tools. Consumers favor these thermometers for their convenience, safety, and affordability, while more individuals include them in travel and emergency medical kits. Rising disposable income is also boosting healthcare spending, contributing to market growth. The correlation between disposable income and medical expenditures is expected to strengthen demand for these thermometers in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $271.9 Million |

| Forecast Value | $ 616.1 Million |

| CAGR | 8.7% |

The market is segmented by type into digital and strip thermometers, with the digital segment projected to expand at a CAGR of 8.5%, reaching over USD 337.8 million by 2034. Consumers are shifting from traditional to digital thermometers due to their improved accuracy, speed, and ease of use. Healthcare providers favor digital thermometers to minimize cross-contamination risks, particularly in hospitals, clinics, and nursing homes. The pandemic further accelerated their adoption in workplaces, schools, and public spaces. Advancements in sensor technology have enhanced accuracy and response times, increasing reliability for both medical professionals and home users. Individuals with chronic conditions requiring frequent temperature monitoring prefer digital thermometers for their portability and efficiency.

Based on target area, the market is categorized into oral, axilla, rectal, and other segments, with oral thermometers expected to reach over USD 192.6 million by 2034 at a CAGR of 8.8%. Oral thermometers remain a popular choice for homes and healthcare facilities due to their ease of use and reliable readings. They are comfortable, cost-effective, and widely preferred in hospitals for infection control. The heightened focus on hygiene during the pandemic fueled demand for disposable oral thermometers in critical care areas.

By end use, the market is divided into hospitals, diagnostic centers, homecare, and other settings. Hospitals held the largest market share of 36.6% in 2024, driven by stringent hygiene protocols and the need for efficient infection control. The pandemic reinforced the necessity of disposable thermometers in emergency rooms, intensive care units, and neonatal wards. These thermometers offer a cost-effective solution by eliminating the need for sterilization between uses, saving time and resources.

In the U.S., the disposable thermometer market was valued at USD 80.8 million in 2021. The country led the North America market in 2023 with USD 89.8 million, up from USD 85 million in 2022. Infection control measures remain a priority for healthcare facilities, increasing reliance on single-use thermometers to prevent cross-contamination. The rise in infectious diseases, seasonal illnesses, and chronic conditions has further propelled demand. An aging population with higher healthcare needs has led to greater adoption of disposable thermometers in hospitals and home healthcare settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing emphasis on infection prevention and control

- 3.2.1.2 Rising hospital acquired infections (HAIs)

- 3.2.1.3 Strict healthcare and sanitation regulations

- 3.2.1.4 Rising demand for home-based care services

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of substitutes

- 3.2.2.2 Technical limitation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Overview on disposable oral thermometer in clinical use

- 3.12 Outlook on the accuracy and function of different thermometry techniques for measuring body temperature

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital thermometers

- 5.3 Strip thermometers

Chapter 6 Market Estimates and Forecast, By Target Area, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Axilla

- 6.4 Rectal

- 6.5 Other target areas

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Homecare

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Acme United Corporation

- 9.3 Advanced Meditech Internationals (AMI)

- 9.4 American Diagnostics Corporation

- 9.5 FIRST AID ONLY

- 9.6 graham field

- 9.7 H-B Instrument

- 9.8 Hopkins Medical Products

- 9.9 LCR Hallcrest

- 9.10 MEDICAL INDICATORS

- 9.11 MEDLINE

- 9.12 microlife corporation

- 9.13 Protontek

- 9.14 tempagenix

- 9.15 Zeal