PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698595

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698595

Solar Cells Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

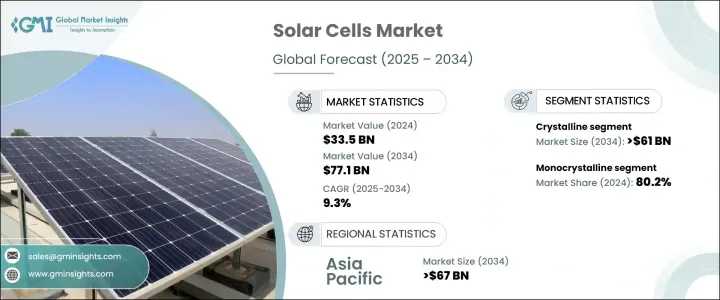

The Global Solar Cells Market was valued at USD 33.5 billion in 2024 and is projected to grow at a CAGR of 9.3% from 2025 to 2034. The market is gaining traction due to advancements in technology, declining production costs, and increasing awareness of renewable energy solutions. Innovations in solar cell efficiency and the widespread adoption of solar energy systems are reshaping the industry. Supportive government policies, net metering incentives, and renewable energy mandates are accelerating expansion. Lower manufacturing expenses and growing competition are further fostering the development of efficient solar power solutions. The rising adoption of off-grid solar applications in remote regions and the integration of solar power with battery storage systems are also fueling market demand. Additionally, increasing installations of residential solar power systems are playing a crucial role in expanding the industry's footprint.

The crystalline solar cells segment is anticipated to surpass USD 61 billion by 2034, driven by cost-effectiveness and superior efficiency. Monocrystalline technology is well-established, offering high-performance solar panels with efficiency rates exceeding 20%. The introduction of advanced technologies such as Passivated Emitter and Rear Cell (PERC), heterojunction technology (HJT), and N-type silicon has further enhanced efficiency levels, making solar solutions more viable for diverse applications. The growing adoption of monocrystalline panels, which accounted for 80.2% of the solar cells market in 2024, is a testament to their reliability and improved performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.5 Billion |

| Forecast Value | $77.1 Billion |

| CAGR | 9.3% |

Advancements in cell technology are optimizing solar energy utilization, improving energy conversion rates, and reducing electron recombination losses. Crystalline solar cells, particularly monocrystalline variants, continue to dominate the market due to their durability and superior energy output. Polycrystalline, CdTe, amorphous silicon (A-Si), and copper indium gallium selenide (CIGS) technologies are also evolving, contributing to the expansion of solar applications across residential, commercial, and industrial sectors.

The US solar cells market recorded values of USD 840 million in 2022, USD 880 million in 2023, and USD 910 million in 2024. The growth is fueled by increasing installations of solar power plants and expanding renewable energy initiatives. The country's focus on large-scale solar projects and supportive state policies is driving adoption across utility-scale, residential, and commercial installations.

The Asia Pacific solar cells market is projected to exceed USD 67 billion by 2034, supported by strong government incentives and rising investments in high-efficiency solar technology. Rapid urbanization and industrialization in emerging economies are increasing the demand for reliable and sustainable energy sources. The expansion of rural electrification programs and the development of hybrid solar projects integrating wind and battery storage are further bolstering market growth. Countries across Southeast Asia are witnessing a surge in solar installations, positioning the region as a key contributor to the global solar market.

The adoption of solar energy is expected to accelerate as nations work toward achieving energy independence and sustainability goals. With ongoing advancements in solar technology and increasing policy support, the market is poised for significant expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Crystalline

- 5.2.1 N Material

- 5.2.2 P Material

- 5.3 Thin Film

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Monocrystalline

- 6.3 Polycrystalline

- 6.4 Cadmium Telluride (CDTE)

- 6.5 Amorphous Silicon (A-Si)

- 6.6 Copper Indium Gallium Diselenide (CIGS)

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 BSF

- 7.3 PERC/PERL/PERT/TOPCON

- 7.4 HJT

- 7.5 IBC & MWT

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Spain

- 8.3.3 France

- 8.3.4 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Malaysia

- 8.4.3 South Korea

- 8.4.4 Japan

- 8.4.5 Taiwan

- 8.4.6 India

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Canadian Solar

- 9.2 DuPont

- 9.3 Hevel

- 9.4 Hanwha Q Cells

- 9.5 Jinko Solar

- 9.6 JINERGY

- 9.7 JA SOLAR Technology

- 9.8 Meyer Burger

- 9.9 MOTECH Industries

- 9.10 RENESOLA

- 9.11 REC Solar Holdings

- 9.12 Silfab Solar

- 9.13 Singulus Technologies

- 9.14 SunPower Corporation

- 9.15 Sunport Power

- 9.16 AIKO

- 9.17 Tongwei

- 9.18 United Renewable Energy

- 9.19 Vikram Solar

- 9.20 Wuxi Suntech Power

- 9.21 Yingli Solar