PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698594

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698594

X-ray Detectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

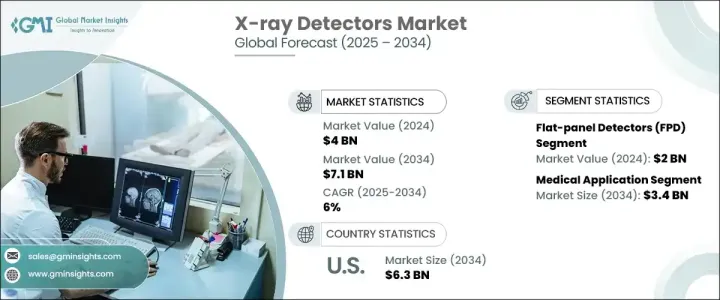

The Global X-Ray Detectors Market was valued at USD 4 billion in 2024 and is projected to expand at a CAGR of 6% from 2025 to 2034. These detectors, which convert X-ray radiation into electronic or visual signals, play a critical role in various imaging applications, particularly in the medical and dental fields. The rising demand for early disease detection, driven by the growing prevalence of chronic illnesses, is fueling market expansion. Cancer remains one of the leading causes of death worldwide, increasing the need for advanced screening and diagnostic solutions. The adoption of X-ray detectors is expected to rise as healthcare systems emphasize early diagnosis and improved imaging accuracy.

Technological advancements have significantly enhanced the efficiency of X-ray detection, leading to improved image quality and faster diagnosis. The transition from film-based to digital X-ray detectors has accelerated, enabling quicker image capture and streamlined workflow in medical settings. Direct digital radiography (DR) systems, known for their speed and accuracy, are gaining traction. The market continues to evolve with the integration of lightweight and wireless detectors, offering better spatial resolution and reduced radiation exposure. Innovations in detector technology are expected to drive industry growth in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $7.1 Billion |

| CAGR | 6% |

By detector type, the market includes flat-panel detectors (FPD), computed radiography (CR) detectors, and charge-coupled device detectors, among others. In 2023, market revenue stood at USD 3.8 billion, with the FPD segment dominating, contributing USD 2 billion in 2024. FPDs are favored for their high image quality, rapid processing speed, and ability to eliminate film-based imaging, improving efficiency in healthcare facilities. Their increasing adoption in digital radiography and fluoroscopy applications is accelerating market growth. Continuous enhancements in direct conversion and wireless connectivity further strengthen their position in the industry, making them the preferred choice for medical imaging professionals.

The market is categorized into medical, dental, and other applications, with the medical segment accounting for 46.9% of revenue share in 2024. This segment is expected to generate USD 3.4 billion by 2034, driven by the increasing prevalence of musculoskeletal disorders and chronic respiratory diseases. A rise in conditions affecting bones and joints has led to greater reliance on X-ray imaging for accurate diagnosis and treatment planning. Additionally, respiratory illnesses necessitate frequent imaging, reinforcing the demand for advanced X-ray detector solutions.

Hospitals remain the leading end users, capturing a 34.5% revenue share in 2024. The high patient volume and sophisticated imaging infrastructure in hospitals contribute to their dominant market position. The integration of digital radiography systems enhances workflow efficiency, supporting the widespread adoption of X-ray detectors. Increased government investment in advanced imaging technologies further propels market growth, as hospitals continue to expand radiology departments to meet the growing demand for diagnostic imaging.

In the U.S., market revenue was USD 1.53 billion in 2023 and is projected to reach USD 6.3 billion by 2034. The rising incidence of chronic diseases and high healthcare expenditure support the extensive adoption of X-ray detectors across medical facilities. Increased awareness of early diagnosis continues to drive demand, positioning the U.S. as a key contributor to global market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.3 Methodology and Scope

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Forecast model

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.6.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for early disease diagnosis

- 3.2.1.2 Technological advancement

- 3.2.1.3 Increased awareness about the benefits of X-ray technology

- 3.2.1.4 Favorable reimbursement scenario

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with X-ray detectors

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flat-panel detectors (FPD)

- 5.3 Computed radiography (CR) detectors

- 5.4 Charge coupled device detectors

- 5.5 Other detector types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Medical application

- 6.3 Dental application

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic laboratories

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agfa-Gevaert Group

- 9.2 Canon Medical Systems

- 9.3 Carestream Health

- 9.4 Fujifilm

- 9.5 General Electric Company

- 9.6 Konica Minolta

- 9.7 Koninklijke Philips

- 9.8 PerkinElmer

- 9.9 Siemens Healthineers

- 9.10 Teledyne Technologies

- 9.11 Thales Group

- 9.12 Toshiba

- 9.13 Varex Imaging