PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698590

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698590

Semiconductor Foundry Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

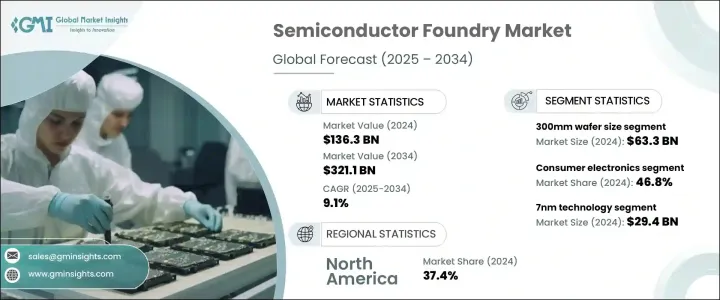

The Global Semiconductor Foundry Market, valued at USD 136.3 billion in 2024, is expected to grow at a 9.1% CAGR through 2034. Market expansion is driven by rising demand for AI applications and advancements in packaging technologies. AI-based applications require high-computing capabilities, fueling the demand for specialized chips like GPUs, TPUs, and AI accelerators. Increased adoption of AI in cloud computing, autonomous systems, healthcare, and financial technology has intensified the need for advanced semiconductor solutions. As workloads in deep learning, natural language processing, and computer vision become more complex, semiconductor foundries are investing in cutting-edge process nodes, including 5nm and below. Expanding manufacturing capacity for high-performance, energy-efficient chips remains a priority as companies seek to enhance processing power while optimizing energy use.

Innovations in advanced packaging solutions are further shaping industry growth. Modern semiconductor designs face challenges in power efficiency and performance as traditional monolithic structures struggle to meet evolving AI and HPC demands. Advanced packaging methods, including 2.5D/3D integration and chiplets, enable better interconnects, improved energy efficiency, and superior computing power. Increased investment in these technologies, backed by national programs and private sector funding, is driving demand for high-performance semiconductor solutions. As technology evolves, foundries are focusing on sophisticated packaging techniques to stay competitive in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.3 Billion |

| Forecast Value | $321.1 Billion |

| CAGR | 9.1% |

The automotive sector is significantly contributing to semiconductor foundry growth. With the integration of ADAS, EV technologies, and IoT-enabled vehicle systems, the need for high-performance semiconductor components has surged. Modern automotive chips ensure seamless real-time data processing and connectivity, which are essential for enhanced safety and automation in vehicles. The increasing complexity of automotive electronics necessitates investments in semiconductor manufacturing for ADAS, electric drivetrains, and infotainment systems, expanding foundry opportunities in this sector.

Market segmentation by wafer size indicates rapid expansion in the 450mm category, expected to grow at a 10.5% CAGR. As semiconductor devices become more advanced, companies are turning to larger wafers to increase production efficiency and scalability. The 300mm wafer segment, valued at USD 63.3 billion in 2024, is witnessing growth due to advancements in chip architectures like heterogeneous integration and 3D stacking. Meanwhile, 200mm wafers, essential for MEMS and RF components in 5G networks and smartphones, are projected to surpass USD 81.3 billion by 2034.

The market is also categorized by application, with consumer electronics dominating at 46.8% market share in 2024. Rising IoT device adoption and AI integration continue to drive demand in this segment. Communications is expected to grow at a 10.9% CAGR, propelled by data center expansions and 5G rollouts. The automotive sector, accounting for 13.6% of the market in 2024, continues to drive demand for semiconductor solutions in EVs and ADAS-equipped vehicles. Industrial applications are also on the rise, with AI-driven automation solutions fueling demand for high-grade semiconductor components.

In terms of technology nodes, 7nm process technology, valued at USD 29.4 billion in 2024, plays a crucial role in high-performance computing. The 10nm node is expanding at a 9.7% CAGR, catering to premium mobile processors and computing devices. The 14nm node is growing significantly, driven by applications in automotive and industrial automation, with projected revenues surpassing USD 48 billion by 2034. The 22nm process node, widely used in wireless communication infrastructure, is expected to grow at a 7.8% CAGR, while the 28nm node remains in demand for OLED displays and networking solutions.

Regionally, North America leads the global market, holding 37.4% market share in 2024. The region's dominance is attributed to strong semiconductor manufacturing capabilities, investments in advanced chip design, and early adoption of cutting-edge semiconductor technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.2.1 Total addressable market (TAM), 2024-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Surging demand for AI Applications

- 3.8.1.2 Transformation in Automotive industry

- 3.8.1.3 Advanced Packaging Technologies

- 3.8.1.4 Expansion of Hyperscale Data Centre

- 3.8.1.5 Adoption of 5G technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Supply Chain Disruptions

- 3.8.2.2 High R&D and Capital Costs

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.10.1 Supplier power

- 3.10.2 Buyer power

- 3.10.3 Threat of new entrants

- 3.10.4 Threat of substitutes

- 3.10.5 Industry rivalry

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology Node, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 7nm

- 5.3 10nm

- 5.4 14nm

- 5.5 22nm

- 5.6 28nm

- 5.7 40nm

- 5.8 65nm

- 5.9 90nm

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Consumer electronics

- 6.3 Communication

- 6.4 Automotive

- 6.5 Industrial

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Wafer Size, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 200mm

- 7.3 300mm

- 7.4 450mm

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Dongbu Hitek Co. Ltd

- 9.2 Globalfoundries Inc.

- 9.3 Hua Hong Semiconductor Limited

- 9.4 Intel Corporation

- 9.5 Microchip Technologies Inc.

- 9.6 NXP Semiconductors NV

- 9.7 ON Semiconductor Corporation

- 9.8 Powerchip Technology Corporation

- 9.9 Renesas Electronics Corporation

- 9.10 Samsung Electronics Co. Ltd (Samsung Foundry)

- 9.11 Semiconductor Manufacturing International Corporation (SMIC)

9.12 STMicroelectronics NV

- 9.13 Texas Instruments Inc.

- 9.14 Tower Semiconductor Ltd.

- 9.15 TSMC Limited

- 9.16 United Microelectronics Corporation (UMC)

- 9.17 Vanguard International Semiconductor Corporation

- 9.18 X-FAB Silicon Foundries