PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698579

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698579

Reusable Transport Packaging (RTP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

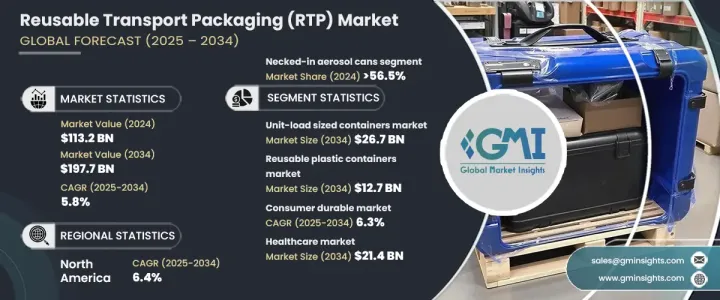

The Global Reusable Transport Packaging Market reached USD 113.2 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Rising concerns over greenhouse gas emissions are driving a shift towards sustainable packaging solutions. Businesses are focusing on cost-efficient logistics, and reusable transport packaging (RTP) is gaining traction due to its ability to reduce packaging and waste disposal costs. Advanced technologies such as RFID and IoT tracking are further enhancing efficiency. Governments and industry stakeholders are promoting reusable packaging to combat climate change, with efforts centered on reducing carbon emissions.

Reusable transport packaging includes handheld crates, pallets, dunnage and cargo protection, reusable plastic containers, unit-load-sized containers, tanks, drums, and barrels. The pallet market, valued at USD 68.3 billion in 2024, is undergoing innovations for improved shipment conditions. Handheld crates, expected to reach USD 25.6 billion by 2034, are widely adopted by retailers for efficient product handling. The dunnage and cargo protection segment, valued at USD 3.3 billion in 2024, is increasingly used for safeguarding fragile items. Unit-load-sized containers, estimated to reach USD 26.7 billion by 2034, are critical for space optimization and waste reduction. The reusable plastic container market is forecasted to reach USD 12.7 billion by 2034, with sensor integration enhancing real-time tracking. Tanks, drums, and barrels, projected to hit USD 6.2 billion by 2034, remain essential for industries transporting bulk liquids and hazardous materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.2 Billion |

| Forecast Value | $197.7 Billion |

| CAGR | 5.8% |

By material type, the market is segmented into plastic, metal, and wood. In 2024, plastic held a 26.4% market share, driven by the demand for lightweight and durable solutions such as high-density polyethylene (HDPE) crates. The metal packaging market is expected to reach USD 26.1 billion by 2034, offering robust solutions for heavy-duty applications. Wood-based packaging, anticipated to reach USD 125.2 billion by 2034, remains a cost-effective and biodegradable option for transportation needs. Manufacturers are expanding their offerings with reusable materials to ensure sustainability and efficiency.

The market is further categorized by end-use industries, including food and beverages, consumer durables, automotive, and healthcare. The food and beverage sector, valued at USD 36.4 billion in 2024, is witnessing an increase in demand for reusable containers to prevent spoilage. The consumer durables segment is expected to grow at a CAGR of 6.3% as sustainable logistics solutions are increasingly adopted for electronics and home appliances. The automotive market is projected to reach USD 42.9 billion by 2034, with manufacturers relying on high-strength reusable pallets. The healthcare sector, forecasted to reach USD 21.4 billion by 2034, is shifting from single-use plastics to reusable containers for transporting delicate medical equipment.

North America's reusable transport packaging market is expected to grow at a CAGR of 6.4% during the forecast period. The region is experiencing a surge in demand for sustainable packaging solutions, with businesses and consumers prioritizing eco-friendly logistics. Companies are adopting reusable transport packaging to lower costs while reducing environmental impact.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global greenhouse gas emissions leading to demand of reuseable transport packaging solutions

- 3.2.1.2 Growing shift from single-use packages to reusable packaging containers

- 3.2.1.3 Rising preferences towards the sustainable options of reusable packages

- 3.2.1.4 Growing support from the government in implementing reusable packaging

- 3.2.1.5 Increasing development of innovative reusable packaging design for efficient transport and logistic handling

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of real-time transparency in tracking the status of reusable containers

- 3.2.2.2 High cost associated with manufacturing and design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pallets

- 5.3 Handheld crates

- 5.4 Dunnage & cargo protection

- 5.5 Unit-load sized containers

- 5.6 Reusable plastic containers

- 5.7 Tanks, drums, & barrels

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Wood

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Consumer durables

- 7.4 Automotive

- 7.5 Healthcare

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Auer Packaging

- 9.2 Borealis AG

- 9.3 CABKA

- 9.4 CDF Corporation

- 9.5 DS Smith

- 9.6 DW Reusables

- 9.7 Georg Utz Holding AG

- 9.8 Greif Inc.

- 9.9 GWP Group

- 9.10 IFCO SYSTEMS

- 9.11 IPL, Inc.

- 9.12 Mauser Packaging Solutions

- 9.13 Myers Industries

- 9.14 Nefab Group

- 9.15 ORBIS Corporation

- 9.16 Rotovia Deventer bv

- 9.17 Schoeller Allibert

- 9.18 Schutz GmbH & Co. KGaA

- 9.19 SSI SCHAEFER

- 9.20 Werit