PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698565

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698565

Fiber Optic Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

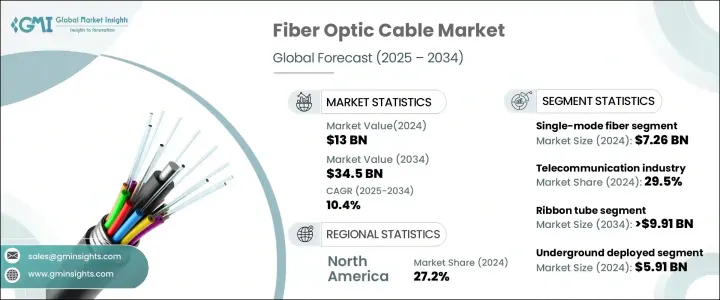

The Global Fiber Optic Cable Market, valued at USD 13 billion in 2024, is expected to grow at a CAGR of 10.4% from 2025 to 2034. Rising demand for high-speed connectivity, the expansion of 5G networks, and the surge in data center deployments are key factors fueling this growth. As 5G technology expands worldwide, the need for robust infrastructure to support seamless, low-latency communication has intensified. The increasing adoption of small cell deployments for better network coverage has created a strong demand for fiber optic cables, which ensure efficient backhaul and fronthaul connectivity. The rise in global 5G penetration, expected to surpass 56% by 2030, is driving fiber optic manufacturers to enhance cable efficiency, durability, and transmission speeds to support modern telecommunication networks.

Expanding data center operations further contributes to market growth, with telecom firms and cloud service providers investing heavily in scalable, high-bandwidth infrastructure. Fiber optic cables enable data centers to manage complex networking demands, ensuring secure and high-speed connectivity. With increased investments in telecom and cloud computing, manufacturers are focusing on fiber technology innovations that enhance efficiency and scalability for hyperscale and edge data centers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13 Billion |

| Forecast Value | $34.5 Billion |

| CAGR | 10.4% |

The market is segmented by fiber type into single-mode and multi-mode fibers. Single-mode fiber led the market with USD 7.26 billion in 2024, offering superior long-distance data transfer capabilities. Multi-mode fiber, projected to grow at a CAGR of 8.5%, is gaining traction for high-speed, short-distance communication, particularly in local area networks and data centers.

By industry, telecommunications dominated in 2024, accounting for 29.5% of market share, driven by the growing demand for high-bandwidth connectivity in 5G networks. The power utilities sector, projected to expand at a CAGR of 10.9%, is seeing increased adoption of fiber optic cables for smart grid applications. The defense industry, with a 14.2% market share, relies on fiber optics for secure, high-speed data transmission, essential for modern communication and surveillance systems. The industrial segment is set to surpass USD 7.34 billion by 2034, supported by rising automation and digital transformation initiatives. The medical industry, expected to grow at a CAGR of 8.2%, leverages fiber optics for precision diagnostics and imaging technologies.

The market is also categorized by cable type, with ribbon tube fiber optic cables projected to exceed USD 9.91 billion by 2034 due to their high fiber density. Loose tube cables, valued at USD 4.35 billion in 2024, are widely used in long-haul telecom networks, while tight-buffered cables, growing at a CAGR of 9.8%, offer enhanced flexibility for indoor applications. Central core cables, expected to reach USD 4.19 billion by 2034, support broadband expansion through Fiber-to-the-Home (FTTH) and Fiber-to-the-Building (FTTB) deployments.

Deployment-wise, underground fiber optic cables led with USD 5.91 billion in 2024, providing secure connectivity for critical infrastructure. The underwater segment, expected to grow at a CAGR of 11.8%, plays a key role in transoceanic communication. Aerial deployments, forecasted to surpass USD 9.14 billion by 2034, offer cost-effective and easily maintainable network expansion.

Regionally, North America held a 27.2% market share in 2024, driven by the rapid adoption of advanced networking solutions and government initiatives supporting 5G infrastructure development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increased broadband penetration

- 3.8.1.2 Continuous expansion of telecom companies

- 3.8.1.3 Growing demand for high-speed internet

- 3.8.1.4 Proliferation of data center

- 3.8.1.5 Adoption of 5G technologies

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Implementation and maintenance cost

- 3.8.2.2 Overcoming signal loss and attenuation

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.10.1 Supplier power

- 3.10.2 Buyer power

- 3.10.3 Threat of new entrants

- 3.10.4 Threat of substitutes

- 3.10.5 Industry rivalry

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Million)

- 5.1 Key Trends

- 5.2 Single-mode fiber

- 5.3 Multi-mode fiber

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD Million)

- 6.1 Key Trends

- 6.2 Underground

- 6.3 Underwater

- 6.4 Aerial

Chapter 7 Market Estimates & Forecast, By Cable Type, 2021 - 2034 (USD Million)

- 7.1 Key Trends

- 7.2 Ribbon tube

- 7.3 Loose tube

- 7.4 Tight buffered

- 7.5 Central core

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million)

- 8.1 Key Trends

- 8.2 Telecommunication

- 8.3 Power utilities

- 8.4 Defense/military

- 8.5 Industrial

- 8.6 Medical

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Belden Inc.

- 10.2 Coherent Corporation

- 10.3 CommScope Holding Company Inc.

- 10.4 Corning Incorporated

- 10.5 Encore Wire Corporation

- 10.6 Finolex Cables Limited

- 10.7 Fujikura Ltd.

- 10.8 Furukawa Electric

- 10.9 Hengtong Group Co., Ltd.

- 10.10 Hexatronic Group AB

- 10.11 LS Cable & System Ltd.

- 10.12 Nexans S.A.

- 10.13 Proterial Cable America Inc. (Proterial Ltd)

- 10.14 Prysmian Group

- 10.15 Sterlite Technologies

- 10.16 Sumitomo Electric Industries Ltd

- 10.17 Yangtze Optical Fiber and Cable Joint Stock Ltd Co.