PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892766

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892766

Smart Ticketing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

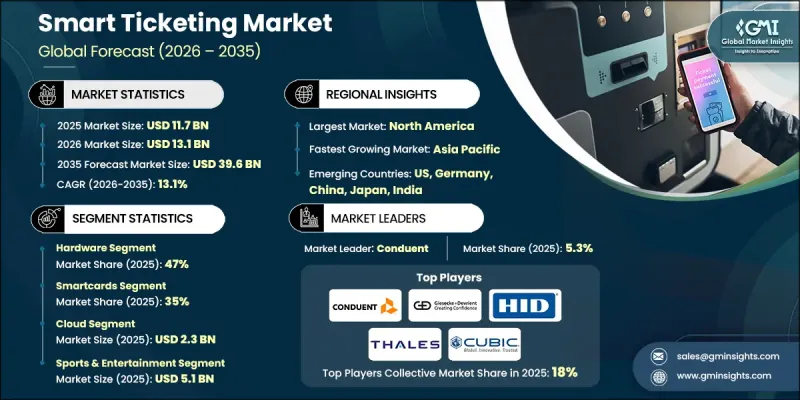

The Global Smart Ticketing Market was valued at USD 11.7 billion in 2025 and is estimated to grow at a CAGR of 13.1% to reach USD 39.6 billion by 2035.

Market growth is being driven by the worldwide transition toward digital and contactless payment ecosystems. Travelers increasingly favor fast and frictionless payment experiences that eliminate physical tickets and cash handling. Transit authorities and public agencies are actively supporting digital fare collection to improve operational efficiency, reduce transaction friction, and enhance passenger convenience. As mobility systems modernize, paper-based ticketing is steadily being replaced by secure, data-driven platforms that support real-time validation and analytics. These solutions also align with public health priorities and cost-reduction strategies. The expanding focus on integrated urban mobility and data-enabled transport planning further supports adoption. Governments are investing heavily in intelligent transport infrastructure as part of broader smart city initiatives, accelerating deployment across buses, rail networks, and metro systems. Smart ticketing platforms are increasingly viewed as foundational digital infrastructure that improves user experience while enabling scalable, future-ready transit ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $11.7 Billion |

| Forecast Value | $39.6 Billion |

| CAGR | 13.1% |

Account-based ticketing and open-loop payment frameworks are reshaping fare collection by shifting transaction logic from physical cards to centralized user accounts. These models enable flexible fare calculation, seamless multimodal integration, and broader interoperability. They simplify onboarding, lower system complexity, and allow travelers to pay using bank cards or mobile devices without relying on proprietary media. As cities pursue unified mobility platforms, these technologies are rapidly replacing legacy closed-loop systems.

The hardware segment accounted for a 47% share in 2025 and is forecast to grow at a CAGR of 12.1% through 2035. Modern systems require advanced validators capable of processing multiple fare media simultaneously. Durability requirements and complex installation environments contribute to higher replacement and upgrade costs, reinforcing hardware's strong revenue contribution.

The smartcards segment held a 35% share in 2025 and is expected to grow at a CAGR of 11.8% between 2026 and 2035. These cards remain central to many established systems due to reliability and security, although gradual migration toward mobile and open-loop options continues. Contactless standards ensure ongoing interoperability, while improved mobile performance is increasing acceptance of smartphone-based ticketing.

U.S. Smart Ticketing Market generated USD 3.1 billion in 2025 and led the North America market. Ongoing modernization of large-scale transit networks is driving sustained demand for advanced fare collection infrastructure and backend platforms.

Key companies operating in the Global Smart Ticketing Market include Cubic, Thales, Conduent, Giesecke + Devrient, HID Global, NXP Semiconductors, Infineon Technologies, and Confidex. Companies in the Global Smart Ticketing Market are strengthening their competitive position through continuous innovation, strategic partnerships, and large-scale deployment capabilities. Providers are investing in interoperable platforms that support account-based architectures, open-loop payments, and mobile-first experiences. Collaboration with transit authorities enables long-term contracts and system-wide rollouts. Many players focus on modular hardware designs and cloud-native software to improve scalability and reduce deployment time.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Ticketing Technology

- 2.2.4 System

- 2.2.5 Deployment

- 2.2.6 Connectivity

- 2.2.7 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 System & platform providers

- 3.1.1.2 Hardware suppliers

- 3.1.1.3 Payment partners

- 3.1.1.4 Niche specialists

- 3.1.1.5 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid adoption of contactless & cashless payments

- 3.2.1.2 Expansion of account-based ticketing (ABT) & open-loop systems

- 3.2.1.3 Smart city initiatives & government digitalization programs

- 3.2.1.4 Growth in smartphone penetration & mobile wallet usage

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial deployment & upgrade costs

- 3.2.2.2 Integration with legacy infrastructure

- 3.2.2.3 Cybersecurity risks & data privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of open-loop EMV and mobile wallet payments

- 3.2.3.2 Growth of QR and mobile ticketing in cost-sensitive regions

- 3.2.3.3 Adoption of biometric and facial recognition access systems

- 3.2.3.4 Government investments in smart city & public transport modernization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 North America

- 3.3.1.1 CCPA / CPRA (California Consumer Privacy Act / California Privacy Rights Act)

- 3.3.1.2 PCI DSS (Payment Card Industry Data Security Standard)

- 3.3.2 Europe

- 3.3.2.1 Privacy Code (Codice in materia di protezione dei dati personali)

- 3.3.2.2 National cybersecurity agency directives

- 3.3.2.3 Data Protection Act 2018

- 3.3.2.4 PSD2 (Payment Services Directive 2) and open-banking rules

- 3.3.3 Asia Pacific

- 3.3.3.1 Digital Personal Data Protection Act 2023 (India)

- 3.3.3.2 PIPA (Personal Information Protection Act, South Korea)

- 3.3.3.3 Telecommunications (Interception and Access) Act 1979 (Australia)

- 3.3.3.4 National data-protection / e-transactions laws

- 3.3.4 Latin America

- 3.3.4.1 LGPD (Lei Geral de Protecao de Dados)

- 3.3.4.2 National Directorate for Personal Data Protection regulations

- 3.3.4.3 Federal Law on the Protection of Personal Data Held by Private Parties

- 3.3.5 Middle East & Africa

- 3.3.5.1 PDPL (Personal Data Protection Law)

- 3.3.5.2 Anti-Cyber Crime Law (various jurisdictions)

- 3.3.5.3 Electronic Communications and Transactions Act (South Africa)

- 3.3.1 North America

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.7.1 By product

- 3.7.2 By region

- 3.8 Cost breakdown analysis

- 3.8.1 Vendor cost structure

- 3.8.2 Implementation of cost components

- 3.8.3 Ongoing operational costs

- 3.8.4 Indirect customer costs

- 3.9 Patent analysis

- 3.10 Business models & monetization

- 3.10.1 Capex sale vs SaaS / managed services models

- 3.10.2 Revenue streams (transaction fees, data services, ads)

- 3.10.3 Hybrid commercial structures

- 3.11 Case studies & reference deployments

- 3.11.1 Large-metro success stories

- 3.11.2 Cost-sensitive / QR-first deployments

- 3.11.3 Lessons learned and common pitfalls

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook and opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Smart card readers

- 5.2.2 Ticket vending machines (TVMs)

- 5.2.3 Fare gates/turnstiles

- 5.2.4 Point-of-sale terminals

- 5.2.5 Mobile/handheld validators

- 5.3 Software

- 5.3.1 Ticketing & fare management software

- 5.3.2 Mobile ticketing apps

- 5.3.3 Real-time passenger information software

- 5.3.4 Revenue management systems

- 5.3.5 CRM & analytics platforms

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Ticketing Technology, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Smartcards

- 6.3 Mobile ticketing

- 6.4 QR code/barcode tickets

- 6.5 Open-loop payment systems

- 6.6 Biometric ticketing

- 6.7 Wearable ticketing

Chapter 7 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Open system

- 7.3 Closed system

Chapter 8 Market Estimates & Forecast, By Deployment, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 On-premise

- 8.3 Cloud

Chapter 9 Market Estimates & Forecast, By Connectivity, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 RFID

- 9.3 Barcode

- 9.4 Near-field Communication (NFC)

- 9.5 Cellular Network

- 9.6 Wi-Fi

Chapter 10 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Parking

- 10.3 Sports & Entertainment

- 10.4 Transportation

- 10.4.1 Roadways

- 10.4.2 Railways

- 10.4.3 Airways

- 10.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Thailand

- 11.4.7 Indonesia

- 11.4.8 Singapore

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Leaders

- 12.1.1 Conduent

- 12.1.2 Cubic

- 12.1.3 Thales

- 12.1.4 Siemens

- 12.1.5 Giesecke+Devrient (G+D)

- 12.1.6 HID Global

- 12.1.7 NXP Semiconductors

- 12.1.8 Infineon Technologies

- 12.1.9 Idemia

- 12.1.10 Verimatrix

- 12.1.11 SITA

- 12.2 Regional Champions

- 12.2.1 CPI Card

- 12.2.2 Confidex

- 12.2.3 TCN Technology

- 12.2.4 Telvent GIT

- 12.2.5 Xerox

- 12.2.6 Scheidt & Bachmann

- 12.2.7 Flowbird

- 12.2.8 Masabi

- 12.2.9 Ridango

- 12.3 Emerging Players

- 12.3.1 Etickets

- 12.3.2 Littlepay

- 12.3.3 FAIRTIQ

- 12.3.4 Snapper Services

- 12.3.5 Eventbrite