PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698556

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698556

Car Audio Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

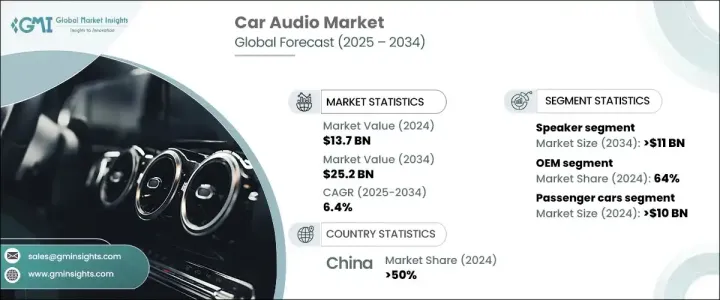

The Global Car Audio Market was valued at USD 13.7 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. The rising adoption of electric vehicles (EVs) creates new opportunities within this sector. As EVs reduce engine noise, they offer a unique acoustic environment that opens the door for innovative audio technologies. Manufacturers are developing solutions to replace traditional engine sounds and enhance the auditory experience within the vehicle.

Consumers are increasingly prioritizing high-quality sound, influenced by the advancements in home and personal audio systems. As a result, car buyers are looking for audio systems that offer immersive, theater-like experiences similar to their home setups. For many, audio quality has become a decisive factor when purchasing a vehicle, particularly among younger generations such as millennials and Gen Z. Features such as spatial audio, high-resolution streaming, and customizable acoustic settings are becoming vital components in car audio systems. To meet these demands, both automotive and aftermarket manufacturers are investing heavily in these technologies to transform vehicles into premium sound environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 billion |

| Forecast Value | $25.2 Billion |

| CAGR | 6.4% |

The car audio market is segmented by components, which include speakers, amplifiers, digital signal processors (DSP), microphones, and tuners. In 2024, speakers accounted for a 45% share, and this segment is expected to generate USD 11 billion by 2034. Manufacturers are enhancing speaker performance with innovative materials such as carbon fiber, aramid fiber, and ceramic-infused polymers. These materials provide increased rigidity, lighter weight, and superior sound transmission, ensuring longevity and reliability under demanding conditions within vehicles, such as temperature fluctuations and vibrations.

Sales channels in the car audio market are divided into OEM (original equipment manufacturer) and aftermarket categories. The OEM segment is projected to generate USD 16 billion by 2034. Automotive companies are focusing on creating advanced audio systems that elevate the in-vehicle sound experience. These systems use cutting-edge audio processing technologies, including object-based sound that generates 3D soundscapes, adapting to passenger positioning and the vehicle's dynamics. Advanced algorithms in these systems allow for precise sound staging, delivering an acoustically immersive environment similar to a concert hall within the vehicle cabin.

Chinese car audio market accounted for a 50% share in 2024. Manufacturers in China are customizing audio systems to align with local preferences and listening habits. Technologies such as machine learning are used to tailor sound profiles, while regional language voice assistants and culturally relevant content differentiate these systems from global competitors. Acoustic designs are also optimized to suit the unique urban sound environments in Chinese cities, offering an enhanced listening experience for local consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Car audio system manufacturers

- 3.2.3 Software providers

- 3.2.4 Technology integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology differentiators

- 3.4.1 High-resolution audio technology

- 3.4.2 Wireless audio solutions

- 3.4.3 Smart connectivity

- 3.4.4 Advanced amplification systems

- 3.4.5 Others

- 3.5 Key news & initiatives

- 3.6 Cost breakdown analysis

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising consumer demand for premium audio experience

- 3.9.1.2 Integrated connectivity of audio devices with vehicles

- 3.9.1.3 Consumer demand for personalized audio experiences

- 3.9.1.4 Advancements in sound technologies

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Increasing consumer price sensitivity

- 3.9.2.2 Cybersecurity and data privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Speaker

- 5.2.1 2-way

- 5.2.2 3-way

- 5.2.3 4-way

- 5.3 Amplifiers

- 5.4 DSP

- 5.5 Microphone

- 5.6 Tuners

Chapter 6 Market Estimates & Forecast, By Sound Management, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Voice recognition

- 6.3 Manual

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.2.1 Speaker

- 8.2.2 Amplifier

- 8.2.3 DSP

- 8.2.4 Microphone

- 8.2.5 Tuners

- 8.3 Aftermarket

- 8.3.1 Speaker

- 8.3.2 Amplifier

- 8.3.3 DSP

- 8.3.4 Microphone

- 8.3.5 Tuners

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpine Electronics

- 10.2 ASK Industries

- 10.3 Bose

- 10.4 Bowers & Wilkins

- 10.5 Clarion

- 10.6 Continental Aktiengesellschaft

- 10.7 Dynaudio

- 10.8 Focal JMLAB

- 10.9 Harman

- 10.10 JL Audio

- 10.11 JVC KENWOOD

- 10.12 KICKER (Stillwater Designs and Audio)

- 10.13 Nippon Audiotronix

- 10.14 NXP Semiconductors

- 10.15 Panasonic

- 10.16 Pioneer

- 10.17 Premium Sound Solutions

- 10.18 Rockford

- 10.19 Sony

- 10.20 ST Microelectronics