PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698544

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698544

Soft Robotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

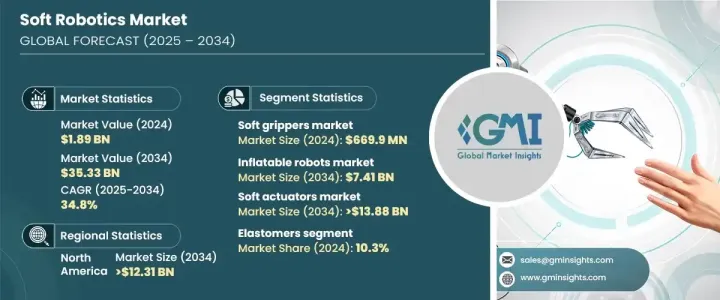

The Global Soft Robotics Market size was valued at USD 1.89 billion in 2024 and is projected to reach USD 35.33 billion by 2034, growing at a CAGR of 34.8% from 2025 to 2034. The rising demand for automation and the expansion of the healthcare and hospitality industries are fueling this growth. Industries are integrating soft robotics to enhance automation, enabling robots to perform complex tasks across various sectors. The increasing adoption of soft robots in healthcare, logistics, and manufacturing is contributing to market expansion, driven by their ability to handle delicate objects with precision and efficiency.

In the healthcare sector, a growing aging population and labor shortages are accelerating the demand for robotic automation. The industry is turning to soft robotics to streamline operations, automate repetitive tasks, and improve patient care. These robots can assist in rehabilitation, perform delicate surgical procedures, and support medical professionals by enhancing operational efficiency. Similarly, the hospitality industry is integrating automation for service delivery, improving efficiency while reducing operational costs. The logistics sector is also adopting soft robotics to optimize supply chain management, automate inventory handling, and enhance overall productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.89 Billion |

| Forecast Value | $35.33 Billion |

| CAGR | 34.8% |

Soft robotics is segmented by type into soft grippers, inflatable robots, exoskeletons, and wearables. Soft grippers, widely used in industrial automation, agriculture, and healthcare, offer a flexible solution for handling delicate items. The market for soft grippers is valued at USD 669.9 million in 2024, driven by increasing adoption in warehouses and manufacturing facilities. The development of advanced sensory feedback, vision systems, and enhanced designs is further improving their efficiency and versatility. Inflatable robots, valued at over USD 7.41 billion by 2034, are gaining traction due to their lightweight and adaptable structure, making them ideal for medical applications, disaster response, and space exploration.

By component, the market includes soft actuators, sensors, control systems, and power sources. The soft actuators segment is set to exceed USD 13.88 billion by 2034, driven by the need for automation in healthcare, logistics, and agriculture. Soft sensors accounted for 25.7% of the market in 2024, playing a crucial role in AI-based automation and tactile sensing technologies. Control systems, valued at over USD 5.7 billion by 2034, integrate AI and machine learning for enhanced autonomy in robotic operations. Power sources, also holding a 25.7% market share in 2024, are evolving with innovations in compact and efficient energy solutions.

The market is further segmented by material, including elastomers, gels, and fabrics. Elastomers held a 10.3% market share in 2024, offering high flexibility and resilience for robotic applications. Gel-based robots, which adapt to stimuli such as heat and electricity, are gaining popularity in biomedical and pharmaceutical applications. Fabric-integrated soft robotics are advancing wearable technology, making them ideal for assistive medical devices and adaptive clothing.

Applications span healthcare, food and logistics, automotive, and agriculture. The healthcare sector, projected to grow at a CAGR of 35.2% from 2025 to 2034, is leveraging soft robotics for prosthetics, mobility assistance, and surgical procedures. The food and beverage sector, set to reach over USD 11.78 billion by 2034, is implementing automation for processing, packaging, and quality control. Logistics, with a CAGR of 33.8%, is optimizing warehouse operations through AI-integrated robotic solutions. The automotive industry, anticipated to surpass USD 3.6 billion by 2034, uses soft robotics for precision assembly, painting, and quality inspections. Agriculture, growing at a CAGR of 31.3%, is adopting robotic solutions for harvesting, pest control, and precision farming.

Geographically, North America is projected to reach over USD 12.31 billion by 2034, driven by regulatory support and technological advancements. The U.S. market, expected to exceed USD 10.22 billion, is leading innovations in automation, with strong government support and funding for research and development in robotics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for automation

- 3.2.1.2 Advancements in material science

- 3.2.1.3 Growth in the hospitality and healthcare industries

- 3.2.1.4 Growing interest in human-robot collaborations

- 3.2.1.5 Environmental sustainability

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited durability and strength

- 3.2.2.2 Data security and privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Mn)

- 5.1 Key trends

- 5.2 Soft grippers

- 5.3 Inflatable robots

- 5.4 Exoskeletons

- 5.5 Wearables

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Mn)

- 6.1 Key trends

- 6.2 Soft actuators

- 6.3 Soft sensors

- 6.4 Control systems

- 6.5 Power sources

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Mn)

- 7.1 Key trends

- 7.2 Elastomers

- 7.3 Gels

- 7.4 Fabrics

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Mn)

- 8.1 Key trends

- 8.2 Medical and healthcare

- 8.3 Food and beverages

- 8.4 Logistics

- 8.5 Automotive

- 8.6 Agriculture

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Soft Robotics Inc. (Schmalz)

- 10.2 Festo AG

- 10.3 ReWalk Robotics

- 10.4 Yaskawa Electric Corporation

- 10.5 ABB Group

- 10.6 Kawada Robotics

- 10.7 Techman Robot Inc.

- 10.8 Permanently closed

- 10.9 Righthand Robotics

- 10.10 Fanuc Corporation

- 10.11 Universal Robots

- 10.12 Cyberdyne Inc.

- 10.13 Beijing Soft Robotics Technology Co.,

- 10.14 OnRobot A/S

- 10.15 Empire Robotics

- 10.16 iCobots

- 10.17 Pneubotics Inc.

- 10.18 Squishy Robotics

- 10.19 embotech GmbH

- 10.20 SpectroPlast

- 10.21 Somnox