PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698535

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698535

U.S. Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

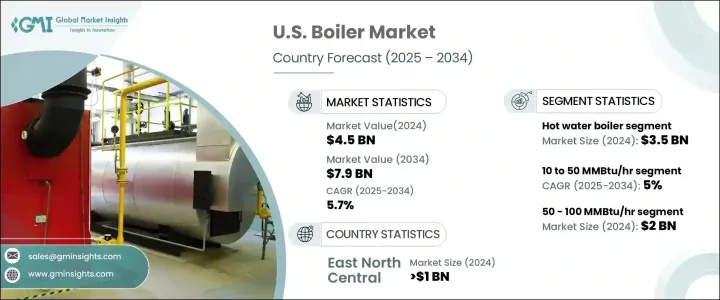

U.S. Boiler Market was valued at USD 4.5 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. Increasing concerns about carbon emissions and the replacement of outdated steam-generating units with energy-efficient boilers will drive market expansion. Aging infrastructure and the push for sustainable solutions are accelerating the demand for modern systems. Investments in manufacturing and the adoption of advanced boilers will align with decarbonization policies, while stricter environmental regulations will support the industry's progression.

Government initiatives and industrial policies are reinforcing market dynamics, emphasizing cleaner energy use and efficiency improvements. The shift toward low-emission heating solutions, including biofuel-compatible boilers, aligns with sustainability objectives. The market will benefit from the expansion of district heating networks and ongoing replacements of obsolete units. Private and public sector efforts to enhance manufacturing and commercial facilities contribute to a robust business environment. Federal initiatives focusing on industrial growth and energy efficiency reinforce the market outlook. The decline in coal-fired power generation in favor of cleaner energy sources has also influenced carbon reduction efforts, enhancing demand for efficient boiler technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 5.7% |

By capacity, the market includes segments ranging from 0.3 to over 250 MMBtu/hr. Boilers in the 0.3 to 2.5 MMBtu/hr range are widely used in commercial spaces like hotels, offices, schools, and retail centers due to their affordability, quick installation, and ease of maintenance. The 2.5 to 10 MMBtu/hr segment is witnessing steady demand driven by increasing floor space in commercial buildings and technological upgrades in heating systems.

Medium-capacity boilers between 10 and 50 MMBtu/hr will expand at a 5% CAGR through 2034, fueled by applications in food processing, chemical production, and refineries. Systems in the 50 to 100 MMBtu/hr range, valued at USD 2 billion in 2024, are set for significant growth as demand increases in sectors such as metal manufacturing, paper production, and industrial processing. High-capacity units ranging from 100 to 250 MMBtu/hr are gaining traction in steel mills, petrochemical plants, and food processing facilities. The largest category, exceeding 250 MMBtu/hr, is seeing increased adoption due to stringent emissions regulations and cost-effective heating solutions.

Technological advancements are shaping market trends, with condensing boiler technology expected to witness a CAGR of over 9% through 2034. These units enhance efficiency by cooling steam to condense water vapors, optimizing fuel consumption. In contrast, traditional non-condensing boilers remain a preferred choice for industrial space and water heating due to their cost advantages and reliability.

Regulatory measures aimed at achieving net-zero emissions by 2050 are driving industries to transition from fossil fuel-based heating to electrified alternatives. The growing need for space heating, cold climate conditions, and infrastructure upgrades are reinforcing the demand for steam boilers. Rising investments in industrial expansion and compliance with energy efficiency standards further bolster market growth. Hot water boiler demand, estimated at USD 3.5 billion in 2024, is increasing across commercial facilities as businesses replace legacy systems to meet sustainability benchmarks. Regional markets such as East North Central and West South Central are witnessing notable growth due to policy-driven energy transitions and expanding industrial development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic outlook

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 0.3 - 2.5 MMBtu/hr

- 6.3 2.5 - 10 MMBtu/hr

- 6.4 10 - 50 MMBtu/hr

- 6.5 50 - 100 MMBtu/hr

- 6.6 100 - 250 MMBtu/hr

- 6.7 > 250 MMBtu/hr

Chapter 7 Market Size and Forecast, By Technology (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Product (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Application (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Commercial

- 9.2.1 Offices

- 9.2.2 Healthcare facilities

- 9.2.3 Educational institutions

- 9.2.4 Lodgings

- 9.2.5 Retail stores

- 9.2.6 Others

- 9.3 Industrial

- 9.3.1 Food processing

- 9.3.2 Pulp & paper

- 9.3.3 Chemical

- 9.3.4 Refining

- 9.3.5 Primary metal

- 9.3.6 Others

Chapter 10 Market Size and Forecast, By Region (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 East North Central

- 10.2.1 Illinois

- 10.2.2 Indiana

- 10.2.3 Michigan

- 10.2.4 Ohio

- 10.2.5 Wisconsin

- 10.3 West South Central

- 10.3.1 Arkansas

- 10.3.2 Louisiana

- 10.3.3 Oklahoma

- 10.3.4 Texas

- 10.4 South Atlantic

- 10.4.1 Delaware

- 10.4.2 Florida

- 10.4.3 Georgia

- 10.4.4 Maryland

- 10.4.5 North Carolina

- 10.4.6 South Carolina

- 10.4.7 Virginia

- 10.4.8 West Virginia

- 10.4.9 Washington D.C.

- 10.5 North East

- 10.5.1 Connecticut

- 10.5.2 Maine

- 10.5.3 Massachusetts

- 10.5.4 New Hampshire

- 10.5.5 Rhode Island

- 10.5.6 Vermont

- 10.5.7 New Jersey

- 10.5.8 New York

- 10.5.9 Pennsylvania

- 10.6 East South Central

- 10.6.1 Kentucky

- 10.6.2 Alabama

- 10.6.3 Mississippi

- 10.6.4 Tennessee

- 10.7 West North Central

- 10.7.1 Kansas

- 10.7.2 Iowa

- 10.7.3 Missouri

- 10.7.4 Minnesota

- 10.7.5 North Dakota

- 10.7.6 Nebraska

- 10.7.7 South Dakota

- 10.8 Pacific States

- 10.8.1 California

- 10.8.2 Alaska

- 10.8.3 Oregon

- 10.8.4 Hawaii

- 10.8.5 Washington

- 10.9 Mountain States

- 10.9.1 Colorado

- 10.9.2 Arizona

- 10.9.3 Nevada

- 10.9.4 Utah

- 10.9.5 Idaho

- 10.9.6 New Mexico

- 10.9.7 Montana

- 10.9.8 Wyoming

Chapter 11 Company Profiles

- 11.1 A.O. Smith

- 11.2 AERCO

- 11.3 Babcock & Wilcox Enterprises, Inc.

- 11.4 Bradford White Corporation, USA

- 11.5 Burnham Commercial Boilers

- 11.6 Clayton Industries

- 11.7 Cleaver-Brooks

- 11.8 Columbia Boiler Company

- 11.9 Energy Kinetics

- 11.10 Fulton

- 11.11 General Electric

- 11.12 HTP

- 11.13 Hurst Boiler & Welding Co., Inc.

- 11.14 Lennox International Inc.

- 11.15 Miura America Co., LTD.

- 11.16 P.M. Lattner Manufacturing Co.

- 11.17 Parker Boiler

- 11.18 PB Heat, LLC

- 11.19 Precision Boilers

- 11.20 Rentech Boiler Systems, Inc.

- 11.21 IHI Corporation

- 11.22 Thermal Solutions LLC

- 11.23 U.S. Boiler Company, LLC

- 11.24 Victory Energy Operations

- 11.25 WM Technologies LLC