PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698525

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698525

Water Recycle and Reuse Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

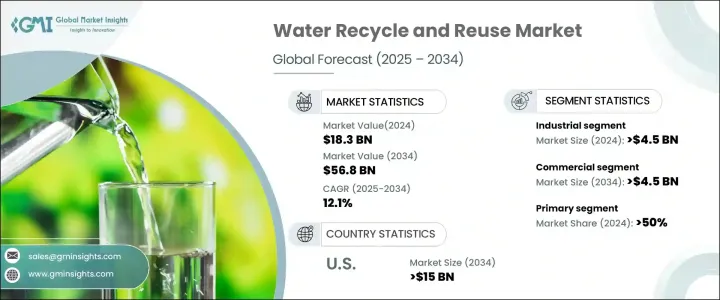

The Global Water Recycle And Reuse Market was valued at USD 18.3 billion in 2024 and is projected to grow at a CAGR of 12.1% from 2025 to 2034. Rising demand for freshwater, driven by rapid population growth, climate change, and urbanization, is pushing industries, municipalities, and the agricultural sector to invest in water recycling solutions. Governments worldwide are enforcing strict water conservation policies and promoting advanced reclamation and treatment technologies, strengthening market growth.

Ongoing advancements in membrane bioreactors, ultraviolet disinfection, filtration, and reverse osmosis are making water recycling systems more cost-effective and efficient, further stimulating demand. The increasing shift toward sustainable water solutions to reduce dependence on natural water sources is also contributing to market expansion. Industries such as food and beverage processing, oil and gas, power generation, and manufacturing, which require large volumes of water to maintain operational efficiency, are key drivers of market development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.3 Billion |

| Forecast Value | $56.8 Billion |

| CAGR | 12.1% |

The market is segmented by technology into primary, secondary, and tertiary treatment systems. The primary segment accounted for over 50% of revenue in 2024, supported by regulatory compliance and increasing global water stress. The adoption of desalination and zero-liquid discharge solutions by industries aiming to meet environmental standards and improve resource efficiency is driving market penetration.

The industrial sector reached USD 4.5 billion in 2024 and is projected to exceed USD 15 billion by 2034, with companies focusing on modular and scalable on-site recycling systems to reduce reliance on municipal water supplies. The need for consistent water quality and high-purity water in pharmaceutical, food processing, petrochemical, and semiconductor industries is a key factor influencing market dynamics. The agricultural sector, valued at USD 3.5 billion in 2024, is experiencing increased adoption of water recycling solutions due to climate change, groundwater depletion, and unpredictable rainfall patterns. Technologies such as filtration, UV disinfection, and reverse osmosis are ensuring safe and effective agricultural wastewater reuse.

The residential segment held a 14% revenue share in 2024, with homeowners investing in water reuse technologies to minimize waste and optimize water supply for daily use. Recycling systems for non-potable applications, including laundry, showers, and rainwater reuse, are gaining popularity. The commercial segment is set to exceed USD 4.5 billion by 2034, as water reuse systems are increasingly implemented in hospitals, shopping centers, hotels, office buildings, and other commercial establishments. Government incentives, tax benefits, and federal grants are further supporting this trend.

Municipal water recycling held a 28.9% market share in 2024, with urbanization and stringent wastewater regulations promoting the adoption of sewage treatment and water procurement technologies. Cities are integrating these solutions to reduce operational costs and enhance infrastructure. The U.S. market was valued at USD 6.9 billion in 2024 and is anticipated to surpass USD 15 billion by 2034, as municipalities and industries seek sustainable solutions to address water scarcity, infrastructure challenges, and climate-related concerns. The region's dependence on groundwater and prolonged droughts are fueling the adoption of recycled water plants.

North America is expected to grow at a CAGR of over 10% through 2034, with increasing emphasis on ESG strategies, water conservation, and advanced filtration technologies. Governments are offering incentives and funding R&D initiatives to promote sustainable water reuse solutions, driving overall market momentum.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Primary

- 5.2.1 Microfiltration (MF)

- 5.2.2 Ultrafiltration (UF)

- 5.2.3 Nanofiltration (NF)

- 5.2.4 Reverse Osmosis (RO)

- 5.2.5 Desalination

- 5.3 Secondary

- 5.3.1 Advanced Oxidation Processes (AOP)

- 5.3.2 Disinfection

- 5.3.3 Chemical coagulation and flocculation

- 5.3.4 Membrane Bioreactors (MBRs)

- 5.3.5 Granular Activated Carbon (GAC) filtration

- 5.3.6 Ion exchange

- 5.3.7 Biological treatment

- 5.4 Tertiary

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Industrial

- 6.3 Agriculture

- 6.4 Residential

- 6.5 Commercial

- 6.6 Municipal

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 Saudi Arabia

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

Chapter 8 Company Profiles

- 8.1 3M

- 8.2 ABB

- 8.3 American Water

- 8.4 Aquatech

- 8.5 BASF

- 8.6 Dow

- 8.7 Ecolab

- 8.8 Hitachi

- 8.9 Kurita Water Industries

- 8.10 MANN+HUMMEL

- 8.11 OVIVO

- 8.12 Pentair

- 8.13 Siemens

- 8.14 SUEZ

- 8.15 Triveni Engineering & Industries

- 8.16 Trojan Technologies Group

- 8.17 Veolia

- 8.18 Xylem