PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698510

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698510

Interface IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

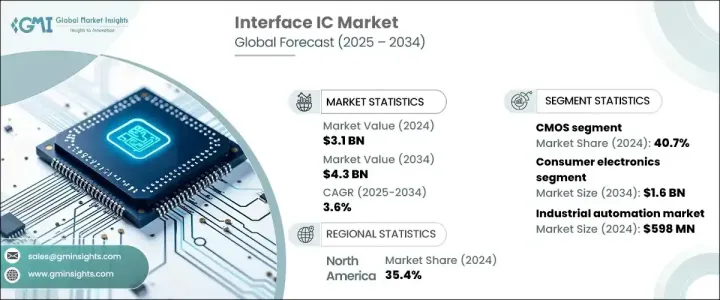

The Global Interface IC Market continues to reach a valuation of USD 3.1 billion in 2024 and is projected to grow at a CAGR of 3.6% between 2025 and 2034. Increasing demand for seamless connectivity, high-speed data transmission, and energy-efficient electronic systems is driving expansion across key industries. As technological advancements accelerate, interface ICs are becoming essential components in next-generation devices, optimizing real-time data exchange and enhancing overall system performance. The increasing adoption of digital transformation, automation, and connected devices is further fueling the need for advanced interface IC solutions.

The rising penetration of interface ICs in automotive applications is a significant growth factor, particularly with the rapid shift toward electric vehicles (EVs) and autonomous driving technology. These components play a critical role in managing electronic communication and safety systems, ensuring reliable and efficient data transmission within vehicle networks. The expansion of advanced driver assistance systems (ADAS) and the integration of high-performance infotainment solutions further underscore the growing importance of interface ICs in the automotive sector. Additionally, industrial automation and smart manufacturing processes continue to drive demand as businesses seek to improve operational efficiency and reduce energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 3.6% |

Another major driver shaping the interface IC market is the increasing reliance on high-speed data transmission technologies. With the proliferation of smart home automation, Internet of Things (IoT) devices, and high-resolution displays, there is a greater need for efficient signal integrity and low-power consumption solutions. Industries such as telecommunications, consumer electronics, and industrial automation rely heavily on interface ICs to ensure smooth data flow across multiple systems, enabling advanced functionalities and enhanced connectivity. As industries transition toward 5G networks and AI-powered systems, the adoption of high-performance interface ICs is set to rise significantly.

In terms of technology, the market is segmented into CMOS, Bipolar, and BiCMOS interface ICs. CMOS technology led the segment in 2024, holding a 40.7% market share, primarily due to its widespread application in consumer electronics, automotive, and industrial automation. The segment accounted for USD 1.2 billion in 2023, driven by its cost-effectiveness, low power consumption, and high-speed data transfer capabilities. As manufacturers prioritize energy efficiency and compact design, the demand for CMOS-based interface ICs continues to surge.

By end-user, the market is categorized into consumer electronics, automotive, industrial automation, telecommunications, and others. Consumer electronics is anticipated to generate USD 1.6 billion by 2034, maintaining its strong position as a key driver of market growth. In 2024, this segment accounted for 36.2% of the global interface IC market. The increasing adoption of smart home automation, growing demand for high-resolution OLED and AMOLED displays, and the expanding use of connected devices contribute to the segment's expansion. With the proliferation of wearables, wireless charging solutions, and next-generation display technologies, the role of interface ICs in consumer electronics remains pivotal.

The United States interface IC market reached USD 843.1 million in 2024, driven by robust demand for ADAS-equipped vehicles and EVs. Increased investment in digital transformation and industrial automation is accelerating market expansion. With the rapid evolution of electronic systems and the growing need for efficient data transfer, the adoption of interface ICs continues to rise across multiple industries. The strong presence of semiconductor manufacturers and continuous advancements in communication technologies further reinforce the market growth trajectory in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of consumer electronics

- 3.2.1.2 Advancements in automotive technology

- 3.2.1.3 Growth in industrial automation

- 3.2.1.4 Expansion of telecommunication infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rapid technological advancements

- 3.2.2.2 Integration and compatibility issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type of Interface, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 Mixed-Signal

Chapter 6 Market Estimates and Forecast, By Interface Standard, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Serial

- 6.3 Parallel

- 6.4 High-Speed

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CMOS

- 7.3 Bipolar

- 7.4 BiCMOS

Chapter 8 Market Estimates and Forecast, By End-Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Industrial automation

- 8.5 Telecommunications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Allegro Microsystems

- 10.2 Analog Devices, Inc.

- 10.3 Broadcom Inc.

- 10.4 Cirrus Logic, Inc.

- 10.5 Diodes Incorporated

- 10.6 Elmos Semiconductor SE

- 10.7 IBS Electronic Group

- 10.8 Ivelta

- 10.9 Mouser Electronics, Inc.

- 10.10 Nuvoton Technology Corporation

- 10.11 NXP Semiconductors N.V.

- 10.12 ON Semiconductor Corporation

- 10.13 Renesas Electronics Corporation

- 10.14 ROHM Semiconductor

- 10.15 SEIKO Epson Corporation

- 10.16 Silicon Labs

- 10.17 STMicroelectronics N.V.

- 10.18 Symmetry Electronics

- 10.19 Texas Instruments Incorporated

- 10.20 Toshiba Corporation