PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698339

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698339

AI in Telecommunication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

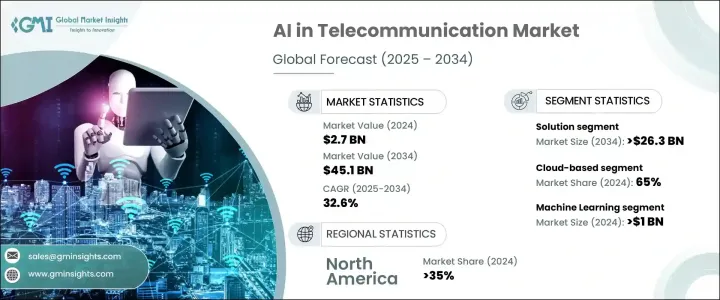

The Global AI In Telecommunication Market, valued at USD 2.7 billion in 2024, is on track to expand at a CAGR of 32.6% from 2025 to 2034. AI-driven solutions are revolutionizing network operations, customer service, and infrastructure management within the telecom industry. The integration of AI with telecom networks and 5G technology enhances automation, real-time analysis, and anomaly detection. With AI, spectrum control improves, ensuring optimized bandwidth management and reduced latency in high-traffic areas. AI-powered fraud detection systems mitigate cybersecurity risks, helping telecom providers safeguard their networks and finances. AI is also transforming customer interactions, as chatbots and digital assistants streamline responses and reduce the need for human intervention. AI-driven natural language processing (NLP) tools allow for automated issue resolution, enhancing customer satisfaction while cutting operational costs.

The market is segmented based on components into solutions and services. The solutions segment, valued at USD 1.7 billion in 2024, is projected to surpass USD 26.3 billion by 2034. AI is widely applied in business process automation, fraud detection, and network performance monitoring, increasing efficiency and security across telecom operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $45.1 Billion |

| CAGR | 32.6% |

Telecom providers rely on AI-powered fraud detection tools to combat security threats. Machine learning algorithms automatically detect and prevent fraudulent activities, ensuring compliance with regulatory standards while minimizing financial losses. AI-driven automation strengthens service response, improving network security and reliability.

Customer service within the telecom sector has seen significant improvements with AI-powered chatbots and virtual assistants. By automating services using NLP, telecom companies handle inquiries faster and resolve issues without human intervention. This automation not only reduces costs but also strengthens brand loyalty. AI also plays a crucial role in streamlining customer interactions by learning from past engagements to personalize responses and improve service quality.

The market is further segmented by deployment models into cloud-based and on-premises solutions. Cloud-based AI dominated with a 65% share in 2024 and is expected to grow substantially throughout the forecast period. The scalability, flexibility, and cost efficiency of cloud computing enable telecom providers to integrate AI without heavy infrastructure investments, accelerating adoption across the industry.

Private AI implementations remain a preferred choice for telecom companies handling sensitive customer data, ensuring better control over security, compliance, and data privacy. Many telecom firms are deploying private AI models to adhere to industry-specific regulations and enhance network efficiency.

AI-as-a-Service (AIaaS) is gaining traction among telecom operators, providing access to data-driven insights without the need for in-house development teams. The AIaaS market, valued at USD 9.7 billion in 2024, is expected to grow at a CAGR of over 33% through 2032. This model allows smaller telecom firms to leverage AI-driven business intelligence solutions at reduced costs.

AI-driven edge computing is optimizing network performance by enabling real-time data processing at the network edge. This innovation reduces latency, improves bandwidth management, and ensures seamless operations even during peak traffic loads, enhancing mobile and broadband services.

The AI in telecommunication market is segmented by applications, including machine learning, NLP, and deep learning. The machine learning segment, valued at over USD 1 billion in 2024, dominates due to its role in predictive maintenance, network optimization, and fraud detection. AI-based machine learning models help telecom companies improve service reliability by reducing network failures.

NLP is transforming customer service automation by allowing AI systems to analyze and respond to user queries based on previous interactions, leading to higher retention rates. The NLP market, valued at USD 5.5 billion in 2023, is expected to grow over 25% from 2024 to 2032.

Deep learning is increasingly used for speech recognition and automated call routing, enabling more efficient customer service operations. AI-driven speech-to-text solutions improve accessibility for people with disabilities while enhancing content indexing and retrieval within telecom systems.

AI automation is also improving administrative telecom network management by monitoring system performance, predicting failures, and allocating resources to maximize efficiency. The rise in smartphone users, projected to reach 7.7 billion by 2028, highlights the growing need for AI-powered telecom solutions.

North America leads the AI in telecommunication market, holding over 35% of the share in 2024. The US remains at the forefront, with major t

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform provider

- 3.2.2 Technology integrators

- 3.2.3 Distributors

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Used cases

- 3.6.1 Used case 1

- 3.6.1.1 Benefits

- 3.6.1.2 ROI

- 3.6.2 Used case 2

- 3.6.2.1 Benefits

- 3.6.2.2 ROI

- 3.6.1 Used case 1

- 3.7 Case study

- 3.7.1 Case study 1

- 3.7.1.1 Consumer name

- 3.7.1.2 Challenge

- 3.7.1.3 Solution

- 3.7.1.4 Impact

- 3.7.2 Case study 1

- 3.7.2.1 Consumer name

- 3.7.2.2 Challenge

- 3.7.2.3 Solution

- 3.7.2.4 Impact

- 3.7.1 Case study 1

- 3.8 Pricing trend analysis

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising AI adoption for network automation and customer service

- 3.11.1.2 Integration of AI with 5G technology

- 3.11.1.3 Increasing demand for predictive analytics in telecom

- 3.11.1.4 Expansion of AI-driven cybersecurity solutions

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Data privacy and security concerns

- 3.11.2.2 High initial investment costs

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Machine Learning (ML)

- 7.3 Natural Language Processing (NLP)

- 7.4 Deep Learning

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Network optimization

- 8.3 Network security

- 8.4 Customer analytics

- 8.5 Virtual assistants

- 8.6 Fraud detection

- 8.7 Predictive maintenance

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Accenture

- 10.2 Amazon Web Services (AWS)

- 10.3 Amdocs

- 10.4 AT&T

- 10.5 Baidu

- 10.6 Cisco Systems

- 10.7 Ericsson

- 10.8 Google

- 10.9 Hewlett Packard Enterprise (HPE)

- 10.10 IBM

- 10.11 Intel

- 10.12 Microsoft

- 10.13 NEC

- 10.14 Nokia

- 10.15 NVIDIA

- 10.16 Oracle

- 10.17 Qualcomm

- 10.18 Salesforce

- 10.19 Samsung Electronics

- 10.20 ZTE