PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698328

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698328

Asset Performance Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

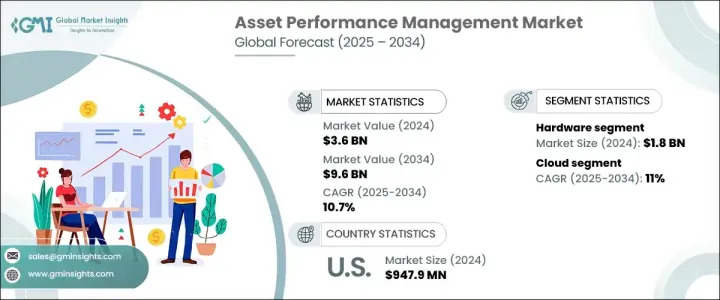

The Global Asset Performance Management Market, valued at USD 3.6 billion in 2024, is anticipated to expand at a CAGR of 10.7% from 2025 to 2034. The increasing adoption of predictive maintenance and IoT technologies is fueling this growth. Organizations are leveraging predictive maintenance to monitor asset conditions in real time, enabling them to detect potential failures before they occur. The integration of IoT with asset management solutions allows businesses to collect and analyze real-time data, helping improve efficiency, reduce operational costs, and extend asset lifespan.

Businesses are prioritizing operational efficiency and cost reduction, prompting them to optimize production models while maintaining minimal expenses. Advanced asset management solutions provide real-time monitoring and analytics to identify inefficiencies and underperforming assets. Companies can take proactive steps to reduce downtime and maintenance costs, ultimately improving asset reliability and resource allocation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 10.7% |

The market is segmented by components into hardware, software, and services. In 2024, hardware accounted for USD 1.8 billion in revenue, while software is projected to grow at a CAGR of approximately 12% by 2034. The rising adoption of advanced sensor technologies is driving hardware demand. Industries across various sectors are focused on extending asset life cycles, necessitating real-time monitoring and predictive maintenance. High-quality sensors are becoming crucial for tracking key performance parameters such as temperature, vibration, and pressure. IoT-enabled sensors further enhance asset monitoring by enabling seamless data collection and real-time diagnostics. Additionally, the advancement of wireless communication technologies, such as 5G, is improving sensor efficiency by facilitating data transmission over long distances.

The market is also categorized by deployment model into on-premises and cloud-based solutions. The cloud segment accounted for approximately 60% of the market share in 2024 and is expected to grow at a CAGR of 11% from 2025 to 2034. Cloud-based solutions offer real-time data analytics and predictive maintenance without requiring extensive on-premises infrastructure. They lower traditional software installation costs while providing scalability. Businesses benefit from collaborative monitoring and remote access, making cloud solutions particularly valuable for enterprises with geographically dispersed operations. These solutions also provide secure data storage and analytics capabilities essential for managing large volumes of asset data, enabling industries to improve operational efficiency, minimize downtime, and lower costs.

By end use, the market is segmented into manufacturing, transportation, chemical and pharmaceutical, oil & gas, energy & utility, mining, and others. Manufacturing leads the market due to the growing need for operational efficiency and asset optimization. Manufacturers rely on complex machinery, making real-time monitoring and predictive analytics crucial for minimizing downtime and maintaining smooth operations. Industry 4.0 is driving automation, IoT integration, and digitalization, increasing demand for APM solutions to enhance asset visibility and control. As manufacturing processes become more sophisticated, intelligent data-driven solutions are critical for improving productivity and reducing operational costs.

North America dominates the global asset performance management market with a 35% share, with the United States generating USD 947.9 million in revenue in 2024. The widespread adoption of Industry 4.0 is a significant driver of growth, as companies increasingly invest in IoT, automation, and advanced data analytics. Asset performance management solutions enable real-time condition monitoring, maintenance forecasting, and reduced unplanned downtime, making them vital in industries like manufacturing, oil & gas, and utilities, where equipment reliability directly impacts profitability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution providers

- 3.1.2 Service providers

- 3.1.3 Technology providers

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Patent landscape

- 3.5 Parent & child market analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for predictive maintenance to minimize downtime

- 3.9.1.2 Increased focus on operational efficiency and cost reduction

- 3.9.1.3 Adoption of IoT sensors and smart devices for real-time monitoring

- 3.9.1.4 Integration of AI and machine learning for advanced analytics and insights

- 3.9.2 Industry pitfalls & challenges

- 3.9.3 High initial implementation costs and resource requirements

- 3.9.4 Data integration challenges across legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud-Based

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small and Medium-Sized Enterprises (SME)

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Transportation

- 8.4 Chemical and pharmaceutical

- 8.5 Oil & Gas

- 8.6 Energy & Utility

- 8.7 Mining

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Asset strategy management

- 9.3 Performance monitoring

- 9.4 Risk management

- 9.5 Maintenance management

- 9.6 Asset lifecycle management

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Applied Materials

- 11.3 AVEVA Group

- 11.4 Bentley Systems

- 11.5 CGI Group

- 11.6 Emerson Electric

- 11.7 General Electric (GE)

- 11.8 Honeywell International

- 11.9 IBM

- 11.10 Infosys

- 11.11 Ivalua

- 11.12 Mitsubishi Electric

- 11.13 Oracle

- 11.14 Rockwell Automation

- 11.15 SAP

- 11.16 SAS Institute

- 11.17 Schneider Electric

- 11.18 Siemens

- 11.19 Toshiba

- 11.20 Uptake Technologies