PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698327

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698327

Insulin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

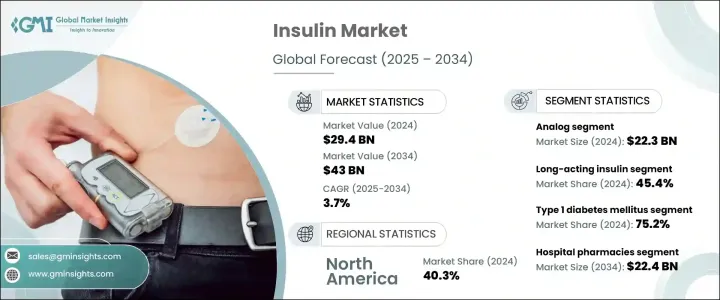

The Global Insulin Market was valued at USD 29.4 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing prevalence of diabetes, especially type 2, is driving market expansion. Factors such as a sedentary lifestyle, rising obesity rates, and an aging population significantly contribute to this growth. Other risk factors, including high-calorie diets, genetic predisposition, and stress, also play a crucial role in diabetes prevalence.

Growing awareness and early medical interventions have increased the demand for insulin therapy, which remains essential for diabetes management. Advances in insulin formulations, including ultra-rapid-acting, long-acting, and biosimilar insulins, have improved treatment adherence and patient outcomes. Additionally, increased government and NGO investments in developing regions have expanded insulin access, further strengthening the market. Favorable reimbursement policies in developed economies have also contributed to market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $43 Billion |

| CAGR | 3.7% |

Insulin is essential in regulating blood glucose levels, ensuring efficient energy utilization. The market includes various insulin formulations, including rapid-acting, short-acting, intermediate-acting, long-acting, and premixed options, as well as biosimilars.

The market is segmented into human insulin and insulin analogs. Insulin analogs dominated the market, accounting for USD 22.3 billion in 2024. Their widespread adoption stems from superior efficacy, lower risk of hypoglycemia, and better patient adherence compared to traditional human insulin. Insulin analogs provide greater dosing flexibility, reduce postprandial glucose spikes, and offer a more predictable response. Long-acting insulin analogs, such as insulin detemir, also minimize weight gain compared to regular insulin. The availability of biosimilar insulin analogs has further expanded accessibility and affordability.

By product type, the market is divided into long-acting insulin, rapid-acting insulin, combination insulin, biosimilars, and other products. Long-acting insulin held the largest share at 45.4% in 2024. Its slow-release mechanism ensures stable insulin levels, reducing the frequency of injections and enhancing patient adherence. These formulations effectively mimic basal insulin secretion, lowering the risk of hypoglycemia. The development of advanced long-acting insulin products and improvements in insulin delivery devices continue to support market dominance.

The market is categorized by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 1 diabetes accounted for 75.2% of the market in 2024 and is expected to grow at a CAGR of 3.6%. Patients with type 1 diabetes rely on daily insulin injections to maintain blood glucose levels. Unlike type 2 diabetes, where lifestyle modifications and oral medications may be effective, type 1 diabetes necessitates consistent insulin administration.

In terms of distribution channels, hospital pharmacies led the market in 2024, projected to reach USD 22.4 billion by 2034. High diabetes-related hospital admissions, access to a wide range of insulin products, and advanced healthcare systems contribute to this segment's dominance.

Regionally, North America led the market with a 40.3% share in 2023. The US market grew from USD 9.6 billion in 2022 to USD 10.2 billion in 2023. The country's high diabetes prevalence, robust healthcare infrastructure, and strong investments in insulin research and development continue to drive market growth. The presence of leading insulin manufacturers further supports market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Advancements in insulin delivery systems

- 3.2.1.3 Government initiatives and policies

- 3.2.1.4 Focus on pediatric diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin

- 3.2.2.2 Availability of alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2023

- 3.6.2 Countries with the highest number of diabetics, 2023

- 3.6.3 Number of diabetes deaths worldwide, by region, 2023

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Human insulin

- 5.3 Insulin analog

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Rapid-acting insulin

- 6.3 Long-acting insulin

- 6.4 Combination insulin

- 6.5 Biosimilar

- 6.6 Other products

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 1 diabetes mellitus

- 7.3 Type 2 diabetes mellitus

- 7.4 Gestational diabetes

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adocia

- 10.2 Biocon

- 10.3 Boehringer Ingelheim International

- 10.4 Eli Lilly and Company

- 10.5 Gan & Lee Pharmaceuticals

- 10.6 Gland Pharma

- 10.7 Julphar

- 10.8 MannKind Corporation

- 10.9 Novo Nordisk

- 10.10 Pfizer

- 10.11 Sanofi

- 10.12 Shanghai Fosun Pharmaceutical

- 10.13 Tonghua Dongbao Pharmaceutical

- 10.14 United Laboratories International

- 10.15 Wockhardt