PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698324

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698324

Artificial Intelligence (AI) Terminal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

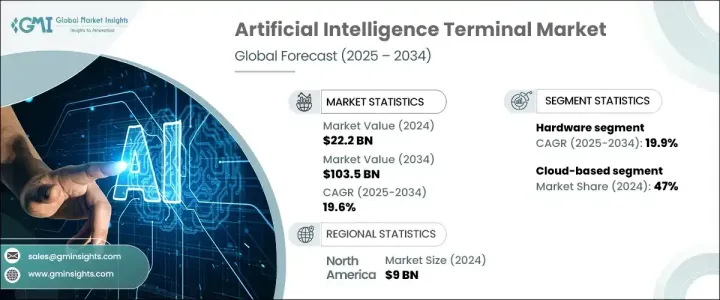

The Global Artificial Intelligence Terminal Market was valued at USD 22.2 billion in 2024 and is expected to expand at a CAGR of 19.6% from 2025 to 2034. Growth is fueled by advancements in AI chipsets, neural processing units (NPUs), and AI accelerators, which enhance performance while improving energy efficiency. AI terminals benefit from edge AI, which processes data locally, reducing reliance on cloud computing. This improves response times, strengthens security, and enables businesses to achieve low-latency AI processing for real-time decision-making. Increasing adoption of AI-powered IoT devices, consumer electronics, and smart healthcare solutions contributes to market expansion. Technological improvements in AI processors are making AI terminals essential for next-generation computing.

The market is categorized by component into hardware and software. In 2024, hardware dominated the sector, generating USD 15.2 billion in revenue, and is projected to grow at a CAGR of 19.9% through the forecast period. AI terminals rely on powerful processors, including GPUs, FPGAs, and ASICs, which are crucial for real-time AI computations. Industries such as automotive, healthcare, and manufacturing are integrating AI inference hardware to support automation and enhance AI-based decision-making. Increased investments in AI chipsets, embedded devices, and AI-enabled servers further reinforce hardware's dominance. The expansion of AIoT, autonomous systems, and AI-driven surveillance solutions is also driving growth, strengthening the market for fintech AI hardware.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.2 Billion |

| Forecast Value | $103.5 Billion |

| CAGR | 19.6% |

Deployment modes in the AI terminal market include on-premises, cloud-based, and hybrid solutions. In 2024, cloud-based solutions led the market with a 47% share and are expected to grow at a CAGR exceeding 20% through 2034. Cloud computing allows enterprises to scale AI applications without substantial hardware investments, supporting AI model training, real-time data analysis, and inference across multiple industries. As businesses generate increasing amounts of AI-driven data, demand for cloud infrastructure continues to rise. AI terminals integrated with cloud-based systems enable efficient data collection and processing, making them an essential tool for enterprises seeking advanced AI capabilities.

By technology, the market is segmented into machine learning (ML) and deep learning (DL), computer vision, robotic process automation, IoT sensors, and other AI-driven technologies. ML and DL remain dominant due to their ability to process vast amounts of data, identify patterns, and execute actions in real-time. AI systems utilizing deep learning neural networks enhance capabilities in natural language processing (NLP), speech recognition, and autonomous systems. The increasing need for AI solutions across banking, retail, and healthcare is accelerating adoption in this segment.

North America held the largest market share in 2024, accounting for approximately 40% of the global AI terminal market, generating around USD 9 billion in revenue. The region benefits from strong investments in AI-driven hardware, edge computing solutions, and semiconductor technologies. The presence of leading technology firms and AI chipset manufacturers supports market expansion across industries, including healthcare, defense, and retail. Enhanced development of edge-based AI computing solutions is further fueling adoption, particularly in applications requiring improved data privacy and security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturer

- 3.2.2 Sensor providers

- 3.2.3 Software developers

- 3.2.4 Technology Integrators

- 3.2.5 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Advancements in edge AI technology

- 3.8.1.2 Rising demand for AI-powered devices

- 3.8.1.3 Expansion of 5G and IoT networks

- 3.8.1.4 Growing AI integration in automotive and healthcare

- 3.8.1.5 Government and enterprise investments in AI infrastructure

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial investment and deployment costs

- 3.8.2.2 Data privacy and security concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 ML and DL

- 6.3 Computer vision

- 6.4 Robotic process automation

- 6.5 IOT sensors

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Hybrid

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Transportation

- 8.3 Healthcare

- 8.4 Retail

- 8.5 BFSI

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adobe

- 10.2 Alibaba Group

- 10.3 Amazon

- 10.4 Apple

- 10.5 Bosch

- 10.6 Cisco

- 10.7 Dell Technologies

- 10.8 Google (Alphabet inc.)

- 10.9 Huawei Technologies

- 10.10 IBM

- 10.11 Intel

- 10.12 Meta Platforms

- 10.13 Microsoft

- 10.14 Nvidia

- 10.15 Oracle

- 10.16 Sony

- 10.17 Tencent Holdings

- 10.18 Tesla

- 10.19 VMware

- 10.20 Zoom Video Communications