PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698311

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698311

Signals Intelligence (SIGINT) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

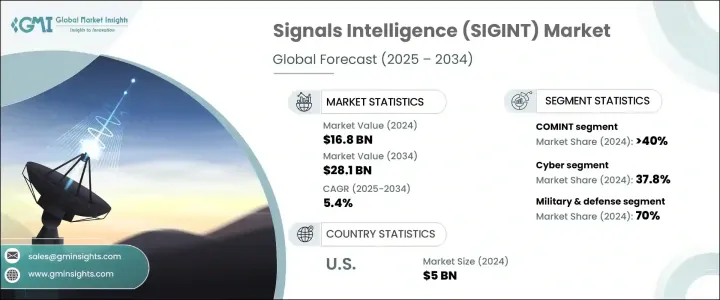

The Global Signals Intelligence Market reached USD 16.8 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2034. This growth is primarily fueled by rapid advancements in artificial intelligence (AI) and sensor technologies. AI algorithms enhance the ability to process vast amounts of data quickly, allowing for faster identification of threats. Coupled with machine learning, these systems are becoming more adept at recognizing patterns and anomalies in communications and electronic signals. Enhanced sensor capabilities, such as improved sensitivity and filtering, have significantly increased the range and precision of SIGINT platforms, enabling more efficient and accurate intelligence collection. These advancements are reducing the reliance on human operators while boosting the effectiveness of both tactical and strategic intelligence operations.

The rising geopolitical tensions and military confrontations worldwide have escalated the demand for SIGINT systems, as countries are increasingly relying on these technologies to monitor adversaries and secure national defense. The market is also expanding due to concerns over electronic warfare (EW), with SIGINT playing a crucial role in countering jamming, spoofing, and other electronic threats. Countries are integrating SIGINT into their military strategies to maintain a competitive edge in modern warfare, especially as threats continue to evolve in regions like Eastern Europe, the Indo-Pacific, and the Middle East.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.8 Billion |

| Forecast Value | $28.1 Billion |

| CAGR | 5.4% |

The market is primarily segmented by types, including Communications Intelligence (COMINT), Electronic Intelligence (ELINT), and Foreign Instrumentation Signals Intelligence (FISINT). Among these, COMINT leads the market, accounting for over 40% of the total share in 2024. COMINT solutions are increasingly used by military and security agencies for intercepting and analyzing voice, text, and encrypted messages, which play a critical role in real-time threat detection and cyber defense.

In terms of applications, the cyber segment is witnessing rapid growth, capturing a significant share of the market. With the increasing threats from cyber espionage and digital warfare, there has been a surge in funding for cyber SIGINT technologies aimed at protecting critical infrastructure. Governments and defense agencies are heavily investing in automated, AI-driven systems to enhance real-time threat detection capabilities.

The military and defense sector continues to dominate the SIGINT market, accounting for nearly 70% of the total market share in 2024. The increasing demand for electronic warfare and threat detection solutions is driving significant growth in this sector. Additionally, governments are leveraging SIGINT for espionage, counterterrorism, and border security operations. The commercial sector is also adopting SIGINT technologies to safeguard against cyber threats and ensure secure communication.

North America leads the global SIGINT market, with the United States contributing a substantial share of USD 5 billion in 2024. The U.S. is making significant investments in AI-powered signal processing and data analytics to strengthen its defense and intelligence capabilities, ensuring robust national security.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Telematics hardware providers

- 3.2.2 Software developers

- 3.2.3 Wireless carriers

- 3.2.4 System integrators

- 3.2.5 Fleet management service providers

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising Demand for telematics & IoT

- 3.9.1.2 Stringent safety & emission regulations

- 3.9.1.3 Growth in e-commerce & last-mile delivery

- 3.9.1.4 Growing adoption of electric & autonomous vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data overload and management concerns

- 3.9.2.2 Driver management and safety issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 COMINT (Communications Intelligence)

- 5.3 ELINT (Electronic Intelligence)

- 5.4 FISINT (Foreign Instrumentation Signals Intelligence)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cyber

- 6.3 Ground

- 6.4 Airborne

- 6.4.1 Fighter jets

- 6.4.2 Special mission aircraft

- 6.4.3 Transport aircraft

- 6.4.4 Unmanned Aerial Vehicles (UAVs)

- 6.5 Naval

- 6.5.1 Ships

- 6.5.2 Submarines

- 6.5.3 Unmanned Marine Vehicles (UMVs)

- 6.6 Space

Chapter 7 Market Estimates & Forecast, By Mobility, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Fixed

- 7.3 Portable

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Military & defense

- 8.3 Government & law enforcement

- 8.4 Commercial & private sector

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 BAE Systems

- 10.3 Boeing

- 10.4 Collins Aerospace

- 10.5 DRS RADA Technologies

- 10.6 Elbit Systems

- 10.7 General Atomics

- 10.8 General Dynamics

- 10.9 Hensoldt

- 10.10 Israel Aerospace Industries

- 10.11 L3Harris

- 10.12 Leonardo

- 10.13 Lockheed Martin

- 10.14 Mercury Systems

- 10.15 Northrop Grumman

- 10.16 Raytheon

- 10.17 Rohde & Schwarz

- 10.18 Saab

- 10.19 SRC

- 10.20 Thales